Live Nation Entertainment Inc (NYSE:LYV) is the world’s premier live entertainment company, consisting of Live Nation, Ticketmaster and Front Line Management Group. The Company engages in producing, marketing, and selling live concerts for artists via its concert pipe. Live Nation owns and operates many venues, including House of Blues music venues and locations, such as The Fillmore in San Francisco, Nikon at Jones Beach Theatre in New York and London’s Wembley Arena. In addition, it also produces, promotes or hosts theatrical, specialized motor sports and other live entertainment events. The Company is driving major innovations in ticketing technology, marketing and service. It offers ticket sales, ticket resale services, and marketing and distribution through ticketmaster.com, an e-commerce site on the Internet. Live Nation Entertainment, Inc. was formerly known as Live Nation, Inc. and is based in Beverly Hills, California.

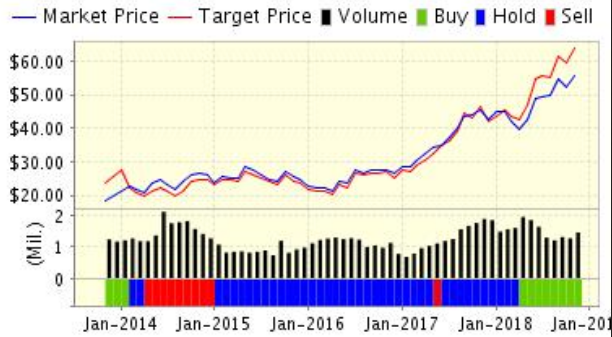

Live Nation appears to have had no issues weathering recent bad news related to ticket scalping at their Ticketmaster subsidiary. Revelations that the firm worked with ticket scalpers to ensure that they would get their cut of profits served to further inflame concert goers, but did little to arrest the rising share price over the past months.

They also continue to shrug off complaints of monopoly behaviour at concert venues, building or buying additional venues in many areas as well as finding new ways to make more money off of concert attendees once they are in those venues.

As far as good news goes, the firm is about to open a wildly-anticipated venue known as “the Met” in Philadelphia and their latest foray into film with the remake of “A Star is Born” starring Bradley Cooper and Lady Gaga is expected to garner numerous Oscar nominations.

In addition, the latest earnings results were impressive. Q3 results were the best ever for the company, with revenue up more than 10%. All divisions of the firm–concerts, sponsorships, and ticketing–were similarly strong. The company expects to sell more than 90 million concert tickets for the year, and that will also be a record.

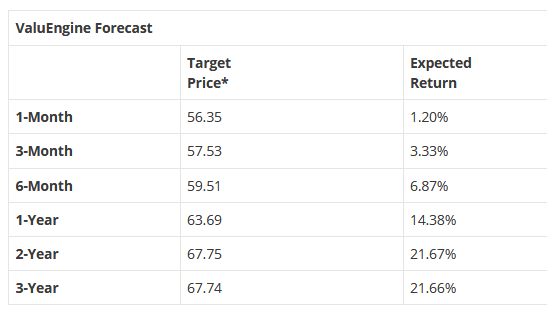

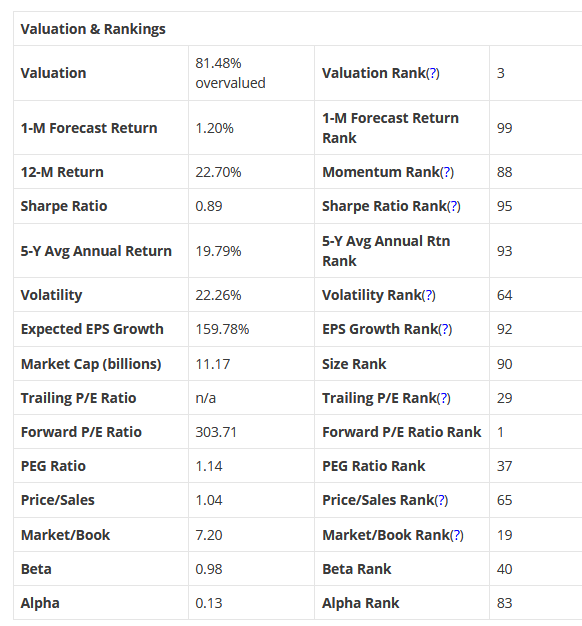

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on LIVE NATION ENT for 2018-11-30. Based on the information we have gathered and our resulting research, we feel that LIVE NATION ENT has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Sharpe Ratio and Earnings Growth Rate.

You can download a free copy of our Live Nation Entertainment, Inc. (LYV) report from the link below.