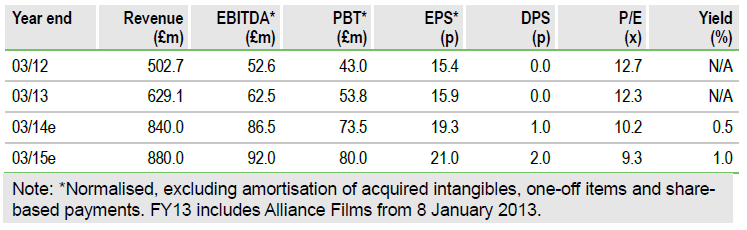

Entertainment One (ETO.L) has issued a positive Q1 IMS and our full year forecast of 21% EPS growth is unchanged. Interim results should look particularly strong, based on our estimate of the mix of revenues, including Alliance Films. With the group set to be included in the FTSE indices from September, and management’s stated intention to introduce dividends, eOne should attract an increasingly wide investor audience. The rating looks very good value with an FY14e P/E of 10.2x and EV/EBITDA of 8.2x.

eOne has reported Q1 revenues up over 40%, with digital revenues more than doubling and full year earnings in line with management expectations. A 65% increase in Film revenue reflected the inclusion of Alliance Films (pro-forma was in line with the prior year, but quarterly fluctuations are normal due to the timing of releases). Key positives include a trebling in box office takings (68 versus 49 films released), increased margins reported for both Film and Television and operating costs in line with expectations with Alliance synergies coming through strongly.

eOne now has a very broad spread of product and geographies. FY14 investment in content and programmes is expected to increase to over £250m (FY13 pro-forma: £219m). Thus individual titles should not be over-emphasised, but we note that upcoming films include RED 2 and The Hunger Games: Catching Fire. We were especially pleased to see the Rookie Blue television series commissioned for season five. We plan to release a full review of eOne in September.

We remain very positive on eOne’s prospects. Management has consistently delivered on its targets and we view January’s £141m acquisition of Alliance Films as transformational. The share rating is undemanding and the July 1 move to the premium list means that eOne should enter the FTSE 350 (/250?) in September.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Entertainment One Having A Red Hot Summer

Published 07/24/2013, 07:01 AM

Updated 07/09/2023, 06:31 AM

Entertainment One Having A Red Hot Summer

Red-hot summer

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.