Industrial battery manufacturer, EnerSys (NYSE:ENS) reported fiscal first-quarter 2018 results with adjusted earnings of $1.12 a share narrowly missing the Zacks Consensus Estimate of $1.13 by 0.9%. The bottom line came in 1.8% lower than the year-ago tally of $1.14.

Inside The Headlines

During the quarter, net sales were up 3.7% year over year to $622.6 million. The figure also trumped the Zacks Consensus Estimate of $621 million. The year-over-year increase was driven by increase in organic volume and higher pricing of products, partially offset by impact of foreign currency translation.

In terms of geography, both the America and EMEA regions recorded a year-over-year increase. The Americas witnessed a modest year-over-year sales improvement of 7.6% on the back of positive contributions from cost savings. Net sales for the EMEA region were up by 1%. However, Asian region net sales dipped 6.6%. Decrease in China telecom revenue and higher lead cost marred performances in the Asia region.

EnerSys’ operating earnings for the quarter totaled $69.6 million, up 5.5% on year over year basis. Improvements in operating earnings came on the back of a favorable impact of the the cost-savings program.

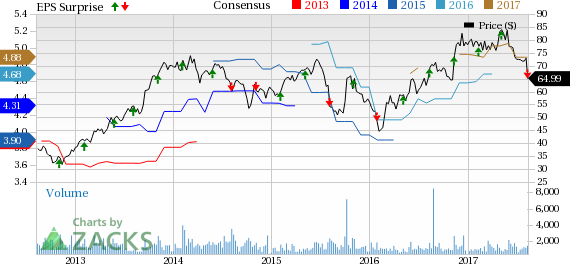

Enersys Price, Consensus and EPS Surprise

Liquidity

At the end of the fiscal first quarter, EnerSys had cash and cash equivalents of $543 million, up from $500.3 million at the end of fiscal fourth-quarter 2017. The company’s long-term debt was $634.2 million, up from $587.6 million at the end of the fiscal fourth quarter.

During the quarter, cash from operating activities came in at $22 million. The company’s credit agreement leverage ratio was just above 1.5 times. Capital expenditures came in at $13 million at the end of the reported quarter compared with $7 million in fiscal 2017.

Guidance

EnerSys expects fiscal second-quarter adjusted earnings per share in the range of $1.03–$1.07. This guidance excludes projected charges of 4 cents from restructuring programs, ERP system implementation and acquisition expenses.

Our Take

EnerSys believes its long-term growth drivers are intact, which will continue to drive top-line performance for fiscal 2018. These factors include higher demand for premium products, lean initiatives, robust prospects in Asia, cost reduction programs and strategic product launches.

The company has an interesting lineup of product launches, which, it believes, will stoke growth in fiscal 2018. As a matter of fact, a rise in the sale of premium products has significantly boosted top-line performance. Recently, the company launched several premium products which are expected to act as catalysts.

However, on the flip side, a significant portion of the company’s revenues and expenses are denominated in foreign currencies. This makes it vulnerable to fluctuations in exchange rates. A stronger U.S. currency might hurt foreign revenues and earnings for the company.

Stocks to Consider

EnerSys (ENS) currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader sector are AGCO Corporation (NYSE:AGCO) , Barnes Group, Inc. (NYSE:B) and Belden Inc (NYSE:BDC) . While AGCO and Belden sport a Zacks Rank #1 (Strong Buy), Barnes Group carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO managed to beat earnings every time in the trailing four quarters. It has an impressive positive average surprise of 39.70%.

Barnes Group has an excellent earnings beat history, having surpassed estimates every time over the trailing four quarters. It has a positive average surprise of 11.60%.

Belden has a positive average earnings surprise of 3.27% for the last four quarters, having surpassed estimates all through.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think. See This Ticker Free >

Belden Inc (BDC): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Enersys (ENS): Free Stock Analysis Report

Original post

Zacks Investment Research