Asian markets rallied, encouraged by a strong rally in Western shares on Monday. The Nikkei soared 2.3% to 8488, the Kospi advanced 2.3%, and the ASX gained 1.1%. Both the Hang Seg and the Shanghai Composite rose 1.2%.

In Europe, markets rose moderately, lifted by a jump in consumer confidence in the US. The DAX gained 1% to 5800, while the CAC40 and FTSE closed up .5%. Policymakers approved a $10.7 billion bailout payment to Greece in an effort to slow the spiraling debt crisis.

Nasdaq Closes Down .5% Continuing the Recent Slide

American Airlines parent, AMR, filed for bankruptcy, sending shares plunging 84% to .26. The company cited high labor costs and rising fuel prices as causes for the company’s cash shortage.

Currencies

The Australian Dollar soared for a second day, jumping 1.2% to 1.0026 as investors slowly recovered their risk appetite. The Pound gained .7% to 1.5609, and the Euro inched up .1% to 1.3328. The Canadian Dollar rose .4% to 1.0302, and the Swiss Franc settled up .3% at 1.0872.

Economic Outlook

Tuesday’s economic data was a mixed bag. Consumer confidence soared to 56 from 40.9, blowing past analyst forecasts. The Case-Shiller home price index dropped 3.6%, more than expected, but the FHFA house price index rose .9%, painting a mixed picture of the housing market.

Central Banks Unite to Boost Liquidity, Western Markets Soar

Equities

China’s Shanghai Composite tumbled 3.3% due to growing concerns the country’s growth with slow, and the Hang Seng fell 1.5% to 17989. China’s central bank cut reserve requirements for the first time in nearly 3 years in an effort to keep the economy on track. In Japan, the Nikkei slipped .5% to 8435, while Olympus shares recovered from a sharp 10% loss at the open after the company affirmed it would release its December earnings report on time. Korea’s Kospi declined .5%, but Australia’s ASX managed to buck the trend, closing up .3%.

A coordinated move by global central banks to increase liquidity sent Western markets sharply higher. The DAX spiked 5%, the CAC40 soared 4.2% and the FTSE climbed 3.2%. Miners jumped 6% amid hopes the easing efforts will boost demand for raw materials.

Dow Soars Nearly 500 Points

Netflix shares slumped 4.5% after the company was downgraded to sell from neutral by Wedbush Securities.

Currencies

The Australian Dollar surged 2.4% to 1.0284 as the recent rally accelerated. The Canadian Dollar jumped 1% to 1.0198, and the Euro gained .8% to 1.3436. The Pound rose .5% to 1.5695, while the Yen declined .5% to 77.55.

Economic Outlook

Wednesday’s reports were exceedingly upbeat. Data from the ADP employment report blew past forecasts, with the economy adding 206K jobs last month, up from 130K in the previous report. Chicago PMI rose to 62.6 from 58.4, well above estimates, and the Challenger job-cut report showed planned layoffs declined by 12.8%.

US Stocks Consolidate after Wednesday’s Rally

Equities

Asian markets opened sharply higher on Thursday in response to the announced cooperative central bank liquidity effort. The Hang Seng soared 5.6%, climbing 1013 point to 19002, leading the region. The Shanghai Composite rose 2.3%, the ASX 200 gained 2.6%, and the Nikkei advanced 1.9%. In Korea, the Kospi rallied 3.7% as Samsung Electronics surged 7% to a new record closing high.

Hong Kong's Hang Seng Index Surges 5.6%

In Europe, the major indexes closed lower after Wednesday’s sharp rise. The DAX fell .9%, the CAC40 dropped .8%, and the FTSE slipped .3%, as investors locked in gains from the previous session.

Currencies

The currency market ended mixed after Wednesday’s steep dollar selloff. The Euro edged up .2% to 1.3459, and the Canadian Dollar advanced .5% to 1.0142. The Australian Dollar slipped .4% to 1.0226, and the Swiss Franc and Japanese Yen both declined by .2%.

Economic Outlook

Weekly unemployment claims unexpectedly rose to 402K from last week’s 396K reading. ISM manufacturing PMI was slightly better than expected at 52.7 vs. 51.6, and monthly auto sales rose to 13.6M from 13.3M last month.

US Unemployment Rate Drops to 8.6%

Equities

Asian markets closed mixed as investors awaited key US payroll data later in the day. The Nikkei rose .5% to 8644, gaining 5.9% for the week, its largest jump in 2 years. Australia’s ASX 200 climbed 1.4%, soaring 7.6% for the week. In China, the Shanghai Composite fell 1.1%, while the Hang Seng ticked up .2%.

European markets advanced, as the banking sector surged 4.2% amid hopes for the upcoming EU summit. The FTSE gained 1.2%, the CAC40 rose 1.1%, and the DAX closed up .7%.

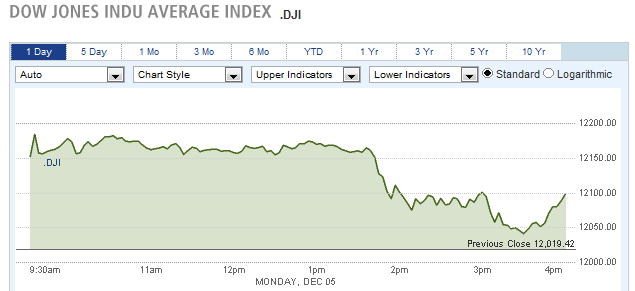

US markets closed little changed, surrendering earlier gains, despite an upbeat jobs report. The Dow had risen more than 125 points earlier in the session, but settled at 12019, down 1 point.

Dow Forfeits Early Gains to Close Flat

Blackberry-maker Research in Motion plunged 9.7% after warning it would fall short of forecasts due to struggling sales of its Playbook tablet.

Currencies

The US Dollar advanced against global currencies. The Euro, Pound, and Swiss Franc each fell .6%, while the Yen eased .3% to 77.98. The Australian Dollar edged lower .1% to 1.0216, reversing a morning spike up to 1.0304.

Economic Outlook

Non-farm payrolls rose by 120K last month, slightly less than the 126K forecast, but stronger than last month’s 100K reading. The unemployment rate unexpectedly dropped to 8.6%, from 9.0% previously. The recent data suggests the US recovery is picking up steam.

Equities Gain, Italy Announces Austerity Measures

Equities

Over the weekend, Italy announced a $30 billion austerity package which helped lift Asian markets The Nikkei rose .8% to 8696, the Kospi edged up .4%, and the ASX advanced by .8%. Tha Hang Seng climbed .7%, while China’s Shanghai Composite lagged the region, dropping 1.2% on weak economic data which dragged down small-cap stocks.

An agreement between French and German leaders concerning the spiraling debt crisis was cheered by European markets. The CAC40 rallied 1.2%, the DAX gained .4% and the FTSE rose .3%. Italy’s MIB index surged 2.9% in response to the new austerity measures.

US markets opened sharply higher, but trimmed their gains later in the day. S&P announced it is placing all 17 Euro zone nations on credit review, due to the spreading debt crisis. The Dow gained 78 points to 12098, the S&P 500 climbed 1%, and the Nasdaq closed up 1.1%.

Stocks Gain, but well off Highs

SAP announced it will acquire SuccessFactors for $3.4 billion. SuccessFactors’ stock soared 51%, while SAP shares slipped 2%.

Currencies

The US dollar eased modestly on Monday. The Euro inched up 9 pips to 1.3398, the Pound rose .3% to 1.5649, and the Yen gained .3% to 77.71. The Australian Dollar posted an outsized gain of .6% to 1.0279, while the Canadian Dollar edged up .2% to 1.0173.

Economic Outlook

Monday’s economic data came in slightly below expectations. The ISM non-manufacturing PMI unexpectedly fell to 52 from last month’s 52.9 reading, and factory orders dropped by .4%, more than forecast.