Entertainment One Ltd (LON:ETO) has announced the proposed acquisition of the remaining 49% of the Mark Gordon Company (MGC) for $209m, financed with a mixture of new equity and debt. We estimate that the deal will be slightly earnings accretive in its first year before an anticipated $7-10m of cost synergies. In our view it is a logical extension of the group’s strategy to build a diversified content business.

Acquisition of the remaining 49% in MGC

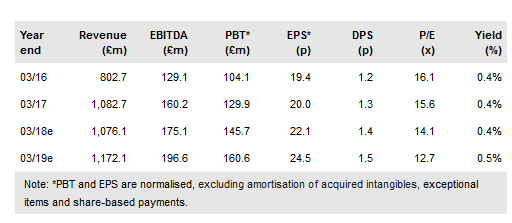

Subject to shareholder approval, eOne has announced the proposed acquisition of the remaining 49% of MCG for $209m (£148m), taking full ownership of the venture. The transaction will be financed via the issue of $49m in equity to Mark Gordon (founder and CEO), an equity placing of $75m (4.1% of the current share capital) and $100m of new debt. The raise is $15m more than the $209m cost in order to cover associated transaction costs and other smaller acquisitions (not disclosed). This implies a multiple of approximately 8.8x FY19e EBITDA, a small discount to eOne’s own multiple.

To read the entire report Please click on the pdf File Below: