Enterprise Products Partners L.P. (NYSE:EPD) recently announced that its plants in the Texas Gulf Coast did not suffer heavy damage from the tropical storm, Harvey. The midstream energy partnership has been able to continue partial operations in the region.

South Texas

Enterprise Products has eight natural gas processing units in South Texas. Among these, two are currently functional, including the partnership's largest unit Yoakum. The remaining six units were shut. Work at the partnership's fractionation facility, Shoup NGL, was also halted due to the storm.

Enterprise Products suffered power loss, the absence of third party services, minor damages and other problems related to the storm, which affected seven facilities. The partnership still managed to keep its natural gas, NGL and crude oil pipelines, which serve the Eagle Ford Shale and South Texas, operational.

Mont Belvieu

The partnership has eight NGL and six propylene fractionators and storage facilities in Mont Belvieu. Among these, four NGL and three propylene fractionators are functional. Due to the tropical storm, Mont Belvieu witnessed rising water and power loss.

Houston

Enterprise Products has its crude oil pipeline infrastructure, Seaway in the Houston area. Its origin point is in Cushing, OK. Although the pipeline is in service, electrical power interruptions at pump stations and confinements at receipt points may disrupt supply. In that case, the crude will be supplied on an allocation basis. The marine terminals at Seaway in Texas City and Freeport stopped shipping traffic. Services at other marine terminals of the partnership have also been stalled as the Houston Ship Channel and the Port of Beaumont stopped shipping traffic.

The partnership’s decision to keep operations online without any major damage shows its efficient management system.

About the Partnership

Enterprise Products, a leading master limited partnership (MLP), is engaged in providing a wide range of midstream energy services to producers and consumers of natural gas, natural gas liquids (NGL), and crude oil. Enterprise Products has an extensive network of pipeline that spreads over almost 50,000 miles and earns stable fee-based revenues.

However, since 2012, long-term debt of Enterprise Products has risen at an exponential rate. As of Mar 31, 2017, the total long-term debt stands at $21.1 billion, while its cash and equivalents came in at only $107 million, reflecting balance sheet weakness.

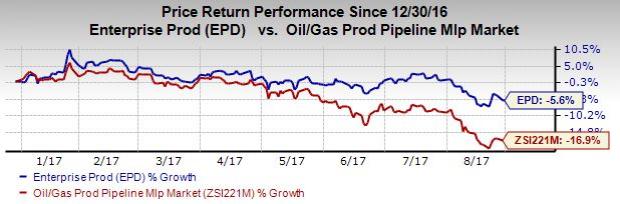

Price Performance

Enterprise Products has lost 5.7% year to date compared with 17% loss recorded by the industry.

Zacks Rank and Stocks to Consider

Enterprise Products carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the oil and energy sector include Range Resources Corporation (NYSE:RRC) , Subsea 7 SA (OTC:SUBCY) and TransCanada Corporation (TO:TRP) . All these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Range Resources’ sales for 2017 are expected to increase 122.8% year over year. The company delivered a four-quarter average positive earnings surprise of 51.8%.

Subsea’s sales for 2017 are expected to increase 11.6% year over year. The company delivered a positive average earnings surprise of 83.8% in the last four quarters.

TransCanada delivered a positive earnings surprise of 12% in the second quarter of 2017.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

Enterprise Products Partners L.P. (EPD): Free Stock Analysis Report

Subsea 7 SA (SUBCY): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Range Resources Corporation (RRC): Free Stock Analysis Report

Original post

Zacks Investment Research