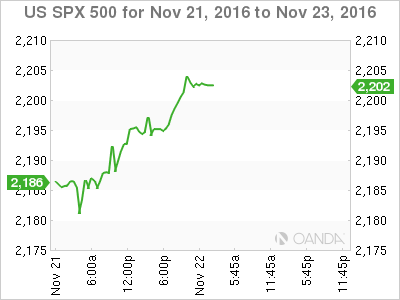

Equities Soar

The holiday week trading conditions were little deterrent to US investors who ramped up their portfolio as major US indices rocketed to record highs. For the most part, this was spurred by a significant rally in the energy sector with crude price up 4% after comments from Iran’s oil Minister suggested that an OPEC production cut will come out of next week’s OPEC meeting in Vienna.

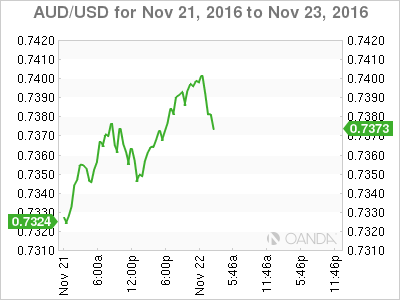

Australian Dollar

The Australian dollar caught some wind in the sails overnight from surging oil prices, as did the rest of the commodity bloc. Also, profit taking was on the cards after the recent sell-off in the US treasuries abated and the US 10-year yields stabilise. Keep in mind that given just how far the US dollar surged last week, position squaring ahead of the US long weekend was expected but the added bounce in oil prices and improving risk sentiment will provide the Aussie bears with the opportunity to buy USD on this reversal.

Not keen to hang the Aussie long-term fortunes on oil speculators, as we have seen so often these oil rallies evaporate as we press WTI US 50 per barrel, the purported sweet spot for US shale producers. More concerning from my chair is the deluge in China’s iron ore stockpiles which certainly bodes poorly for near-term prices.

On the commodity front, it is not only China that is cracking down on commodity speculation; reports are circulating the CFTC, the leading US derivative SRO, is eager to get legislation passed on traders position sizes to curb excessive speculation in commodity price action. As was the case in China iron ore speculative frenzy; regulators are likely trying to manage commodity markets’ anticipated “free for all” ahead of the proposed Trump infrastructure fiscal spend.

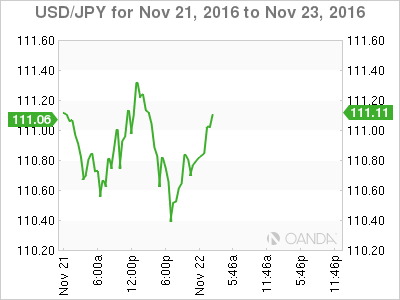

Japanese Yen

The yen is strengthening on the back of repatriation flows and its traditional safe-haven role. After a natural disaster, it’s normal to see a more rapid repatriation of funds and foreign currency asset flows. The market is waiting to hear the damage fall out but the disaster fallout will provide short term crosswind effect to the current USD/JPY momentum.

Volumes have accelerated, as the market reaction has been very robust given that traders were viewing USD/JPY as the first currency pair to express long USD positioning, so some profit taking in low liquidity conditions may be amplifying the move. However, it is accepted that the market is still under positioned long USD, and while we could see continued downward pressure on USD/JPY in the short term, we should anticipate robust demand for dollars into the earthquake induced sell off as the USD bull run remains firmly entrenched. In the meantime, traders will continue to focus on Japanese equity markets, which have rebounded well after the initial reactionary gap lower.

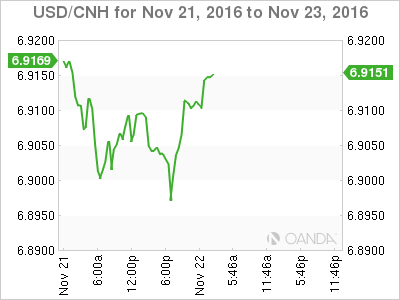

Chinese Yuan

Broader USD moves continue to drive the underlying momentum and currently the active regional correlation to USD/JPY remains intact. After reaching eight years lows as capital outflows accelerate in the face of a steeper US yield curve, the yuan will continue to be pressured and will likely see some form of intervention for nothing other than to stem the current tide of capital outflows.

Some discussion is circulating in academic circles that the PBOC should accelerate the Yuan depreciation and abandon FX market intervention so that the Market will determine the real yuan value. While I view this as the PBOC ultimate end game, I believe at this stage Mainland capital markets are not mature enough to withstand the financial instability of such a move at this juncture, and the PBOC will continue to view their primary task is to maintain stability.

EM Asia

Despite all the talk of curbing NDF trade, the MYR and the BMN return to the spotlight tomorrow when they are expected to keep interest rate policy unchanged. While the economic conditional may favour a rate reduction, the state of affairs in the currency markets dictates they stay neutral so as not to fuel on the weakening ringgit.