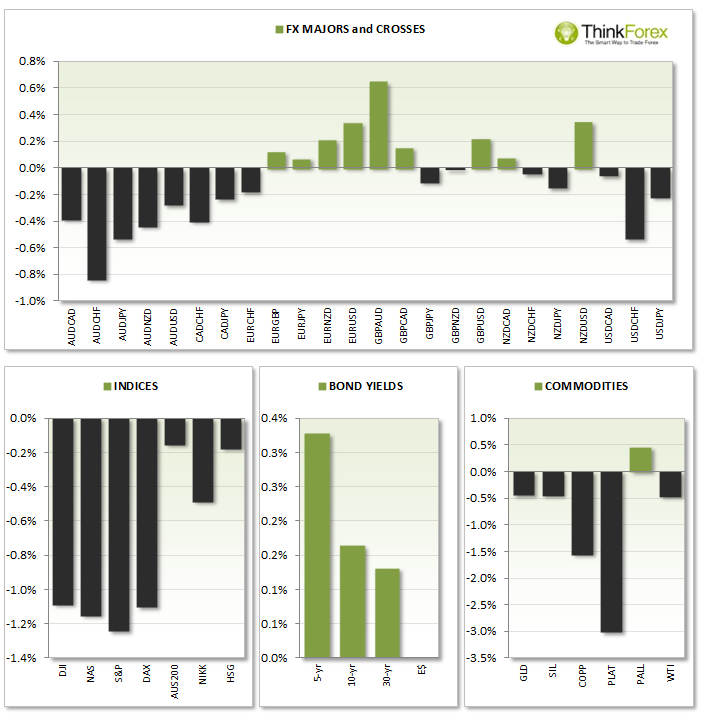

Whilst FX remained within corrective ranges Indices took the centre stage and provided the better opportunities.

INDICES:

Global Equities continued to slide after growing concerns regading valuations

NASDAQ was down a further 1.2% yesterday and has shed over 6% since the 7th March swing high;

Equities Europe also tumbled with Asian Equities expected to continue the trend today

COMMODITIES:

Copper has closed above $3.00 after a failed attempt to break below; POtential bullish hammer has formed

Silver remains below $20 resistance; Potential bear flag forming below this level, a break above confirms a basing pattern

Gold retraced from last week's high to confirm 13074 as reistance; near-term still appears bullish

Palladium shed 3% yesterday, its largest single day loss this year

FOREX:

Swiss CPI beat came in at a 2-year high at 0.4% vs 0.2% forecast

Money flowed into the Swiss Franc whilst AUD continued to retrace against last weeks gains to see AUDCHF down -0.9% at end of trading

GBP also capitalised on AUD weakness to see GBP/AUD as the biggest daily gainer at 0.62%