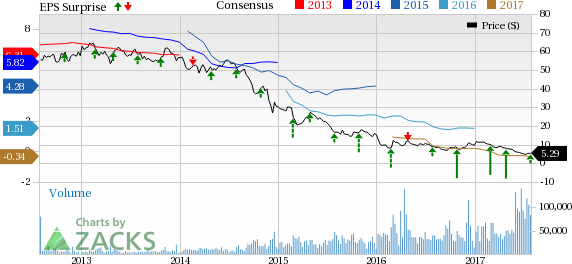

Oil and natural gas driller, Ensco plc (NYSE:ESV) , reported diluted second-quarter 2017 loss (excluding one-time items) of 10 cents a share, narrower than the Zacks Consensus Estimate of a loss of 12 cents. Notably, the company posted earnings of 51 cents in the year-earlier quarter.

Total revenue declined to $457.5 million from $909.6 million in the year-ago quarter. The top line also missed the Zacks Consensus Estimate of $463 million.

The decline may be attributed to lower realized dayrates and higher costs.

Segmental Performance

Floaters: Revenues were $264 million compared with $636.4 million in the prior-year quarter. This was primarily because of fewer rig operating days and a decline in the average day rate to $338,675 from $359,575 a year ago.

Reported utilization was 43% compared with 57% last year. Adjusted for uncontracted rigs and planned downtime, operational utilization remained unchanged from last year at 99%.

Jackups: Revenues were $178.9 million compared with $251.3 million a year ago. This was due to a decline in average day rates to $88,583 from $111,791 in the prior-year quarter. Fewer operating days for several jackups also contributed to the decrease in revenues.

Reported utilization was 64% compared with 63% in second-quarter 2016. Adjusted for uncontracted rigs and planned downtime, operational utilization in the reported quarter was 98% as against 99% a year ago.

Other: Revenues plummeted to $14.6 million from $21.9 million in second-quarter 2016. Contract drilling expenses decreased to $13 million from $19 million in the year-ago period.

Costs and Expenses

Depreciation expenses declined to $107.9 million from $112.4 million in second-quarter 2016. This was due to the extension of lives for certain contracted assets. General and administrative expenses increased to $30.5 million from $27.4 million last year, mainly due to higher transaction costs relating to the acquisition of Atwood.

Balance Sheet and Capex

At the end of the second quarter, Ensco had $169.6 million in cash and cash equivalents. Long-term debt (including current maturities) was $4,744.7 million, with net debt-to-capitalization ratio of 36.7%.

Zacks Rank

Currently, Ensco carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space include Enbridge Energy, LP (NYSE:EEP) , Braskem S.A. (NYSE:BAK) and TransCanada Corp (TO:TRP) . While Braskem and TransCanada sport a Zacks Rank #1 (Strong Buy), Enbridge Energy carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enbridge Energy delivered a positive earnings surprise of 128.57% in the preceding quarter. The company beat estimates in three of the trailing four quarters with an average positive earnings surprise of 38.22%.

Braskem delivered a positive earnings surprise of 107.79% in the quarter ending September 2016.

TransCanada delivered a negative earnings surprise of 7.58% in the preceding quarter. It surpassed estimates in two of the trailing four quarters with an average positive earnings surprise of 1.06%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Enbridge Energy, L.P. (EEP): Free Stock Analysis Report

Braskem S.A. (BAK): Free Stock Analysis Report

ENSCO PLC (ESV): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Original post

Zacks Investment Research