Envision Healthcare Corp. (NYSE:EVHC) reported second-quarter earnings of 79 cents per share, surpassing the Zacks Consensus Estimate by 5.33%, but declining from $1.01 reported in the year-ago quarter.

The company reported net revenue of $1.95 billion, which missed the Zacks Consensus Estimate by 0.5% but increased from $758.5 million in the year-ago quarter.

Total operating expenses of $1.75 billion increased from $600 million in the year-ago quarter.

Segment Update

Net revenues from the Physician Services segment were $1.63 billion in the second quarter of 2017, reflecting an increase of 9.3% year over year. The revenue growth was driven by 10.6% contribution from acquisitions and 2.5% from same contracts.

Net revenues from Ambulatory Services were $318.5 million, reflecting a decline of 0.4% year over year. Same-center revenues increased 0.6%, comprising a 0.5% increase in net revenue and a 0.1% increase in procedure volume.

Financial Update

Envision Healthcare had cash and cash equivalents of $441.3 million, up from $316.9 million as of Dec 31, 2016.

Total long-term debt increased to $6.3 billion as of Jun 30, 2017 from $5.8 billion as of Dec 31, 2016.

The company’s ratio of total net debt at Jun 30, 2017 to trailing 12-month EBITDA as calculated under the company’s credit agreement was 4.5 times.

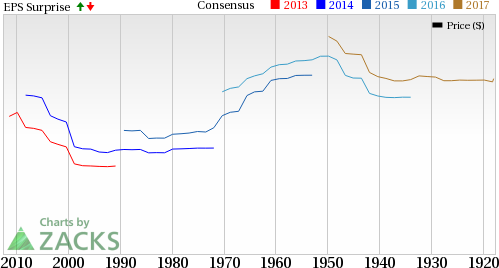

Envision Healthcare Corporation Price, Consensus and EPS Surprise

Guidance Update

For 2017, the company lowered its revenue guidance to $7.75–$8.00 billion (from the previous guidance of $7.80 billion to $8.05 billion), adjusted EBIDTA to $1.02 billion to $1.04 billion (from $1.038 billion to $1.066 billion) and adjusted EPS to $3.35 to $3.45 (from $3.38 to $3.52).

It, however, kept intact, the same contract revenue growth guidance of 3% to 4% in the physician services segment and 0% to 1% in ambulatory services.

For the third quarter, the company expects adjusted EBIDTA of $266 million to $278 million and adjusted EPS of 87 cents to 93 cents.

Zacks Rank & Other Releases

Envision Healthcare carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Among the other stocks in the healthcare space, the bottom lines at UnitedHealth Group Inc. (NYSE:UNH) , Aetna Inc. (NYSE:AET) and Humana Inc. (NYSE:HUM) beat their respective second-quarter estimates.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Aetna Inc. (AET): Free Stock Analysis Report

Humana Inc. (HUM): Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Envision Healthcare Corporation (EVHC): Free Stock Analysis Report

Original post