Equinix Inc (NASDAQ:EQIX). EQIX recently announced a multi-year partnership with Nasdaq, Inc. NDAQ to scale the latter’s NY11 data center. This will support the build-out of NDAQ's cloud infrastructure in Carteret, NJ.

Nasdaq leveraged Platform Equinix for more than 13 years. The extended partnership reflects spurring demand for Equinix’s data-center infrastructure amid robust growth in cloud computing.

Per management "Our goal with this hybrid infrastructure is to provide new services and products for our clients with added flexibility and low latency, including virtual connectivity services, market analytics, risk tools and machine learning."

Equinix remains well-poised to bank on solid demand in the data center space with its Platform Equinix, which comprises more than 237 data centers across 65 metros.

Solid growth in cloud computing, the Internet of Things and big data, and a greater call for third-party IT infrastructure is buoying demand for data-center properties. Moreover, growth in artificial intelligence, autonomous vehicle and virtual/augmented reality markets is anticipated to be robust over the next five to six years.

However, the increased competition could prompt rivals to resort to aggressive pricing policies, making Equinix vulnerable to pricing pressure.

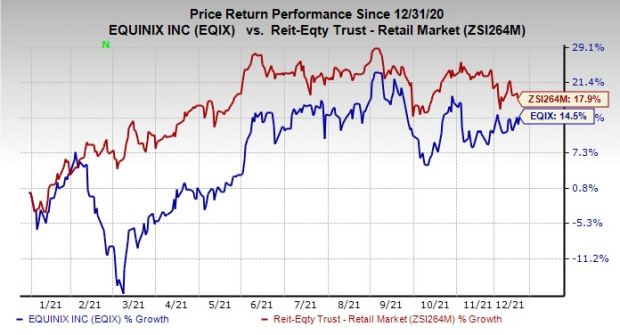

Shares of Equinix have gained 14.5% year to date, underperforming the industry's growth of 17.9%. EQIX currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Nasdaq’s 2021 fund from operations (FFO) per share has been raised marginally over the past two months. NDAQ’s 2021 FFO per share is expected to increase 9.4% from the year-ago quarter’s reported figure.

Nasdaq carries a Zacks Rank 3 at present. Shares of NDAQ have rallied 4.8% in the past three months.

Stocks to Consider

Some better-ranked stocks from the REIT sector are OUTFRONT Media OUT and Cedar Realty (NYSE:CDR) Trust CDR.

The Zacks Consensus Estimate for OUTFRONT Media’s 2021 FFO per share has been raised 13.8% over the past two months. OUT’s 2021 FFO per share is expected to increase 45.71% from the year-ago quarter’s reported figure.

OUTFRONT Media flaunts a Zacks Rank 1 (Strong Buy) at present. Shares of OUT have rallied 7% in the past three months.

The Zacks Consensus Estimate for Cedar Realty’s current-year FFO per share has been raised 2.6% to $2.36 in the past two months. Over the last four quarters, CDR’s FFO per share surpassed the consensus mark twice and missed the same in the other two, the average surprise being 6.4%.

Currently, CDR sports a Zacks Rank of 1. Shares of Cedar Realty have appreciated 44.6% in the past six months.

Note: Anything related to earnings presented in this write-up represent FFO — a widely used metric to gauge the performance of REITs.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nasdaq, Inc. (NDAQ): Free Stock Analysis Report

Equinix, Inc. (EQIX): Free Stock Analysis Report

Cedar Realty Trust, Inc. (CDR): Free Stock Analysis Report

OUTFRONT Media Inc. (OUT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research