I’m a keen watcher of the Indexes and also an active trader of them. If you have been following me, you would know that I am quite a fan of the FTSE 100, as I think it’s a very easy index to trade as it does not offer a lot of surprises, and technically it's just rather easy.

But overnight, equity markets were shaken heavily by the Federal Reserve (FED), as it looked to taper further on the back of stronger American economic data. This should come as no surprise to many observers that the American economy is improving rapidly, however, what is a surprise is the hawkish nature of the FED in aggressive tapering.

Overnight, the FED moved to taper 10 billion a month, bringing the amount to 65 billion USD for the month of February. People had worried that the FED may indeed actually look to slow this a little, but by all accounts it was full steam ahead.

What this means though, is interesting for equity markets.

The FTSE 100 plummeted, hitting lows not seen since December. It also pushed through its current trend line, opening up the possibility that we will see a push further downwards, which in turn would lead to a bearish market trend for the impressive UK economy. Although the fact that the UK economy is so solid, it might just lead to ranging rather than any serious trending downwards.

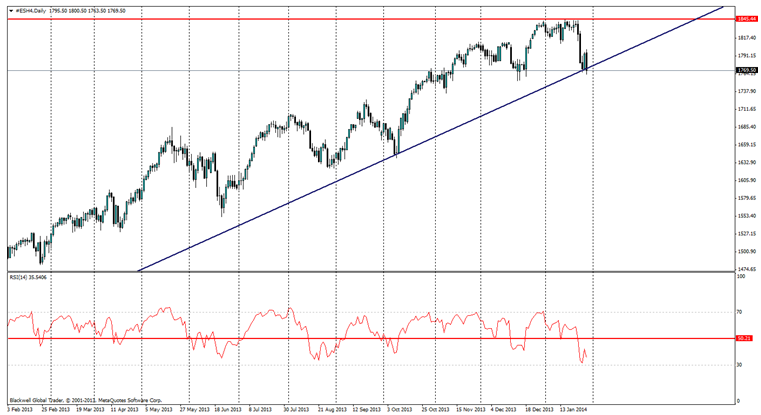

The S&P500 is also in the same position as the FTSE 100, after recent tapering, it has fallen heavily to a monthly low. After an impressive bull run, and a solid ceiling of resistance forming, it seemed slightly inevitable. However, the tapering overnight has pushed heavily on the S&P 500 despite the majority of listed companies beating analyst forecasts.

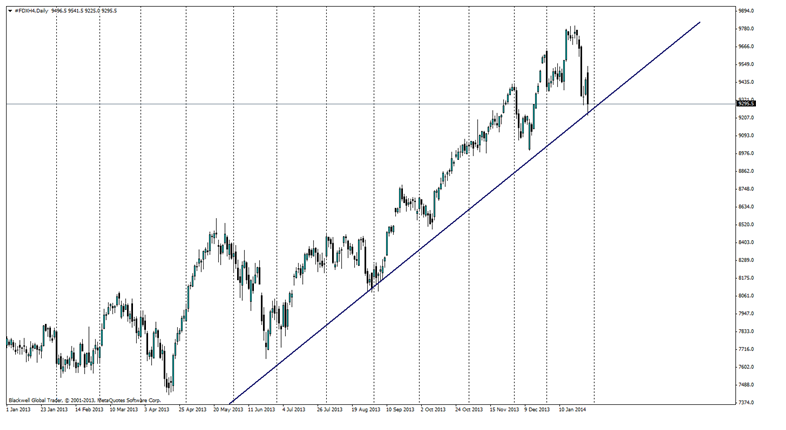

The DAX has also felt the pinch as of late, showing a similar pattern of a rapid rise, but with the recent falling markets, it’s now testing its bullish trendline. It’s worth noting that the DAX is also a very strong index, but global tremors are certainly putting pressure on it as well.

Adding further pain to the boiling pot is the emerging markets crisis, which seems to be brewing, as a lot of countries globally like Turkey, Argentina, China are starting to feel the global pinch of rapid of change. This seems to have thrown a bit of a spanner into the works of the global economy and the effects are yet to be seen, but a full blown crisis is never good for the equity markets.

This much is certain, equity markets have hit ceilings globally. And it’s likely there are more movements to come – an obvious statement I know. But with tapering coming through and the FED acting on its promises, we are likely to see more aggressive market movements, especially with the emerging markets having a few hiccups as of late. The key thing to note though is market corrections are an intrinsic part of trading, and we could be well along the way to witnessing one very soon. Either way, the joys of trading in CFDs and FX is you can trade both sides of the coins and a market fall is a traders opportunity.