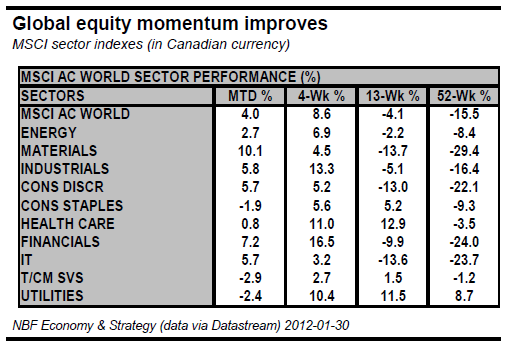

Equity markets seem to have got some mojo back in the first month of the year. At this writing the MSCI All Country index is up 4.0% year to date. The drivers have been cyclically oriented sectors, led by Materials (10.1%), Financials (7.2%), Industrials (5.8%), Consumer Discretionary (5.7%), and Information Technology (5.7%) (table).

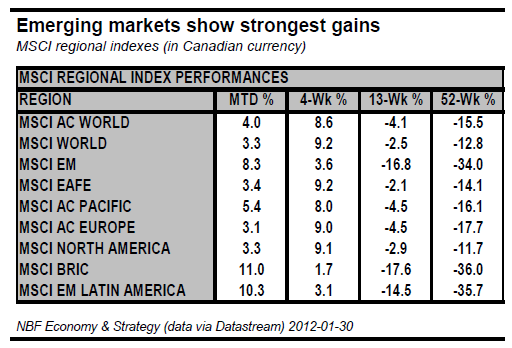

All regional MSCI indexes are up year to date in both local and Canadian dollars, led by BRIC (11.0%) and Latin America (10.3%). The weakest region is Europe up 3.1% (table).

This said, several regional markets have yet to make up the ground they lost earlier in the past 13 weeks. Emerging countries still show double-digit losses for the period.

Signs of stabilization

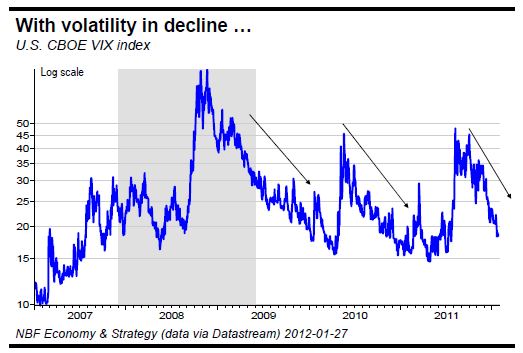

The rally that began in early October has been accompanied by a decline of volatility. The U.S. CBOE VIX index is down sharply.

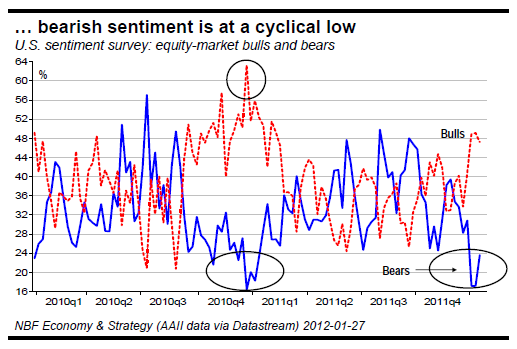

Sentiment indicators have also improved markedly. The sentiment survey of the American Association of Individual Investors currently shows investors less bearish than at any time since late 2010, when equity markets were gaining strongly. It also reports a rise in the number of bulls, though not yet to the 2010 peak.

We are glad to see confidence back, but cannot help remarking that the point at which everyone agrees on the direction of the market is often a time for caution.

What is driving the optimism?

The reasons for the current strength of the market include easing of monetary policies, better-thanexpected indicators in the U.S. and little propagation of the European recession to the rest of the world.

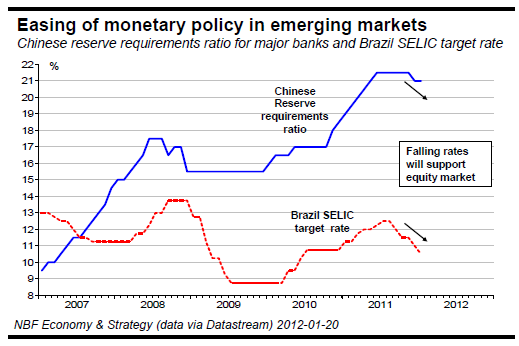

There is a strong conviction in the markets that emerging market central banks are going to allow easier monetary conditions. The expectation that Chinese and Brazilian monetary policy will become increasingly expansionary fuels hope that emerging economies will continue to grow robustly instead of slowing.

U.S. indicators continue to cheer investors. The labour market seems to be firming. Initial jobless claims, a leading economic indicator, are in decline. Recent

payrolls have been stronger than expected.

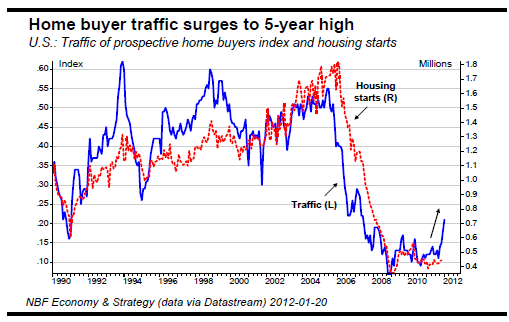

Even the U.S. housing market has given reason for optimism. Housing starts have begun to trend up and are now at a 21-month high. Homebuyer traffic has recently surged to a 5-year high, setting the stage for continued strengthening of the market in 2012.

Finally, there is very little indication that the European recession has taken a toll on the rest of the world. It is true that some Asian indicators are slowing – there is relative weakness in the Chinese manufacturing PMI – but this was to be expected. Trade and output outside continental Europe have held steady in Q4. In last month’s Equity Monitor we discussed how central and eastern Europe was a region especially at risk from a euro-zone recession because of its volume of trade with the zone, which takes 48% of its exports. Yet the latest numbers show the region’s exports at a new high in November (chart).

However, we suggest that investors remain cautious about exposure to central and eastern Europe. This decoupling cannot last.

Reflation at all costs?

The U.S. central bank continues to keep monetary policy easy. Its policy rate of 0.25% is the lowest since the Fed began targeting interest rates. At their latest FOMC meeting policy makers said that the policy rate would remain unchanged at least through 2014, extending the previous pledge by 18 months. What the Fed did is affect markets with extreme jawboning in the hope that it will help reignite the animal spirit of investors and businesses. Unless the central bank is surprised by inflation, Bernanke and friends are telling you that the current environment of negative interest rates will last for a long time, the longest in U.S. modern history.

However, unlike late 2010 when QE2 drove bond yields and equity prices higher we expect a more muted reaction from investors resulting from recent FED rhetoric. Yields of longer term U.S. government bonds will see relatively little upside, with the U.S. 10- year government bond yield likely to trade below 2.50% through out the year. Equities are likely to see limited multiple expansion in 2012.

Earnings season

The U.S. fourth-quarter earnings season is well under way, with over 40% of S&P 500 companies now having reported. At this writing the results are better than expected with EPS growth recording a 2.4% positive surprise. Breadth among S&P 500 companies having reported is also solid with a positive to negative surprise ratio of 2.1 Sales have also been better than expected with a positive surprise of approximately 1.65%. However, let us recall even though Q4 is lining to be another reporting season with earnings beating market expectations, there have been significant downward revisions over the last few months leading to these results.

Headwinds from profit margins

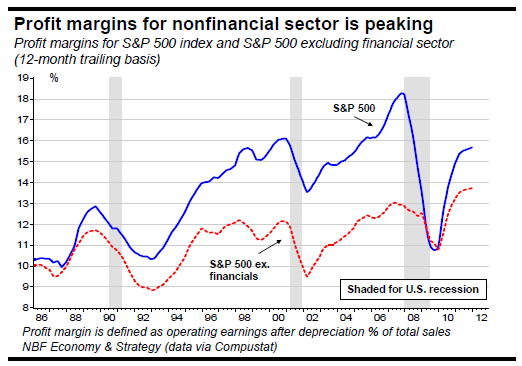

The U.S. and Canadian earnings outlook for 2012 is increasingly conservative. The primary culprit is profit margins, which are likely to grow marginally if at all over the year. In both countries this fundamental has begun the year at historical highs. As the chart below shows, the profit margin of S&P 500 nonfinancials as a group is unmatched in at least the last 25 years.

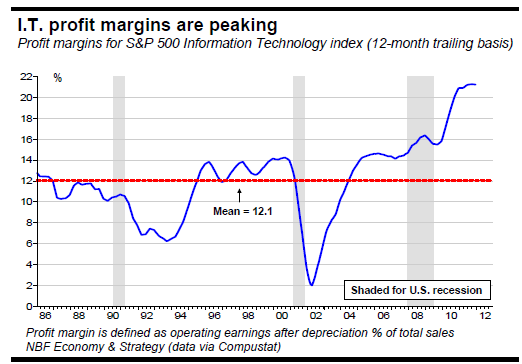

This is the result of improvements in productivity and of an increase in the market weight of sectors with above-average margins, especially IT, whose share of S&P 500 earnings is up 6.5 percentage points from Q4 2006 and whose aggregate operating earnings are now second only to financials among the sectors of the index. However, as the next chart shows, IT margins seem to be peaking.

In this light it is very hard to imagine U.S. nonfinancial margins increasing even another 10% in 2012.

What about multiple expansion?

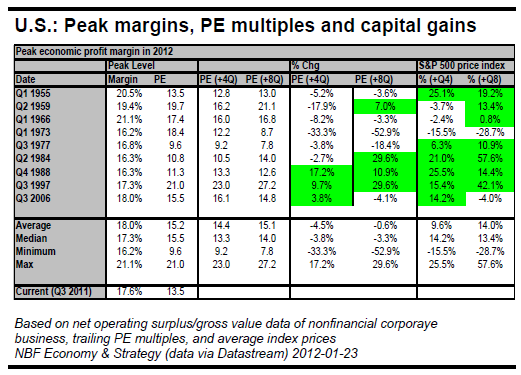

If margins are poised to peak in 2012, what about multiples? The following table presents S&P 500 peak margins (via NIPA), P/E expansions and capital gains for the last nine margin peaks. The numbers for the nine episodes vary greatly, but the summary statistics suggest that market return is likely to be greater in the first four quarters after a peak than in the second four quarters (see median capital gains).

The 9.6% average return in the first year following a peak is two-thirds of the average return in the two years following a peak. The median return in the first year is greater than the median return in the two years following a peak. In short, 2012 may turn out to be an okay year for total return, but 2013 may be less so.

Large-cap vs. small-cap

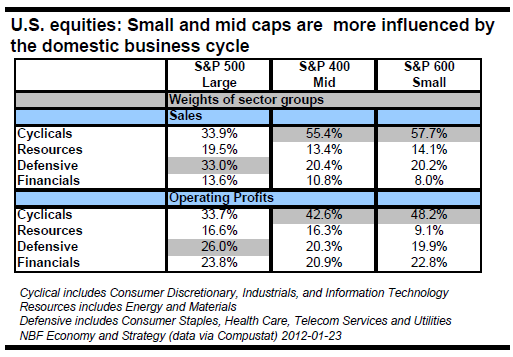

The small- and mid-cap S&P indexes are likely to do better in H1 2012 than the large-cap S&P 500. The reason is the difference in their sector weights.

Cyclical sectors account for 55.4% of the S&P midcap 400 and 57.7% of the S&P small-cap 600, far more than the 33.9% weight of these sectors in the S&P 500. The story is the same for the weight of their earnings. The corollary is that the sales and earnings of the small- and mid-cap indexes have less foreign exposure. With Europe in recession and global growth slowing, the U.S. economy is expected to grow faster than other developed economies. Less international exposure also means less risk from translation of currencies to a stronger dollar.

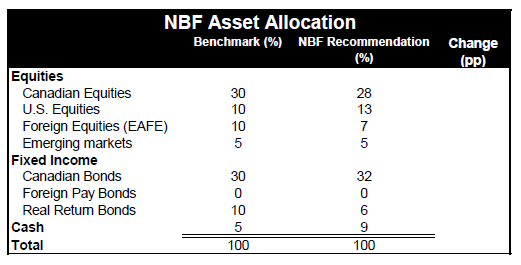

Asset allocation

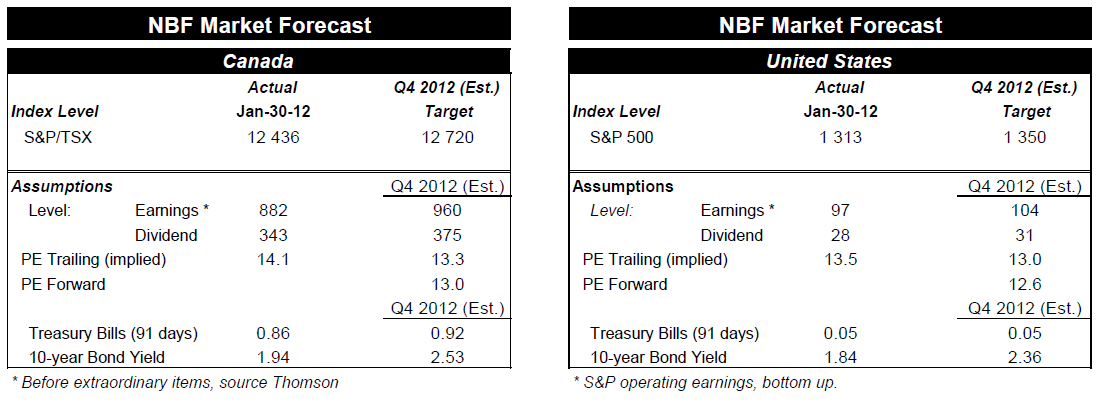

With increased confidence brushing away fear of slower growth, equity markets have made significant gains since the beginning of the year. At this writing the S&P 500 has been up as much as 21.7% from its early-October bottom. The S&P/TSX has climbed 21% over a similar period. However, it is a truth universally acknowledged that markets don’t move in straight lines. We expect an ebb and flow of equity prices in 2012, the major drivers being monetary easing in emerging markets – promoting a reflation trade – versus debt problems in the developed world and the uncertainty surrounding them. We see current Canadian and U.S. equity prices as close to fair value. Upside remains, but the pace of gains will slow. Our current year-end target for the S&P/TSX composite is 12,720 after a calendar-year EPS of 960, for a trailing P/E of a little more than 13. We would be comfortable with multiples within 8% of this target – a a fair-value range of 12.2 to 14.3. At this time we are also comfortable with our portfolio recommendation for benchmark weighting of equities. We do however favour U.S. stocks, partly because we anticipate gains from U.S.-dollar appreciation. There are no changes in our portfolio recommendations this month.

We maintain our preference for defensive sectors with large dividend yields, particularly Telecoms and Utilities. However, we are making some tactical changes this month. We recommend an increase in the capital-goods industry group to overweight. This industry group has been building strong momentum of late. It is good value and has a solid top-line outlook for 2012 with a significant backlog of unfilled orders. We are also increasing our exposure to automobiles & components from underweight to overweight, as this Canadian industry will benefit from U.S. economic expansion and improving U.S. labour markets. U.S. automakers are ramping up production and their U.S. sales continue to trend up. Prices are showing constructive action and are expected to improve. Lastly, we suggest profit-taking in real estate stocks, which have done extremely well since our September recommendation to overweight. We are moving this industry to market weight.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Equity Highlights: February 2012

Published 02/01/2012, 04:43 AM

Updated 05/14/2017, 06:45 AM

Equity Highlights: February 2012

An upbeat start to 2012

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.