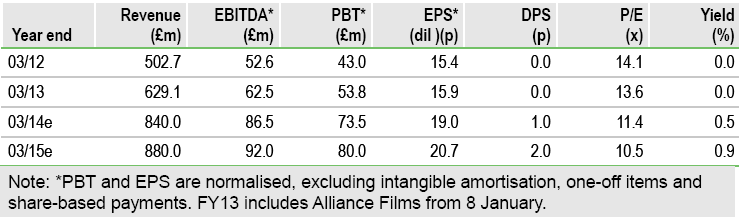

Entertainment One Ltd (ETO.L) is a focused play on the growing demand for entertainment content. Its library is worth well over $650m (£410m) and represents more than half the £752m EV; the remaining EV is only 1.2x the annual investment in content, which we estimate should achieve an IRR of c 20%. Based on the recent trading update, we expect H1 normalised EPS to increase by 58%, helped by the successful integration of Alliance Films. Analysis of the business model underpins our expectation of strong positive cash flows from FY15, and both a peer group comparison and DCF point to a share price over 273p, 26% above the current level.

Step change in scale, cash positive from FY15

Alliance Films increased eOne’s size by over 40%, bringing economies of scale and greater diversification, both by product and geography. The group is continuing to invest heavily in content and programmes (with further bolt-on acquisitions still a possibility). This is reflected in our estimate of September adjusted net debt of £150m (March 2013: £87.8m) or £210m including TV debt. However, this report revisits the business model and shows that as soon as the growth in content investment begins to stabilise – as we expect from FY15, and something that is very much under management’s control – the group will turn strongly cash positive.

Positive pre-close update

On 26 September, eOne reported that H1 revenue and EBITDA was “significantly higher than the comparative period”, with full year earnings “anticipated to be in line with management expectations”. We expect a doubling in H1 EBITDA to £26.0m (H113: £13.4m) due to the inclusion of Alliance Films and the timing of releases. Our full-year profit estimates are unchanged (although we have trimmed EPS to allow for increased diluted share capital, with FY14e at 19.0p versus 19.3p).

Valuation: Still plenty of upside

eOne’s share price has risen by 29% since the start of 2013, helped by the move to a premium listing and promotion to the FTSE 250, the successful integration of Alliance and estimated FY14e EPS growth of 18%. Yet the FY14e EV/EBITDA is still only 9.0x. Entertainment company multiples have increased over the same period and our peer comparison and DCF now point to a share price of 273-286p per (diluted) share, suggesting plenty more upside.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Entertainment One: Still Plenty Of Upside

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.