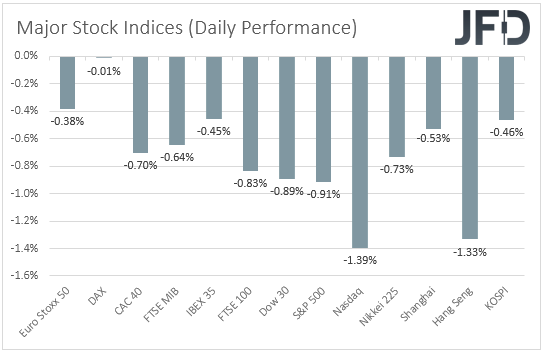

Stock indices were a sea of red yesterday, with the negative appetite rolling into the Asian session today as well, perhaps after the UK reported its first death from the Omicron coronavirus variant. Investors may have also reduced their risk exposure in anticipation of the FOMC decision.

First Omicron Death, A Potentially Hawkish Fed Hurt Market Sentiment

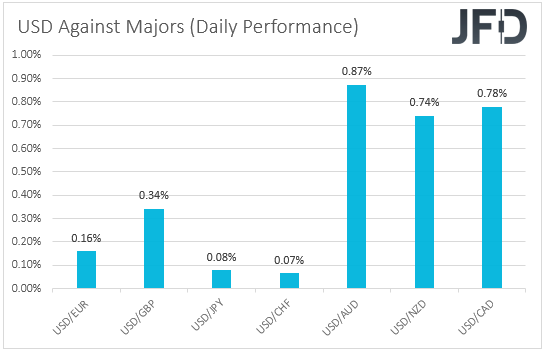

The US dollar traded higher against all the other major currencies on Monday and during the Asian session Tuesday. It gained the most versus AUD, CAD, and NZD, while it eked out the least gains against JPY and CHF.

The relative strength of the safe-havens dollar, yen, and franc, combined with the weakening of the risk-linked Aussie, Kiwi, and Loonie, suggests that financial markets traded in a risk-off fashion yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that major EU and US indices were a sea of red, with the negative sentiment rolling into the Asian session today as well.

Investors may have turned cautious again after the United Kingdom reported its first death from the Omicron coronavirus variant. Deaths from the new strain may have occurred in other countries, but there was no official confirmation outside the UK yet.

Remember that last week, equities rallied on news that the symptoms of the Omicron variant are not as severe as previously thought. Still, although we saw decent chances for some indices, especially the US ones, to enter uncharted territories, we were reluctant to call for a long-lasting advance.

We specifically noted that headlines pointing to more severe symptoms of the Omicron variant are likely to result in stress and anxiety again, and thereby another round of risk-aversion. This is what happened yesterday, and bearing in mind that news surrounding COVID can move the markets in either direction, we prefer to turn to the sidelines for now.

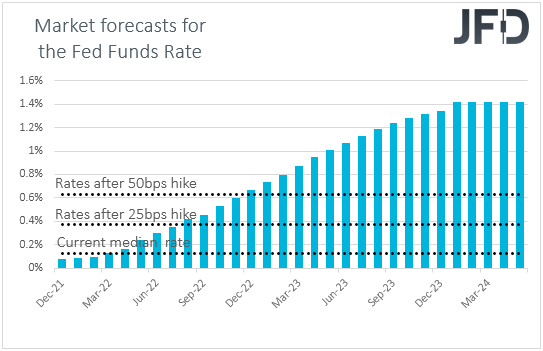

Market participants may have also reduced their risk exposure in anticipation of the FOMC decision. Following the hawkish appearance of Fed Chair Powell before Congress a couple of weeks ago, investors are now expecting the Committee to remove the “transitory” wording with regards to inflation from the statement and signal a faster tapering process.

Such a decision is hawkish by itself, but given that it is already anticipated, we don’t believe that it would be the primary catalyst behind the dollar’s reaction. We believe that it may be the updated “dot plot.” According to the Fed funds futures, the financial community anticipates the first post-pandemic rate hike to be delivered in July next year, while it factors in another one before the end of the year.

Therefore, the new “dot plot” needs to point to two or more quarter-point increases for the US dollar to gain next year. This could affect the broader market sentiment as well, and thereby other currencies besides the US dollar.

Some currency pairs we expect to experience some volatility despite not having the US dollar in the equation are AUD/JPY, AUD/CHF, NZD/JPY and NZD/CHF. In other words, pairs consist of a risk-linked currency and a haven.

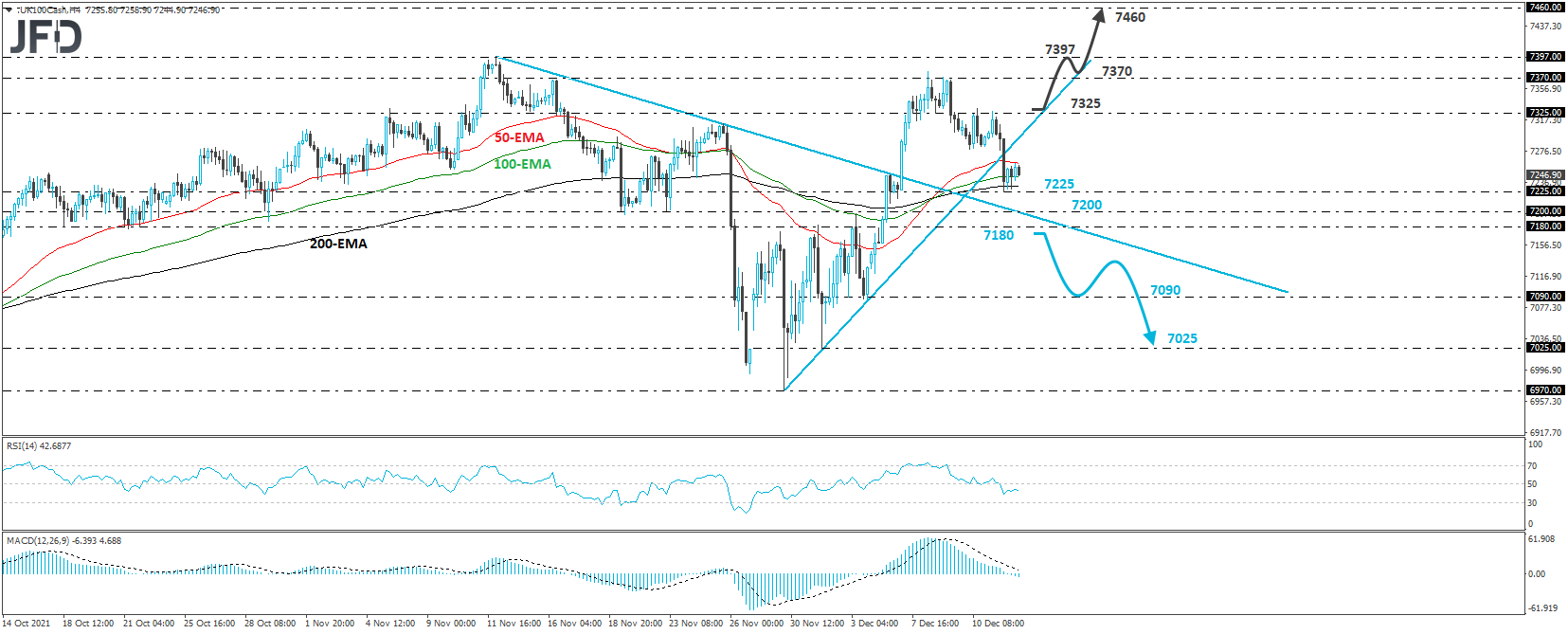

FTSE 100 – Technical Outlook

The UK FTSE 100 index traded lower on Monday, breaking below the upside support line drawn from the low of Nov. 30. That said, the slide was paused near the 7225 level, still above the last downside resistance line drawn from the high of Nov. 12. As long as the index trades between those two lines, we would stay sidelined.

To start examining whether the outlook has darkened further, we would like to see an apparent dip below 7180, support marked by the inside swing high of Dec. 1. The price will already be below the aforementioned downside line, and the bears may get encouraged to push the action towards the low of Dec. 3, at 7090.

If they are not willing to stop there, then we could see them pushing towards the low of Dec. 1, at 7025. On the upside, we would like to see a clear rebound back above 7325 before we start examining whether the bulls have gained complete control again.

This will take the index above the upside line taken from the low of Nov. 30 and could aim for the 7370 or 7397 zones, marked by the highs of Dec. 9 and 12, respectively. Another break, above 7397, could see scope for extensions towards the peak of Feb. 21, 2020, at around 7460.

AUD/CHF – Technical View

AUD/CHF traded slightly lower after hitting resistance at 6630 on Friday, a barrier also marked by the high of Nov. 29. Overall, the rate remains below the downside resistance line taken from the high of Oct. 27, and thus, we would see more chances for the upcoming wave to be a negative one rather than an upside.

Nonetheless, we prefer to wait for a confirmation break below the 0.6525 barrier, marked by the low of Nov. 30, before we get confident on further declines. Such a break could pave the way towards the low of Dec. 3, at 0.6417, the break of which may see scope for declines towards the 0.6315 zone, marked by the low of May 22.

We will start examining the bullish case only if we see a strong rebound above 0.6695, a resistance marked by the inside swing lows of Nov. 11 and 19. This could confirm the break above the downside resistance line taken from the high of Oct. 27 and may initially target the high of Nov. 24, at 0.6760.

Another break above 0.6760 could see scope for advances towards the peak of Nov. 16, at 0.6812, which, if violated as well, could encourage the bulls to climb towards the peak of Nov. 2, at 0.6860.

Elsewhere

We already got the UK employment report for October during the early European morning. The unemployment rate ticked down to +4.2% from +4.3% as expected, but the net change in employment revealed less jobs than anticipated.

Average weekly earnings, both including and excluding bonuses, have slowed by less than forecast. In any case, the report passed unnoticed as GBP traders may have been keeping their gaze locked on Thursday’s BoE meeting.

Later in the day, we have the US PPIs for November, and similarly to the CPIs, they are expected to have accelerated further. Tonight, we get New Zealand’s current account balance for Q3, while RBNZ Governor Adrian Orr will hold a speech.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI