In this series of articles called "Entering Into 2013", so far I've expressed my negativity towards the US equity market and as well as expressed my outright favouritism towards the Precious Metals sector as a long term investor - not just for 2013, but further along as the secular commodity bull matures. Let us now turn our attention to all commodities and not just the precious type. Once again, as stated previously, I will leave the fundamentals out of the current article, as they have been discussed many times in previous posts.

Anyone that has closely followed financial markets since 2008 understands the close relationship between commodities and equities. They both corrected sharply during the Global Financial Crisis and after the cleansing was done, both bottomed between late 2008 and early 2009. Eventually, they started rising together with a close correlation for the next several quarters.

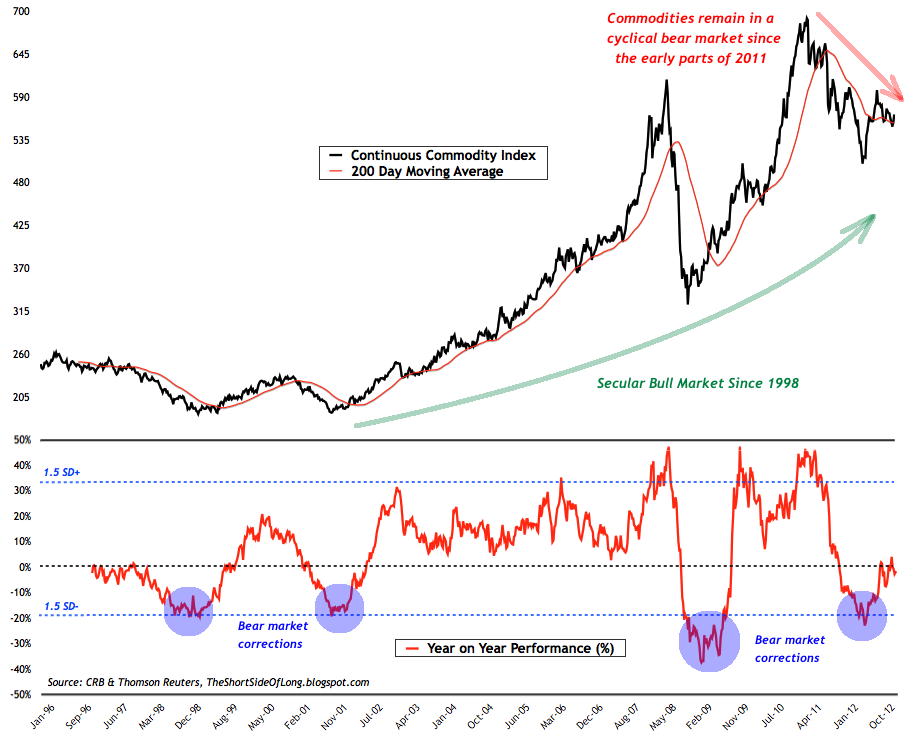

Chart 1: Commodities are experiencing a cyclical correction within a long term bull market

Commodities managed to have a super run into early parts of 2011. While the correction in almost all risk assets followed in the fall of that year, commodities never really recovered unlike US equities. The breakdown in the correlation has become evident to even the most novice of investors over the last 12 months, as S&P 500 has managed to rally towards new bull market highs, while the Continuous Commodity Index (best way to track commodities) remained in a bear market correction.

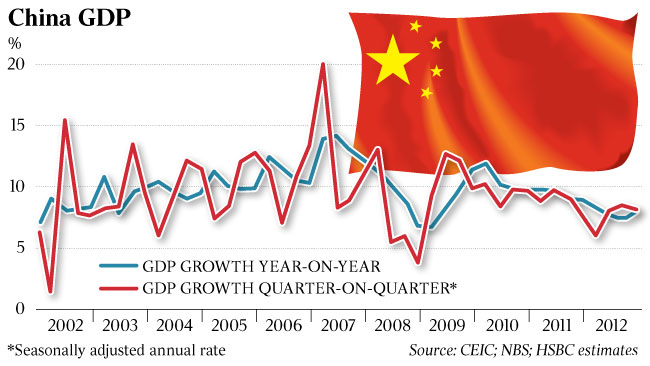

There are many reasons why this occurred. Some investors link it to the end of QE2 in 2011, while others claim that the secular bull market in commodities most likely peaked out. In my opinion, the correction is mainly linked to weakening demand out of China as its quarterly GDP growth slumped in late parts of 2011 and into 2012. As for the end of the secular commodity bull market, I tend to disagree as I believe that we just witnessed a corrective phase within a major uptrend.

Chart 2: Chinese slowdown has been a major demand impact on commodities

Long term secular bull markets tend to end in major oversupply. When one studies history one could easily conclude that great commodity bull markets of the past have always ended during the period of major oversupply. While supply has increased over the last decade, we have not seen anything even close to what historically occurs at the end of these great trends. The current conditions are not even remotely close to those of late 1940s and late 1970s, as two pervious secular commodity bulls came to a close.

Furthermore, and even more importantly, long term bull markets tend to end in speculation and mania. Today, commodities do not resemble either. The way gambling in Technology stocks became mainstream pass time during late 1990s, in the same fashion one day Precious Metals and maybe other sectors too, could experience a similar type of euphoria. During late stages of the secular bull markets, prices tend to go rapidly parabolic as public, usually clueless towards financial developments, becomes aware of certain assets and starts viewing them as a "sure bets".

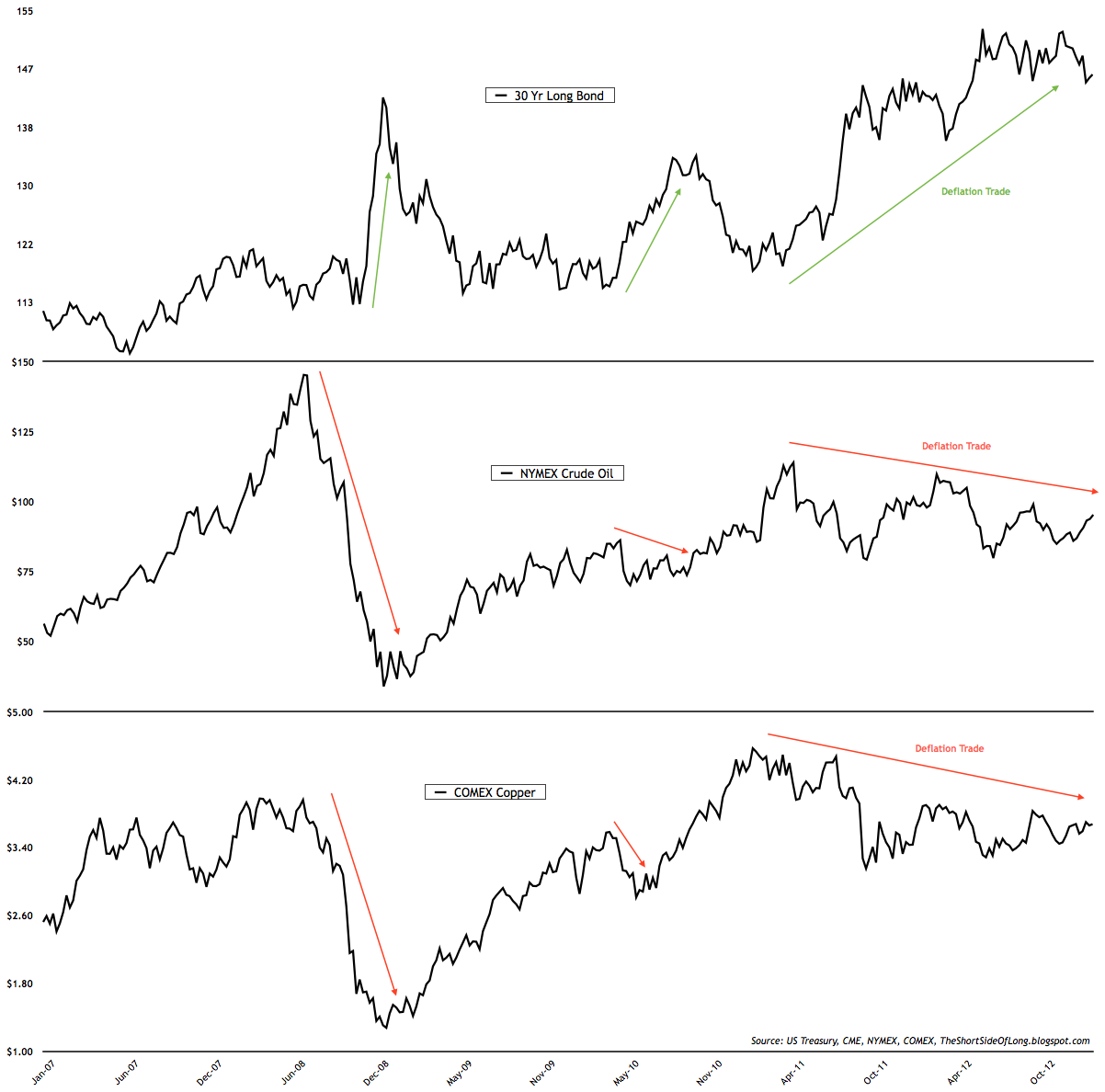

It is very difficult to claim commodities are in a bubble right now. The truth is, majority of investors are currently much more concerned about deflation and have allocated funds accordingly. Looking at the chart, we can see a very close inverse correlation between US Treasury government bonds (deflationary asset) and industrial commodities like Copper and Crude Oil (inflationary assets). Despite a majority of investors constantly focusing on the US Dollar direction to gauge where commodities might head next, just as important anchor for commodity prices in recent years has been the performance of government bonds.

Chart 3: Government bond rally has impacted commodities

I personally believe investors have become very confused since Lehman Brothers bankruptcy of 2008. On one hand, majority of investors understand that markets did not properly clear themselves and therefore most likely a major bottom has still not been witnessed. On the other hand, central banks constantly intervene into financial markets to try and prop up assets which are desperately trying to deflate back towards normal levels. These phenomena has been branded by the media as "risk on / risk off" or "inflation vs deflation" trade.

As the chart above shows us perfectly, industrial commodities as well as other assets with the CRB complex, have all remained in a cyclical bear market and continue to under-perform as long as the Treasury Long Bond remains bid up. I find it very interesting that the bottom in the Long Bond between Feb and May 2011 was also the top for almost all industrial, precious and agricultural commodities.

For the last two years, Bonds have done great while commodities have done poorly. However, at some point in the future as central banks print more and more money, investors will realise that inflation will become the main focus. As we approach the inflection point, capital allocation will eventually switch from a deflation trade (bonds) and into an inflation trade (commodities).

Majority of the readers of this blog, as well as regular followers of the financial markets in general, will claim that as funds flow out of bonds, they will go into stocks. I will have to disagree here.

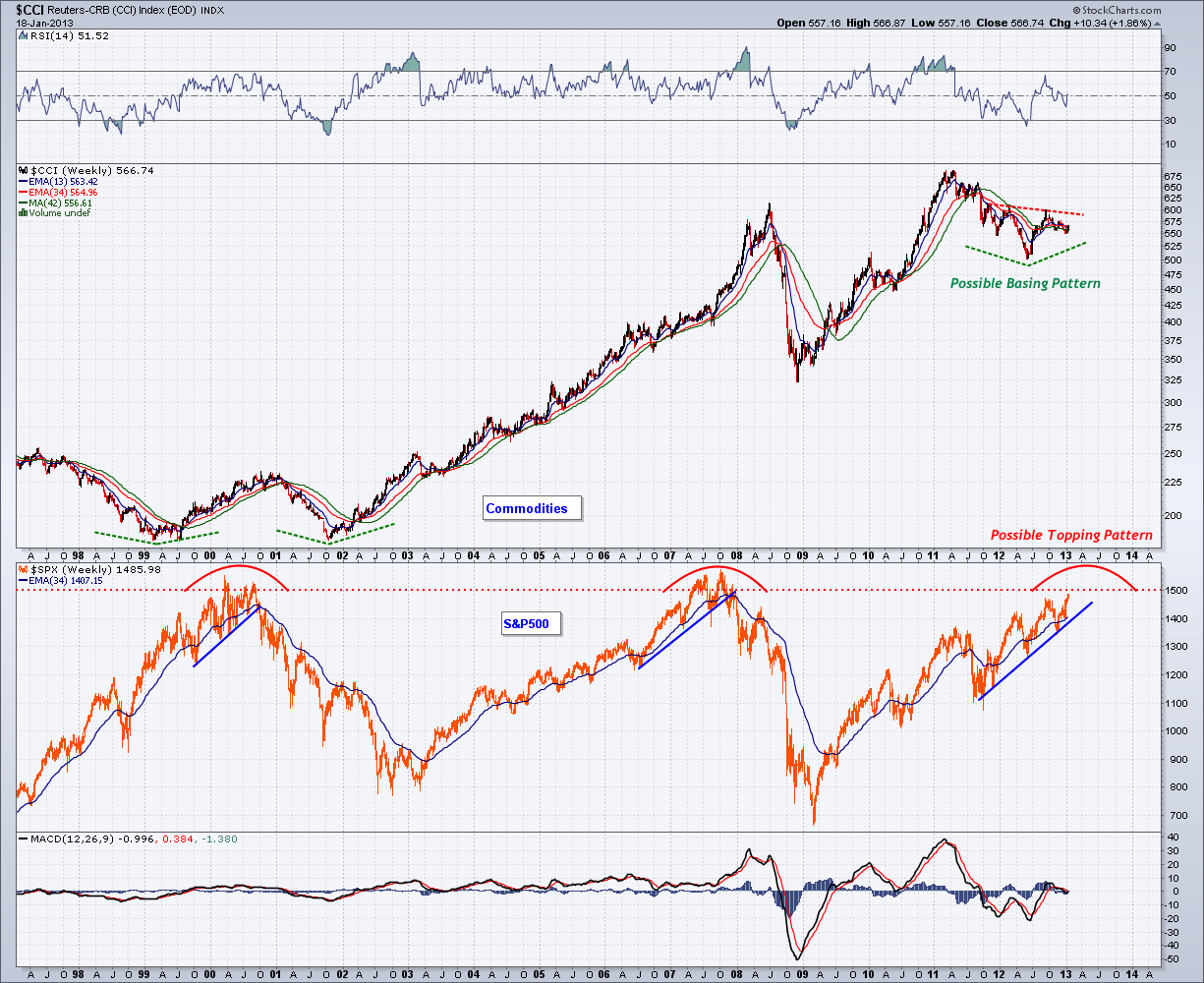

Chart 4: Stay with commodities as equity returns could easily disappoint in the future

Well... let me clarify that statement. I disagree in the short to medium term, but I do agree with that statement in the very long term. Investors are right in saying that eventually, the end of the bond bull market will help equities start another secular bull market. However, the way I view financial markets right now, this will most likely not occur until commodities experience a final blow off top and equities experience a final bear market correction.

Looking at the chart above, I believe that commodities could be creating a basing pattern, from which a final rally could occur. On the other hand, I believe that as commodities rally just like they did in later parts of 2007 and early parts of 2008, huge inflationary forces will squeeze consumer spending and earnings will totally disappointment. A recession and a financial crisis will follow. At that point, equities will most likely correct in a meaningful cyclical bear market.

Therefore, I urge long term investors to stay with commodities as equity returns could easily disappoint in coming quarters and years ahead.

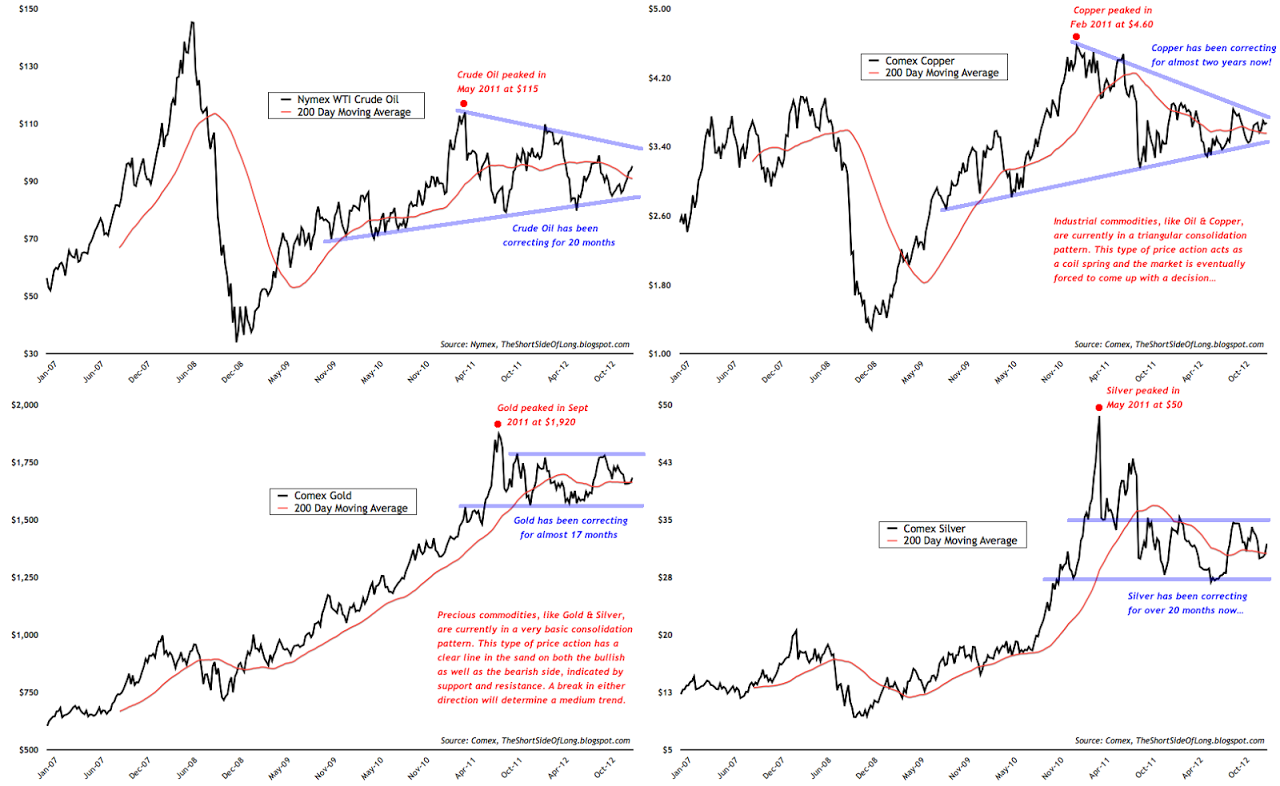

Chart 5: A lot of commodities are now at technical decision points

The current so called "basing pattern" Continuous Commodity Index is experiencing is not yet complete and therefore not 100% reliable. Commodities could also break down too. The chart above shows that majority of commodities are in some kind of consolidation patterns. For example, we can see that industrial commodities like Crude Oil and Copper continue to triangulate towards a climax and soon enough a direction will have to be chosen. On the other hand, Precious Metals remain in a sideways consolidation between a clear cut support and resistance. While prices can continue to move sideways for a long period of time, eventually here too a break in either direction will decide the direction of the medium term trend.

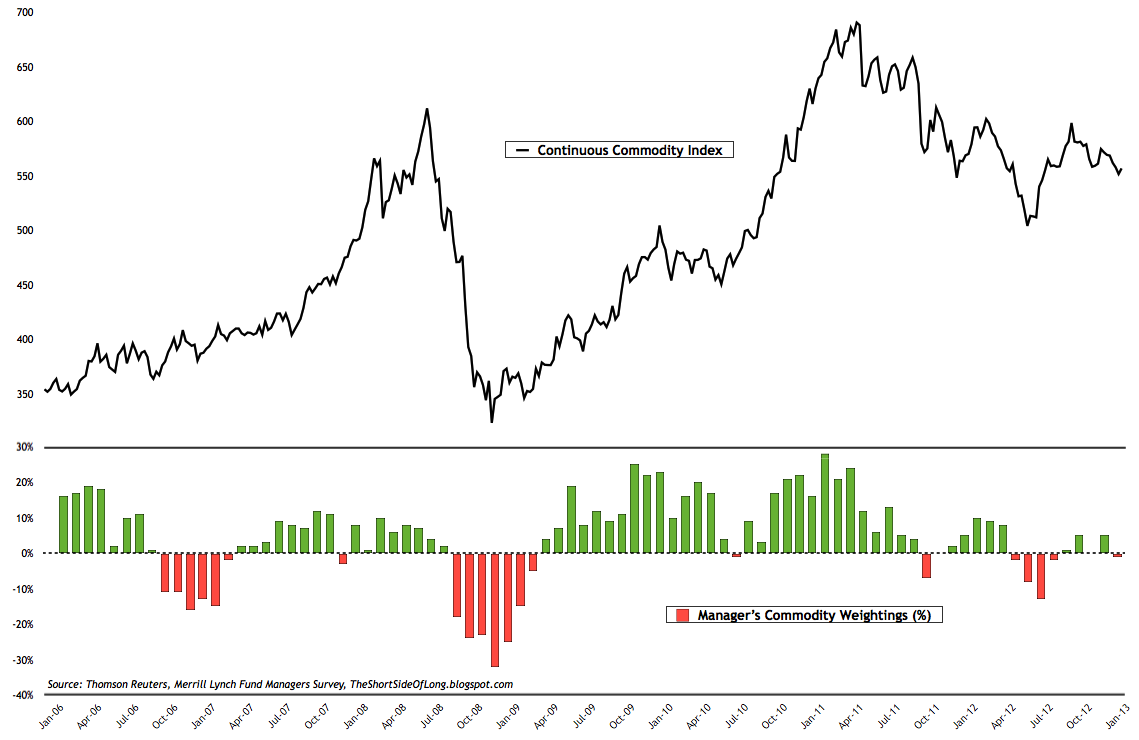

Chart 6: Investors are under-exposed to commodities...

Chart 7: ... and sentiment reading show investor disinterest!

Unlike the equity market in the US, which is currently experiencing abidance of complacency as major risk factors wait around the corner, commodity sentiment is muted as investors show disinterest and underexposure in various surveys. Furthermore, many individual commodities show negative sentiment readings right now, which further support this fact.

In summary, one could make a case that commodities are currently in a cyclical bear market correction within a longer term secular bull market. This correction has lasted almost two years now and is coming closer to the end. All the usual signals seen near the end of a major trend are not yet present and the current cyclical correction has most likely shaken out a lot of weak hands and created total investor disinterest.

This type of a condition possibly creates a good chance that the current basing pattern in the CCI is gifting us a buying opportunity. While I do not see equities as an attractive long term investment, I definitely think the best way for retail investors to play the final stages of the secular commodity bull market is through precious metals or agricultural commodities. While I already covered PMs in the previous post, it is quickly worth saying that food pries remain very depressed when adjusted for inflation and could easily surprise us on the upside, as we inch closer towards another "Food Crisis" with similarities of 2008.

What I Am Watching

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Entering 2013: Commodities And Equities (Part 4)

Published 01/22/2013, 02:47 AM

Updated 07/09/2023, 06:31 AM

Entering 2013: Commodities And Equities (Part 4)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.