It has been about a month since the last earnings report for Enterprise Products Partners L.P. (NYSE:EPD) . Shares have lost about 2.8% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Second-Quarter 2017 Results

Enterprise Products reported second-quarter 2017 adjusted earnings per limited partner unit of $0.30, which missed the Zacks Consensus Estimate of $0.33. The bottom line, however, improved from the year-ago quarter earnings of $0.27 per limited partner unit.

Quarterly revenues increased to $6,608 million from $5,618 million in the year-ago quarter. The top line, however, missed the Zacks Consensus Estimate of $6,712 million.

The year-over-year upside was attributed to increase in volumes from all four segments of the master limited partnership (NGL Pipeline & Services, Natural Gas Pipeline and Services, Crude Oil Pipelines & Services and Petrochemical & Refined Product Services) during struggling oil prices, which was partially offset by increased costs and expenses.

Quarterly distribution at Enterprise Products Partners increased 5% year over year to $0.42 per common unit. Adjusted distributable cash flow of $1.1 billion provided coverage of 1.2x. The partnership retained $145 million in cash flow, gaining the financial flexibility to fund growth capital projects, reduce debt and decrease the need to issue additional equity. The partnership managed to generate strong levels of cash flows and rewarded its unitholders with growing distribution amid a tough business environment.

Second-Quarter Segmental Performance

The operating income from the different segments increased primarily due to increased volumes.

Gross operating income in the NGL Pipeline & Services segment rose to $759.9 million from $719.1 million in the year-ago quarter due to contractual increases in committed volumes. Improved contribution from Mont Belvieu NGL and associated product storage business supported the segment.

Natural Gas Pipeline and Services segment recorded gross operating income of $194.4 million compared with $177.4 million in the prior-year quarter as the gathering system in the Permian Basin transported more volumes than the previous year comparable quarter.

Gross operating income from the Crude Oil Pipelines & Services segment surged 33.4% year over year to $236.7 million due to the rise in production from the Permian Basin.

Gross operating income from the Petrochemical & Refined Product Services segment grew to $188.4 million from the year-earlier level of $175.5 million owing to the lower operating costs.

Cost and Expenses

During the second quarter of 2017, the partnership’s total cost and expenses surged 19% to $5,775.9 million due to an 18.8% increase in operating costs and 30.2% increase in general and administrative expenses.

Financials

Outstanding total debt principal as of Jun 30, 2017 was $23.6 billion. Enterprise Products Partners had consolidated liquidity of $4.1 billion, which comprised unrestricted cash on hand and available borrowing capacity. The partnership reported total capital spending of $869 million in this quarter.

Outlook

Enterprise Products expects growth projects worth $2.8-$3 billion to come online in the second half of the year, which will increase the estimates for the coming quarters (which may lead to an increase in expectations for the coming quarters). The partnership is developing a petrochemical plant at Mont Belvieu, TX with annual production capacity of 750,000 tons of polymer-grade propylene.

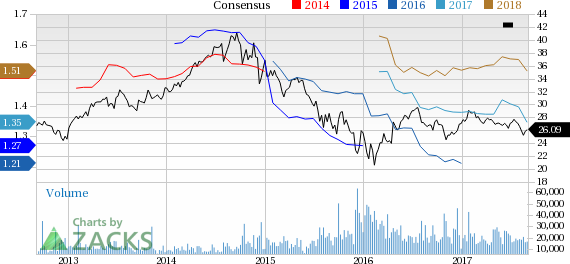

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been six revisions lower for the current quarter. In the past month, the consensus estimate has shifted lower by 5.5% due to these changes.

VGM Scores

At this time, Enterprise Products' stock has a nice Growth Score of B, though it is lagging a lot on the momentum front with an D. However, the stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of C. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than value investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We are looking for an inline return from the stock in the next few months.

Enterprise Products Partners L.P. (EPD): Free Stock Analysis Report

Original post

Zacks Investment Research