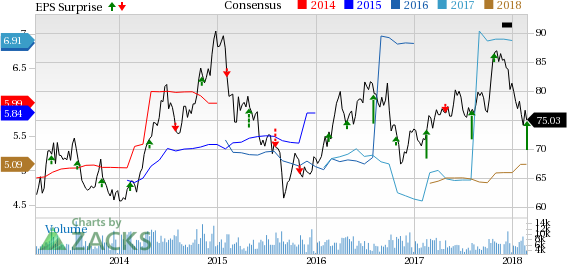

Entergy Corporation (NYSE:ETR) reported fourth-quarter 2017 adjusted earnings of 76 cents per share, beating the Zacks Consensus Estimate of 42 cents by 81%. Moreover, the number improved 145.2% from the year-ago quarter’s figure of 31 cents.

On a GAAP basis, the company reported a loss of $2.66 per share compared with a loss of $9.88 a year ago. The difference between GAAP and operating earnings in the reported quarter was due to the effect of special items.

In 2017, Entergy reported adjusted earnings of $7.20 per share, beating the Zacks Consensus Estimate of $6.91 by 4.2%. Moreover, the number rose 1.3% from the year-ago figure of $7.11.

Segment Results

Utility, Parent & Other: The segment’s quarterly earnings were 41 cents per share compared with 35 cents in the prior-year quarter.

Entergy Wholesale Commodities (EWC): The segment reported operating earnings of 35 cents per share compared with loss of 4 cents in the year-ago quarter.

Highlights of the Release

Interest expenses were $662 million in 2017, down 0.6% from $666 million in the prior year.

In 2017, total retail customers served by the company increased 0.6% to nearly 2.9 million.

Financial Highlights

As of Dec 31, 2017, the company had cash and cash equivalents of $781 million compared with $1,188 million as of Dec 31, 2016.

Total debt, as of Dec 31, 2017, was $16.7 billion compared with $15.3 billion as of Dec 31, 2016.

For 2017, the company generated cash from operating activities of $2,624 million, down $2,999 million from the prior-year quarter.

Guidance

For 2018, Entergy issued operational earnings guidance per share in the band of $6.25-$6.85.

The Utility, Parent & Other adjusted earnings are expected in the range of $4.50-$4.90 per share.

Zacks Rank

Entergy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

Duke Energy (NYSE:DUK) reported fourth-quarter 2017 adjusted earnings of 94 cents per share, beating the Zacks Consensus Estimate of 91 cents by 3.3%.

PG&E Corporation’s (NYSE:PCG) adjusted operating earnings per share of 63 cents in fourth-quarter 2017 missed the Zacks Consensus Estimate of 69 cents by 8.7%.

CenterPoint Energy, Inc. (NYSE:CNP) reported fourth-quarter 2017 adjusted earnings of 33 cents per share, beating the Zacks Consensus Estimate of 30 cents by 10%.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

Entergy Corporation (ETR): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG): Free Stock Analysis Report

Original post

Zacks Investment Research