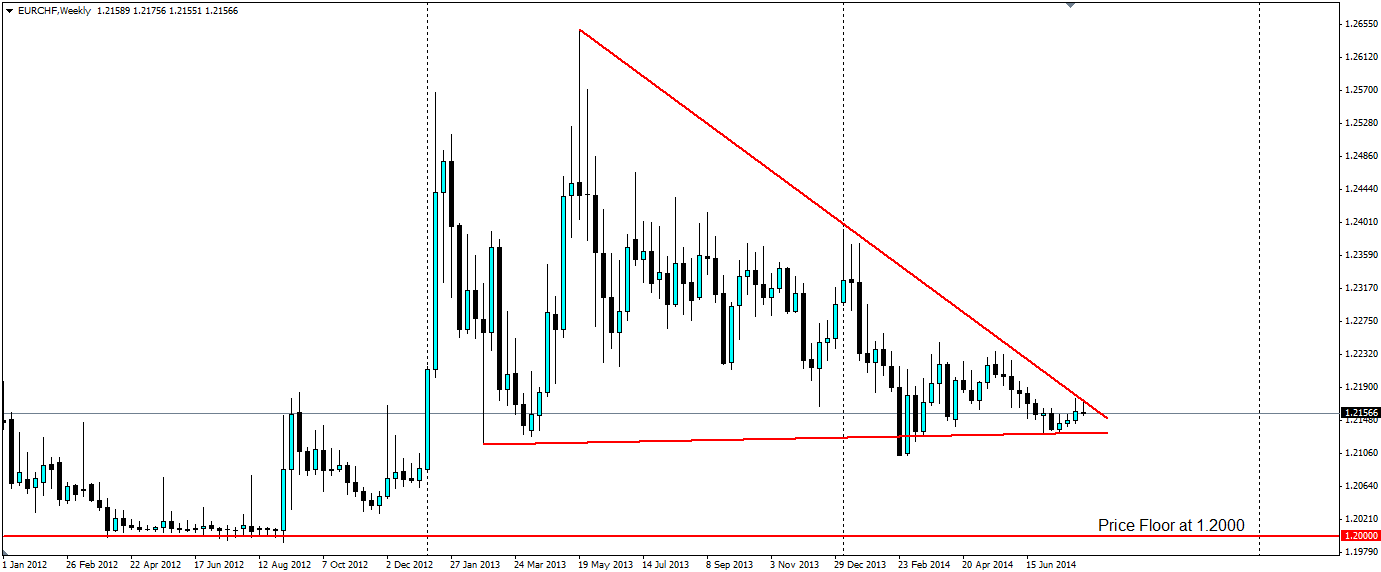

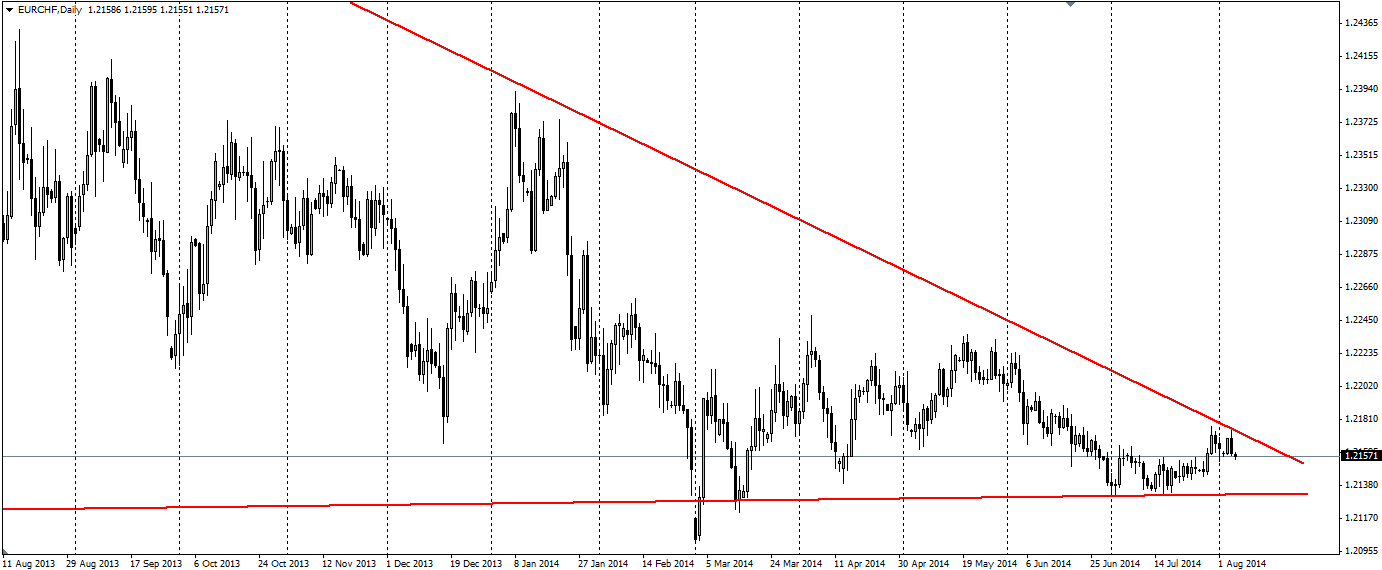

Over the last 18 months a huge triangle has formed between the Euro and the Franc. With a price floor in place, a breakout lower for the EURCHF will not be going any lower than 1.20, however, a breakout higher could be large.

In early 2013, the EURCHF pair was extremely volatile as the EU emerged from the sovereign debt crisis that threatened to break up the Euro zone. At the peak of the crisis the price floor at 1.2 Euros per Franc between the two was put to the test as capital fled the EU for the safety of the Swiss Alps. The Floor was put in place by Switzerland’s central bank (the SNB) to combat falling inflation. Since interest rates were already at zero, they saw the price floor as the most appropriate strategy to prevent deflation by keeping the currency artificially weak and therefore imports artificially high. The SNB even pledged to “defend the floor with unlimited reserves”.

Once confidence returned the capital outflows led to extreme volatility between the pair which has slowly been diminishing. The stimulus in the EU has led to the descending bearish trend as the return differential between the two currencies diminishes. Also at the first signs of a crisis the pull of the ‘safe haven’ title the Franc affords leads to capital outflows from the Euro zone.

If we see more stimulus from the ECB, which is a distinct possibility given the falling inflation rate has fallen to just 0.4%, we will see a breakout of the support that forms the bottom of the triangle around 1.2132. The ECB is meeting at the end of this week, so we will know where they stand by then. A movement lower will be cut short by the price floor at 1.2000, making it a 132 pip movement at maximum. From here, it’s a pretty safe long given the stance of the SNB and their “unlimited reserves”.

A breakout to the upside is a possibility if inflation returns to the EU. We are seeing some positive signs in the form of Services PMIs from Germany at 56.7 and France at 50.4, and also Spain’s unemployment rate coming down to 24.5% along with the EU wide unemployment falling to 11.5%. Furthermore, it looks like the Swiss economy is feeling a bit of stress with the KOF economic barometer falling to 98.10 from 100.50, however we will know more by the end of the week when Swiss CPI and Unemployment is reported.