- China support aids rebound in stocks after bruising week amid surging yields

- Dollar steady as markets brace for possible surprises in July jobs report

- Pound off lows but BoE offers little upside, aussie crawls higher too

Mood improves as bond rout eases before NFP

Global equity markets started Friday on a somewhat more optimistic tone after coming under heavy selling pressure this week from a spike in bond yields even as major central banks signal doubts about the need for additional rate hikes. The jump in yields came after the US Treasury Department said on Wednesday it will ramp up the size of its quarterly bond sales to $103 billion, boosting the issuance of longer-term debt.

The Treasury’s announcement came just hours after the ratings agency Fitch downgraded America’s prized triple A credit rating, sending bond markets into a spin.

The yields on 10- and 30-year Treasury notes have shot up this week to near nine-month highs, putting a lid on Wall Street gains as equity traders now have a new threat to grapple with just as the Fed potentially stays on pause for the rest of the year.

The deluge of supply in US Treasuries could spell an end to the dubious rally in stocks this year as not only is it likely to push yields even higher, but it looks poised to drain significant liquidity out of the markets.

Worries about higher yields put on hold

For the moment, however, the selloff in bonds is taking a breather with Treasury yields holding steady around yesterday’s highs. Upbeat earnings results from Amazon.com (NASDAQ:AMZN) overnight have brought some relief, buoying Wall Street futures after all the major indices closed in the red on Thursday.

Amazon shares rallied 8% in after-hours trading but Apple (NASDAQ:AAPL) declined more than 1.5% after the company reported a drop in iPhone sales.

In Asia and Europe, stocks were lifted from further pledges by Chinese policymakers to support firms in the private sector. Although most investors have stopped holding out for a full-scale stimulus from Beijing, this drip feed of targeted measures seems to be broadening and China-related assets are taking note.

Aussie and pound lick their wounds

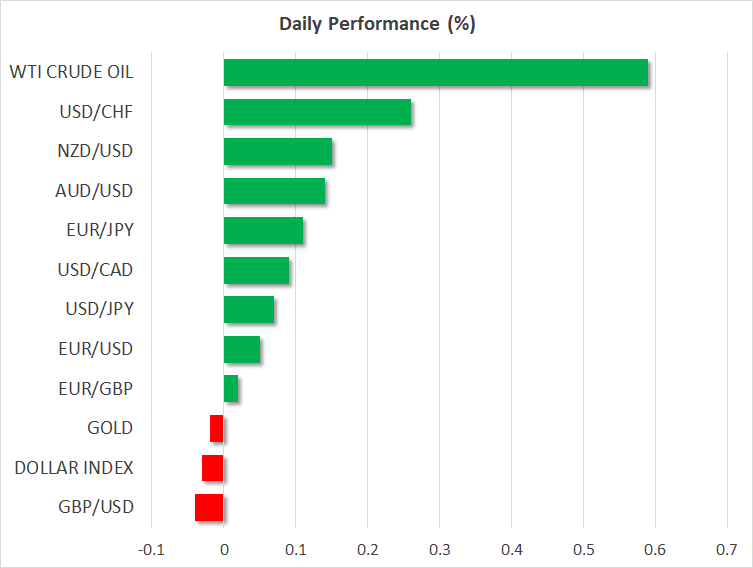

The Australian dollar is attempting a rebound today on the back of the brightening light at the end of the China slowdown tunnel. There was a further boost for the aussie today from the RBA’s latest quarterly Monetary Policy Statement, which projected that inflation may not fall to the 2-3% target band until the end of 2025. Although growth forecasts were revised lower, the Bank’s inflation outlook does suggest that rates won’t be coming down quickly even if no additional hike is on the cards.

Another currency struggling to find its feet is the British pound, as investors were disappointed that the Bank of England didn’t strike a more hawkish tone when it raised its key rate by the expected 25-basis-points on Thursday.

The pound tumbled yesterday after Governor Andrew Bailey told reporters he didn’t think there was a case for a 50-bps hike. The downgrade in growth forecasts could also be weighing on sterling even though inflation is seen falling to 2% or below by 2025. But with upside risks to wage growth, investors remain sceptical about how quickly the BoE will be able to get inflation under control.

Dollar on standby for NFP surprise

The yen fell back slightly on Friday as the 10-year JGB yield steadied around 0.65% after jumping again yesterday, while the US dollar was flat against a basket of currencies.

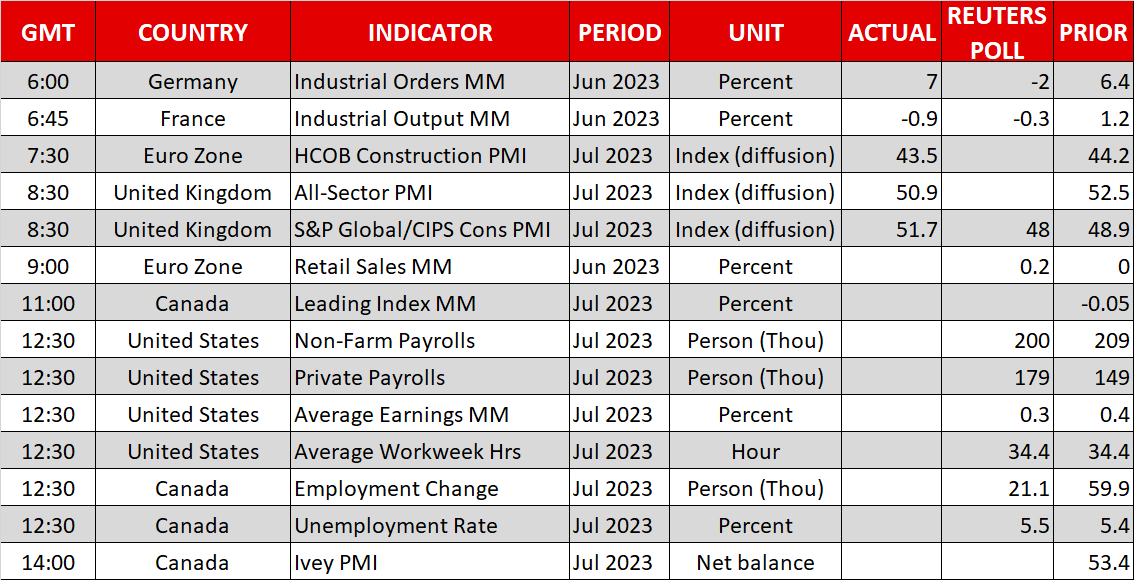

The July ISM PMIs were a mixed bag as far as the US economic outlook is concerned and given the heavy rate cut pricing for 2024 on the one hand and elevated Treasury yields on the other, the risks to the greenback heading into the nonfarm payrolls report are symmetrical.

Judging from the other employment indicators released during the week, a positive NFP surprise is more likely than a negative one.

In commodities, oil futures were eyeing fresh highs after Saudi Arabia said it will extend its production cut of 1 million barrels a day into September and may even increase the size of the reduction in the Autumn. The decision comes ahead of a meeting of OPEC+ producers later today.