On October 8, I served up the question, “Will Apple (AAPL) Nibble Away At Your ETF Portfolio?” At that time, the i-Everything producer had dropped -9% from its $702.10 closing price, while iShares DJ Technology (IYW) had slipped -4.3%.

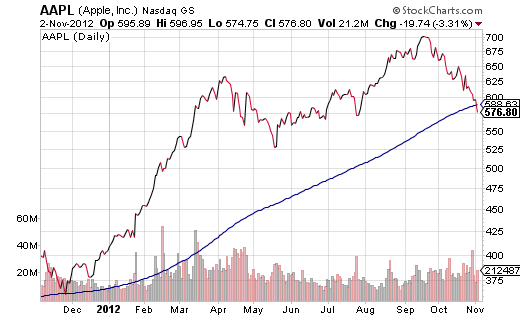

Then came an inauspicious earnings report. Later, an executive shake-up gave investors indigestion. And by the close of business on Friday, November 2, the mighty Apple (AAPL) found itself down -17.8%.

And that’s not all. For the first time in nearly 12 months, the price of one share of the largest company in the world by market capitalization had fallen below its long-term, 200-day moving average.

Put another way, the last time the exceptionally popular device maker breached its 200-day, shares traded at $365. Raise your hand if you wished you had been confident enough to take a bigger bite… anyone?! After all, a 92.3% unrealized gain in less than a year is not too shabby.

At roughly $575, it may be a stretch to project AAPL hitting $1105 by next November. Then again, scores of analysts have already gone on record with the $1000 per share call by year-end 2013.

In other words, it may not be entirely crazy to show some love. (You know you wish you had on the previous go-around.)

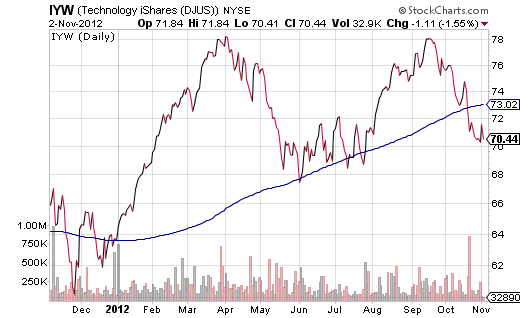

Keep in mind, AAPL fell -16% in the May-June gloom of this year. That correction turned out to be a fairly decent opportunity for traders. What’s more, if you’re looking for a healthy helping, you could look to iShares DJ Technology (IYW) with its 24% weighting in the corporation.

Granted, IYW is close to correction levels itself, having plummeted -9.8% since September. It has also breached the 200-day trendline.

Nevertheless, you can choose to buy the dips on a fund that holds mega-brands like Oracle (ORCL) International Business Machines (IBM) and Google (GOOG). Simply employ a stop-limit loss order to protect against the possibility that the pullback in tech morphs into a bear market mauling.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Entry Strategy For Technology ETF Enthusiasts

Published 11/04/2012, 05:48 AM

Updated 07/09/2023, 06:31 AM

Entry Strategy For Technology ETF Enthusiasts

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.