Equity funds and ETFs took a drubbing for the Refinitiv Lipper fund-flows week ended Wednesday, May 11, 2022, with the average equity fund declining 8.65% for the flows week—its worst one-week loss since Mar. 25, 2020.

However, equity mutual fund and ETF investors only redeemed a net $8.6 billion this week, compared to $27.1 billion for the week ended Mar. 25, 2020.

Year-to-date, equity funds (including ETFs) have taken in a relatively strong $68.6 billion considering the average equity fund is down 16.89% so far this year. That said, the trends for conventional funds versus ETFs are quite different.

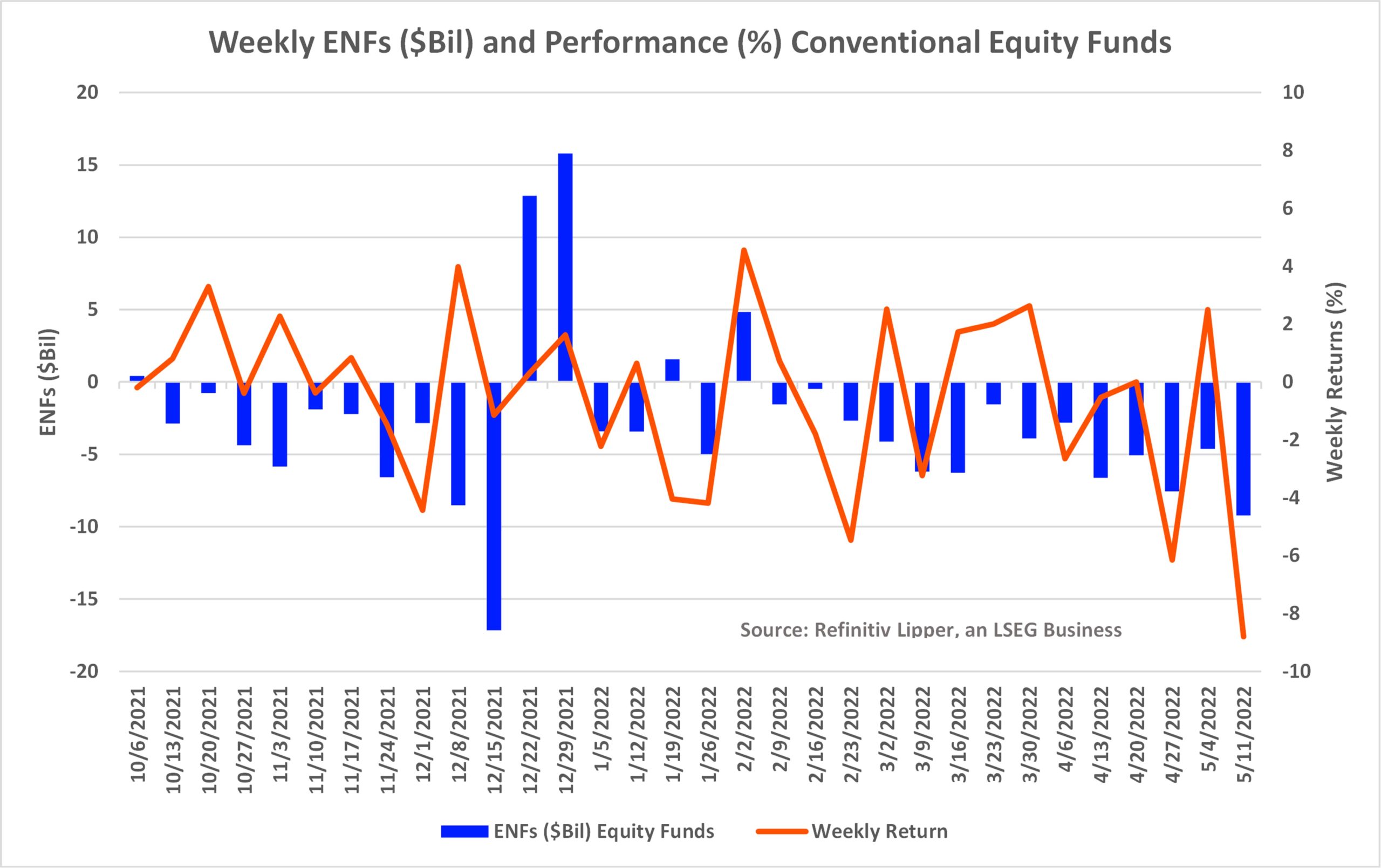

For the first 19 weeks of 2022, conventional equity funds have suffered 17 weeks of net outflows, with the last net inflow occurring for the flows week ended Feb. 2, 2022, and the largest net outflows over the period occurred just this week, with conventional equity funds handing back some $9.2 billion—their largest net redemption since Dec. 15, 2021.

Year-to-date, conventional equity funds have suffered net redemptions to the tune of $65.4 billion.

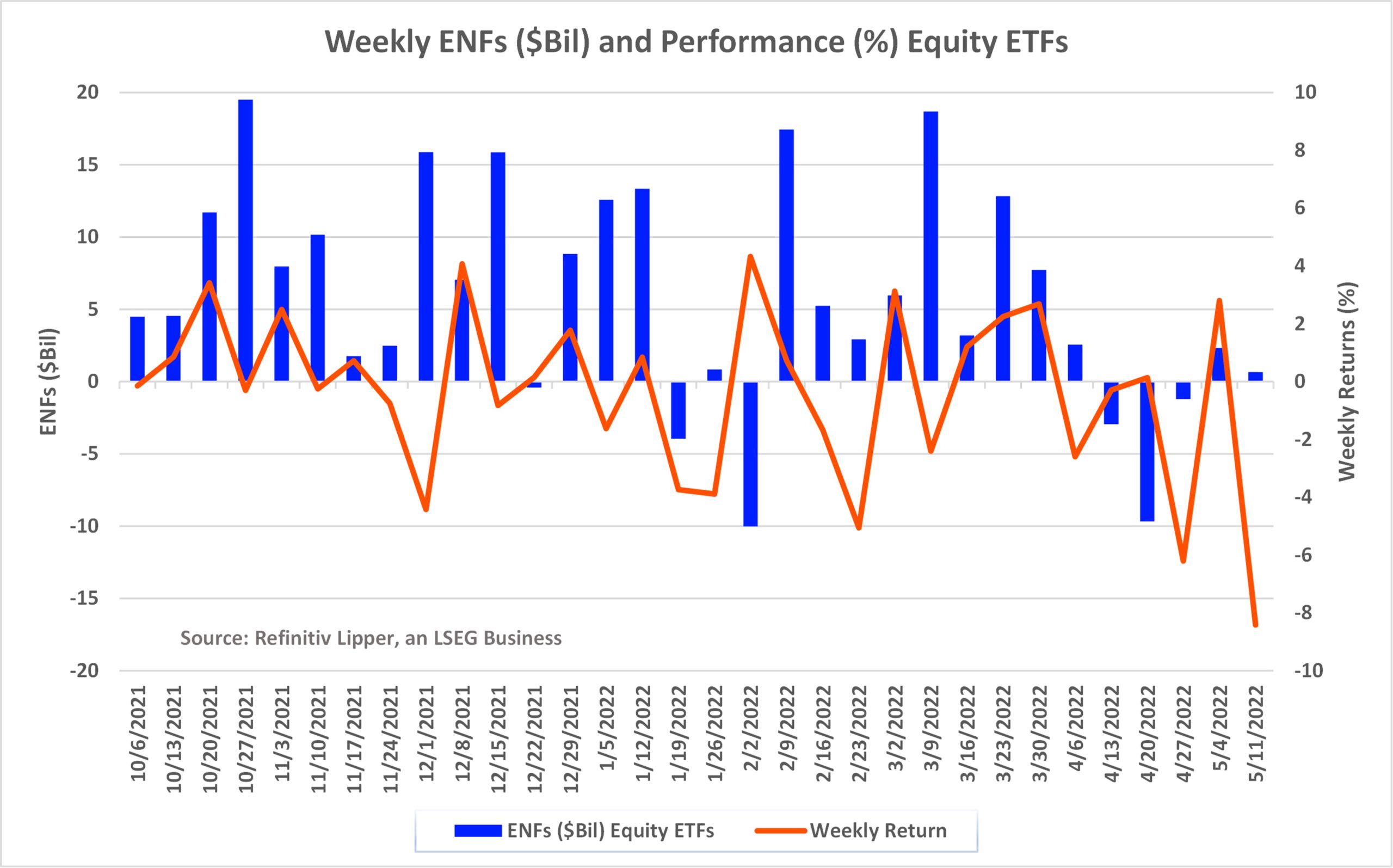

In contrast, equity ETFs have seen net inflows in 14 of the last 19 weeks, with equity ETFs witnessing their second consecutive week of net inflows for the most recent fund-flows week, taking in $647 million despite the horrible returns mentioned above.

So far for the year, equity ETFs have a attracted some $134.0 billion.

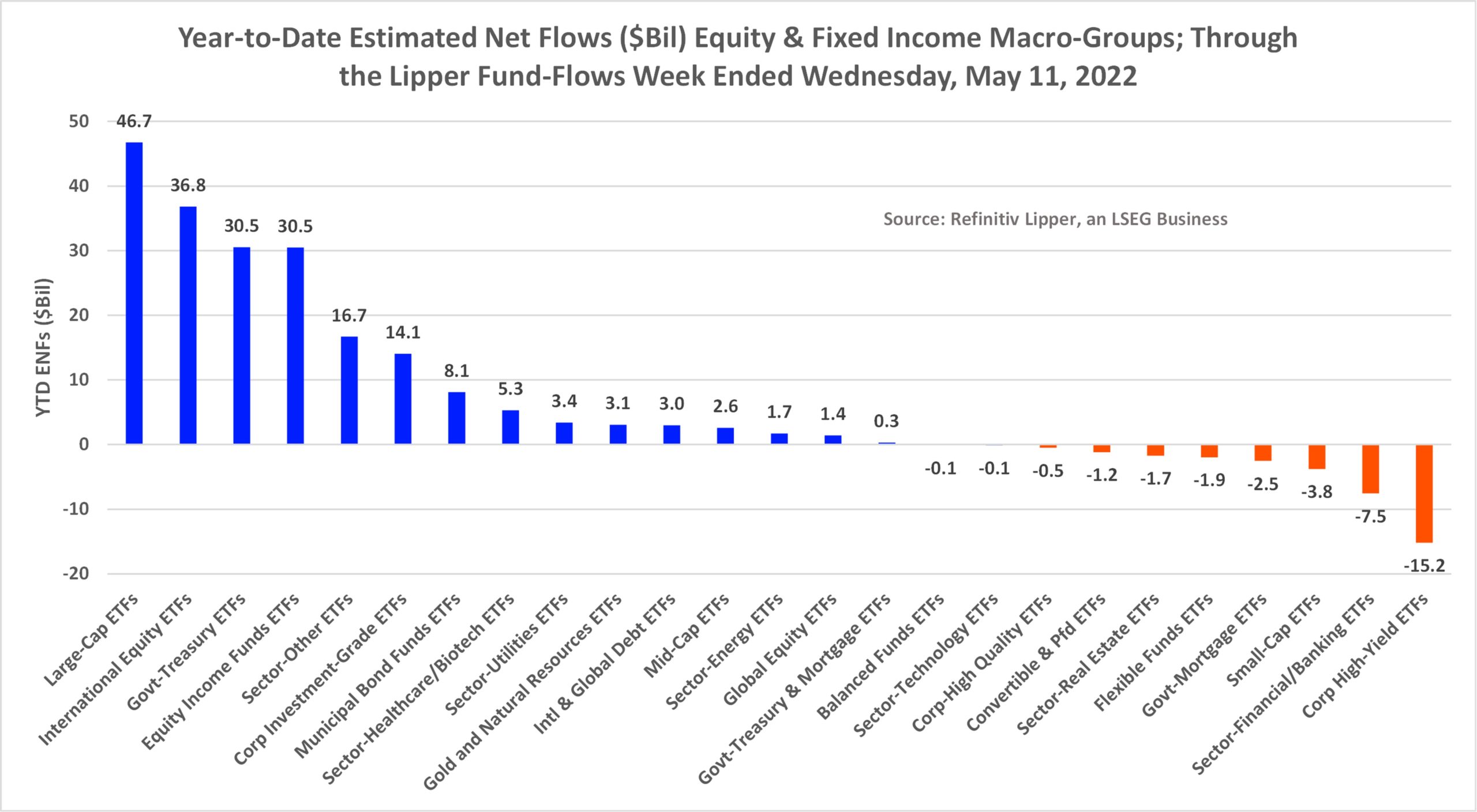

So far this year, ETF investors have padded the coffers of quasi-safe haven plays and some out-of-favor issues, injecting the largest amount of net new money into large-cap ETFs (+$46.8 billion), international equity ETFs (+$36.8 billion), government-Treasury ETFs [+$30.6 billion, just about equally split between Short U.S. Treasury ETFs (+$19.1 billion} and General U.S. Treasury ETFs (+$16.3 billion)], and equity income ETFs (+$30.5 billion).

Corporate high-yield ETFs (-$15.2 billion) and sector-financial/banking ETFs (-$7.5 billion) suffered the largest YTD net redemptions in the first 19 weeks of 2022.

For the most recent flows week, SPDR® Portfolio S&P 500 High Dividend ETF (NYSE:SPYD), +$1.3 billion and iShares Russell 2000 ETF (NYSE:IWM), +$930 million, attracted the largest amounts of net new money of all individual equity ETFs.

At the other end of the spectrum, SPDR® Gold Shares (NYSE:GLD), -$1.3 billion, experienced the largest individual net redemptions and iShares MSCI USA Value Factor ETF (NYSE:VLUE), -$735 million, suffered the second largest net redemptions of the week.

Focusing on YTD equity ETF flows, Vanguard S&P 500 Index ETF (NYSE:VOO), +$15.1 billion, attracted the largest amount of net new money, followed by Vanguard Total Stock Market Index Fund ETF Shares (NYSE:VTI), +$10.6 billion, Vanguard Value Index Fund ETF Shares (NYSE:VTV), +$9.9 billion, and SPDR® Gold Shares, +$7.3 billion.

SPDR® S&P 500 ETF Trust, -$26.4 billion, and iSharesRussell 2000 ETF, -$2.9 billion, were the equity ETF pariahs so far this year.

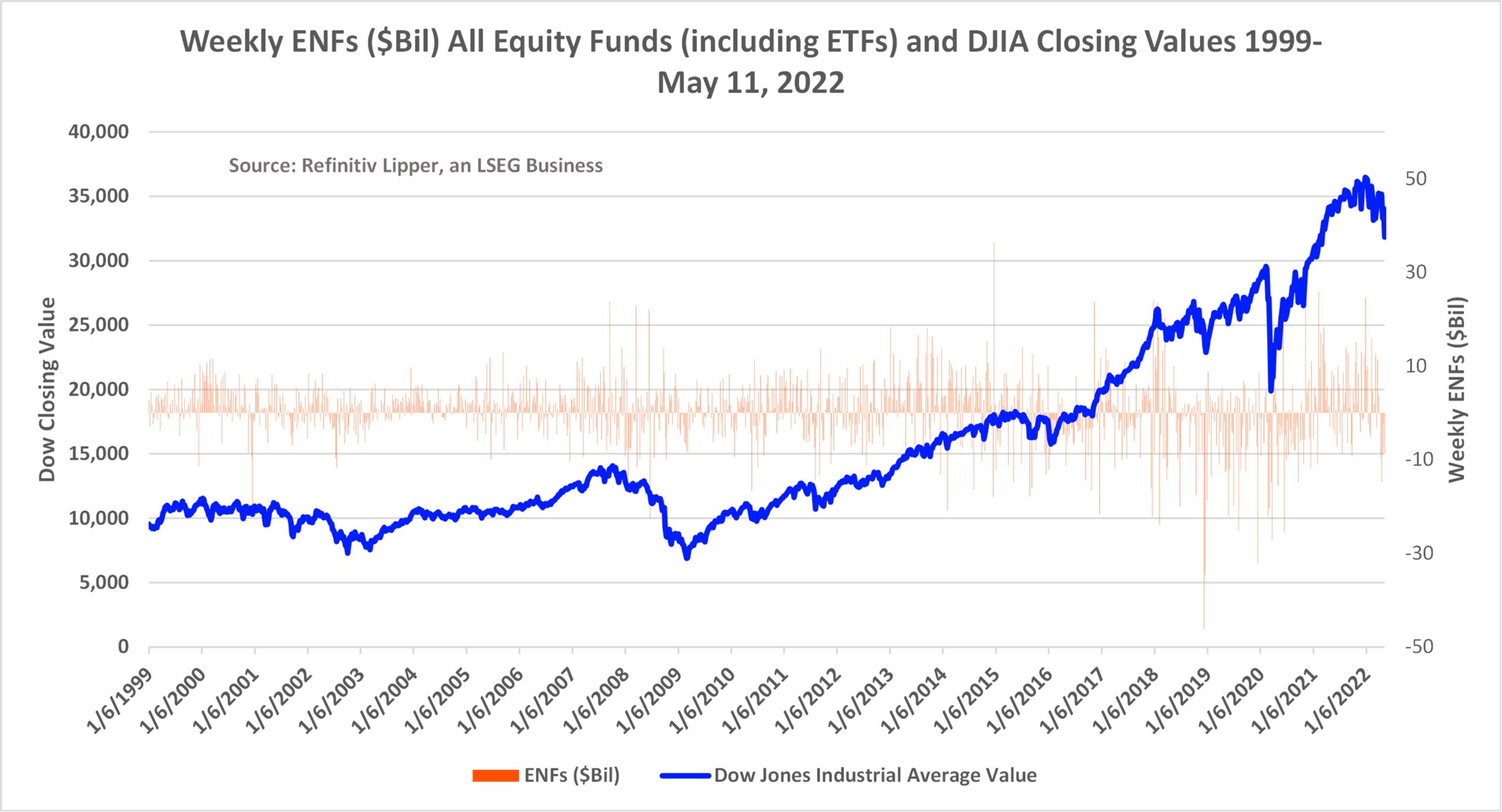

While no one knows when the most recent market meltdown will end and many are looking for signs of capitulation, such as peak negativity, rising CBOE Volatility Index (VIX), spikes in put/call ratio, spikes in declining to advancing issues, sharp moves down on big volume, and large declines in margin debt, we don’t appear to be there yet.

Some appear to be flashing but looking at historical fund flows as only one small measure of peak negativity, we see the outflows continue to be moderate...at least in comparison to what was witnessed in the Financial Crisis of 2008, the market correction of 2018, and the short-lived COVID related crash of 2020.

Check out more weekly flow trends here.