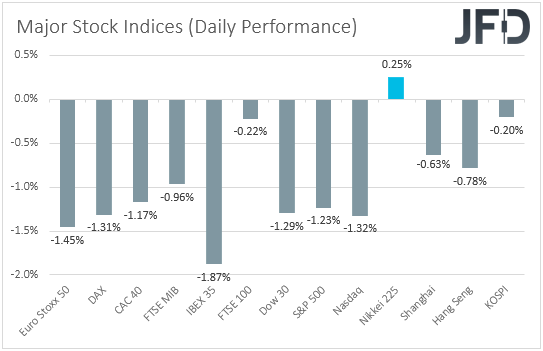

All but one of the major global indices under our radar traded in the red yesterday and today in Asia, with market participants perhaps locking profits ahead of several meetings between US President Biden and other NATO and European leaders. More measures targeting Russia could be decided. As for today, the most important items on the economic calendar are the preliminary PMIs from the EU, the UK, and the US. We also have an SNB monetary policy decision.

Risk Appetite Deteriorates Ahead of Biden’s Meetings With EU Leaders

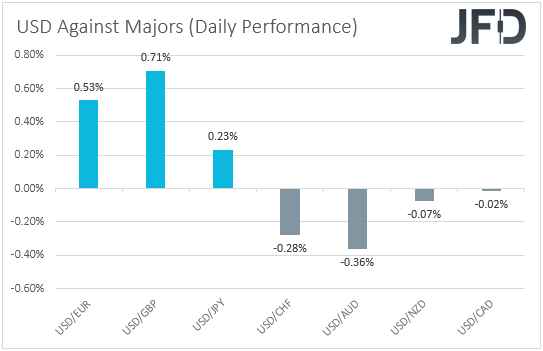

The US dollar traded mixed against the other major currencies on Wednesday and during the Asian session Thursday. It gained versus GBP, EUR, and JPY, in that order, while it underperformed against AUD, CHF, and NZD. The greenback was found virtually unchanged versus CAD.

At first glance, the FX performance paints a blurry picture regarding the broader market sentiment. But trying a little more to decode it, we estimate that the weakening of the pound and the euro, combined with the relative strength of the franc and the commodity-linked currencies, at a time when oil prices rose as well, suggest that some concerns with regards to the war in Ukraine may have kicked back into the markets.

Turning our gaze to the equity world, we see that all the major EU and US indices under our radar were a sea of red, with most of them losing more than 1%, while the negative appetite rolled over into the Asian session today.

However, we stick to our guns, and we refrain from saying that this is the start of a large downfall, as the technical picture of several indices points to just a corrective setback in a recent price structure of higher highs and higher lows. We still see the case for another rebound, despite the war in Ukraine raging, and we explained the reasons for that in yesterday’s report.

However, we repeat for the umpteenth time that we are not calling for a long-lasting recovery. We need concrete evidence that the war is over to start considering this. Now, regarding yesterday’s slide, it may not have been fears of further escalation in the war per se.

Perhaps some investors decided to take the opportunity and lock some gains made during the recovery of the last days, especially ahead of several meetings between US President Biden and other NATO and European leaders, at which more measures targeting Russia could be decided.

It could also be concerns that the further advances in oil prices could lead to even higher inflation, despite several central banks beginning to tighten their respective policies, which could weigh global economic growth. Oil prices jumped around 5% yesterday due to weather-related disruptions to Russian and Kazakh crude exports via the Caspian Pipeline Consortium (CPC) pipeline.

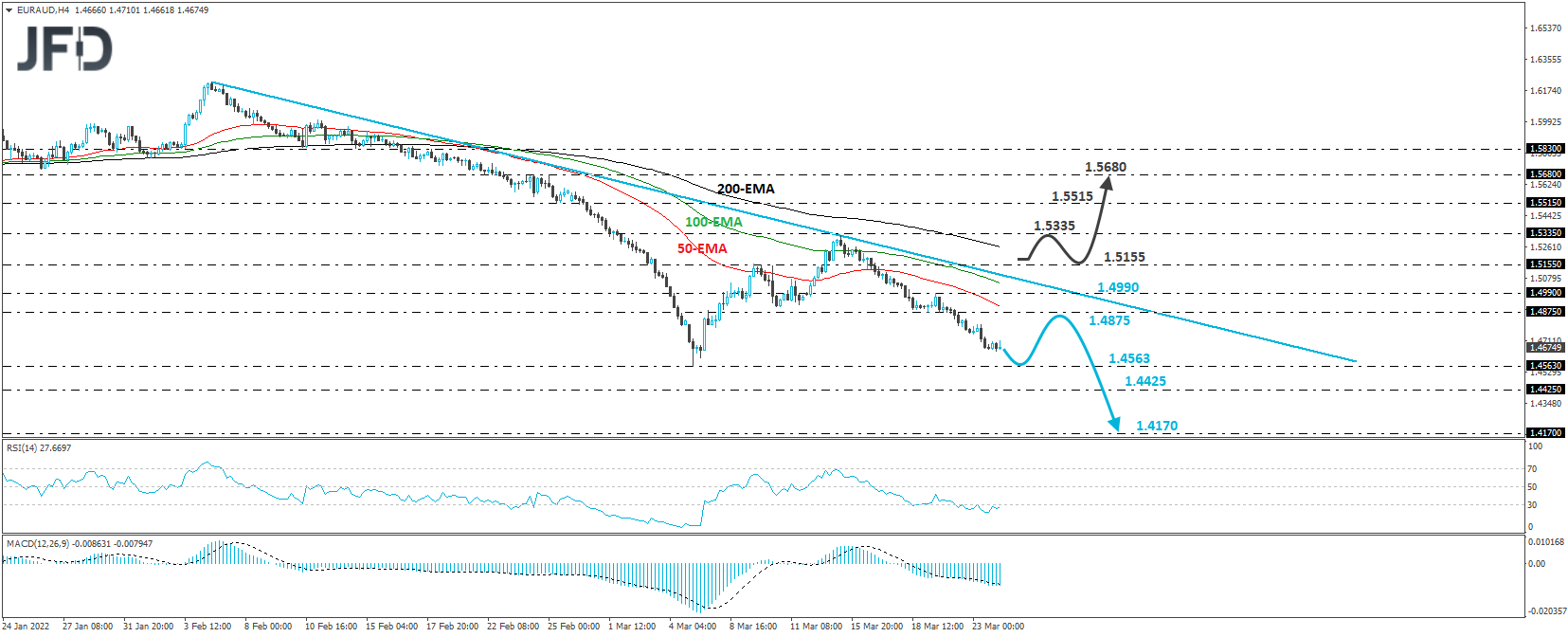

EUR/AUD – Technical Outlook

EUR/AUD has been n a sliding mode since Mar. 15, when it hit resistance at 1.5335. Overall, the rate continues to trade below the downside line drawn from the high of Feb. 4, and thus, we will consider the near-term picture to be negative.

We see the case for the bears to challenge the 1.4563 level soon, marked by the low of Mar. 7, but we will stay careful over a possible rebound after testing that zone. However, if the rebound stays limited below the aforementioned downside line, we would consider another leg south, a break below 1.4563, and a test at 1.4425, support marked by the low of Jul. 20, 2017. If the bears are unwilling to stop there, we may see them pushing for larger declines, perhaps towards the low of Apr. 21, 2017.

On the upside, we would like to see a clear break above 1.5155 before examining the bullish case. This could signal the break above the downside line drawn from the high of Feb. 4 and may initially target the 1.5335 barrier, marked by the peak of Mar. 15. Another break, above 1.5335, could open the path towards the 1.5515 zone, marked by the inside swing low of Feb. 25, the break of which could see scope for advances towards the high of that same day, at 1.5680.

USD/CHF – Technical Outlook

USD/CHF traded lower yesterday, but it was again stopped by the key support zone of 0.9295, which was also recently tested on Monday. Despite the rate trading between a downside line drawn from the high of Mar. 16, the fact that it cannot fall below 0.9295 keeps us on the sidelines for now.

To assume that the bears are back in full control, we would like to see a clear and decisive dip below 0.9295. This would confirm a forthcoming lower low and may pave the way towards the 0.9250 zone, marked by the low of Mar. 9, or the 0.9240 barrier, marked by the inside swing high of Mar. 2. If neither obstacle can halt the slide, we will likely experience extensions towards the low of Mar. 7, at 0.9200.

We will start examining the bullish case upon a break above 0.9375. This will confirm the break above the downside line and a forthcoming higher high. The bulls could then get encouraged to push towards the 0.9430 barrier, marked by the high of Mar. 15, the break of which could aim for the peak of the day after, at 0.9460.

As for Today’s Events

The main items on the economic agenda may be the preliminary Markit PMIs for March. We get the manufacturing, services, and composite indices from the Eurozone, the UK, and the US, and they may provide a first glimpse as to how those major economies have been affected by the war in Ukraine.

Expectations are for slight declines in all indices, but we see the case for negative surprises as more likely in the EU and UK indices. Big disappointments could raise questions again as to whether the ECB and the BoE should prioritize stopping accelerating inflation instead of supporting economic growth.

We also have a central bank deciding on monetary policy on Thursday, and this is the SNB. Although inflation in Switzerland is slightly above 2%, at +2.2% YoY specifically, that rate is well behind other major economies, like the Eurozone, the UK, and the US. Thus, we don’t believe that Swiss policymakers will soon signal a willingness to lift interest rates.

Also, with the EUR/CHF staying in a downtrend mode since January last year, despite the latest recovery started on Mar. 8, we believe that officials will maintain an extra-loose monetary policy, reiterating their willingness to intervene in the FX market if deemed necessary.