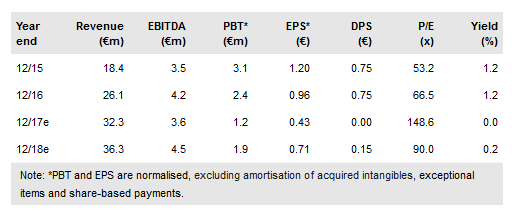

Eqs Group AG (DE:EQSn) flagged in September that it was accelerating investment to grasp the market opportunity prompted by further regulation. Q3 figures show the impact of the additional cost, with year-to-date EBITDA of €1.9m (prior year: €2.5m). Our forecasts are unchanged on confirmed guidance. The newer cloud-based products are scalable and should build recurring revenues, with market interest to date very encouraging. The service range continues to broaden out, particularly in corporate governance and compliance, while the geographic reach is also extending. The valuation remains in line with global peers, reflecting EQS’s strong growth potential.

Organic and acquired revenue growth

Year-to-date revenues are up 22%, reflecting organic growth of 9% plus the consolidation of ARIVA. There was strong demand in Germany for products to help corporates comply with ever-tightening regulation, driving domestic revenues up by 28%. The impending introduction of MiFID II, along with SAPIN II in France, Market Abuse Regulation (EU) and PRIIP-Regulation (EU) are all fuelling the need for logging and reporting systems to ease the regulatory burden on corporates. EQS’s cloud-based platform approach allows extra functionality to be added with relatively modest project implementation costs. While the individual contract values can be quite small, the numbers of potential clients are substantial.

To read the entire report Please click on the pdf File Below: