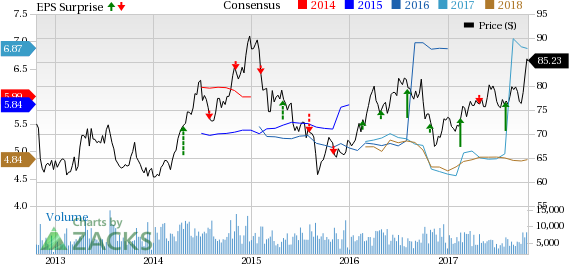

Entergy Corporation (NYSE:ETR) reported third-quarter 2017 operational earnings of $2.35 per share, beating the Zacks Consensus Estimate of $2.24 by 4.9%. However, the reported number improved 1.7% from the year-ago figure.

On a GAAP basis, the company posted earnings of $2.21 per share compared with $2.16 a year ago. The difference between GAAP and operating earnings in the reported quarter was due to effects of special items.

Total Revenue

In the quarter under review, Entergy reported total revenue of $3,243.6 million, surpassing the Zacks Consensus Estimate of $3,129 by 3.7%. It was also up 3.8% from the year-ago figure of $3,124.7 million.

Segment Results

Utility, Parent & Other: The segment’s quarterly earnings were $1.90 per share compared with $2.12 in the prior-year quarter.

Entergy Wholesale Commodities (EWC): The segment reported operating earnings of 45 cents per share compared with 19 cents in the year-ago quarter.

Highlights of the Release

Operating expenses in the quarter were $2.51 billion, up 6.8% from $2.35 billion spent in the year-ago quarter. The year-over-year increase was primarily owing to higher fuel, fuel related expenses and gas purchased for resale, purchased power, and other operation and maintenance expenses, asset write-offs, decommissioning, depreciation and amortization expenses and taxes other than income taxes charges.

Interest expenses were $166.9 million, down 0.2% from $167.2 million in the year-ago quarter.

In the reported quarter, total retail customers served by the company increased 0.6% to nearly 2.9 million.

Financial Highlights

As of Sep 30, the company had cash and cash equivalents of $546.3 million compared with $1,187.8 million as of Dec 31, 2016.

Total debt, as of Sep 30, was $14.0 billion compared with $14.5 billion as of Dec 31, 2016.

For third-quarter 2017, cash from operating activities was $893.1 million, down from $1,000.3 million in the prior-year quarter.

Guidance

For 2017, Entergy reaffirmed its operational earnings guidance per share in the band of $6.80-$7.40.

The Utility, Parent & Other’s adjusted earnings are still expected in the range of $4.25-$4.55 per share.

Zacks Rank

Entergy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Upcoming Peer Releases

DTE Energy Company (NYSE:DTE) is scheduled to report third-quarter 2017 results on Oct 25. The company carries a Zacks Rank #3.

American Electric Power Co., Inc. (NYSE:AEP) is scheduled to report third-quarter 2017 results on Oct 26. The company carries a Zacks Rank #3.

Edison International (NYSE:EIX) is scheduled to report third-quarter 2017 results on Oct 30. The company carries a Zacks Rank #3.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

American Electric Power Company, Inc. (AEP): Free Stock Analysis Report

Entergy Corporation (ETR): Free Stock Analysis Report

Edison International (EIX): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Original post

Zacks Investment Research