- “We believe more policy easing is still warranted at the current stage to support growth.” ~ Qu Hongbin, chief economist, HSBC China

- “There are also, of course, risks of waiting too long to remove accommodation. We have a highly accommodative policy that’s been in place for some time. We have to be forward looking.” ~ Fed Chair Janet Yellen, in Tuesday testimony to the Senate Banking Committee

Janet Yellen is preparing Wall Street for rate hikes — and investors are bullish anyway.

In her testimony to a US Senate committee on Tuesday, Yellen placed subtle emphasis on the possibility of a June rate hike. She didn’t say anything directly about June. She did say a hike was ruled out for the March and April Fed meetings.

Reading between the lines, that means June is still on the table…

Yellen’s message now is essentially:

- The US economy looks good.

- If it continues to look good, we will hike…

- There are risks in waiting too long…

- so be prepared, and don’t say we didn’t warn you.

As a baby step, the word “patient” may be dropped from the Fed statement in the March meeting.

Investor reaction to all this was bullish.

The media interpreted Yellen’s testimony as dovish — but mainly because markets went up.

Various outlets reported Yellen’s congressional testimony as dovish (i.e. on the side easing, staying friendly, etc).

But this is more a matter of reporters reacting to what markets did — attempting to backfill the story based on the reaction that was observed.

We would argue the following:

- Yellen’s testimony was NOT dovish.

- If anything it was a thinly veiled warning.

- But the markets decided to blow it off…

- Indicating a strong current of risk appetite.

As the saying goes: “It’s not the news, it’s the reaction to the news.” The reaction to Yellen was investors pressing their bullish bets, even in the face of warnings.

With Greece in the clear for a while, global indices are pushing to new highs.

The emphasis now is on Euro QE… and a Fed that still has a little bit of “patience” left… and stimulus in general with a window of time to push markets higher.

This feels very much like a false trend to us. Blatant warning signs are being ignored.

But the bulls arguably have a bit of elbow room now:

- Greece is off the table for sixteen weeks.

- “Sell in May” is still months away.

- The Yellen Fed is rumbling but not moving yet.

- Euro QE is about to begin.

- More China stimulus is probably on the way.

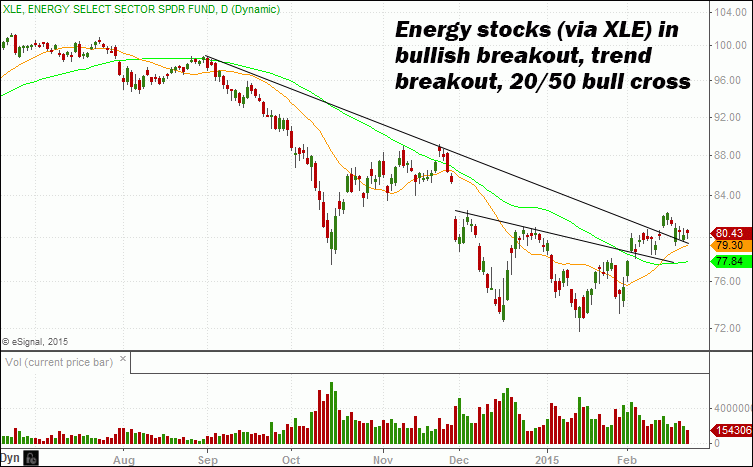

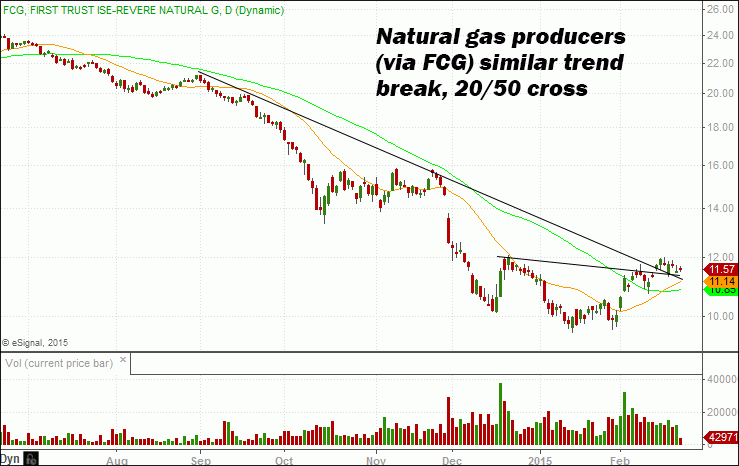

- Energy stocks look a bargain.

- So why not buy?

Again to borrow one of our favorite Nietzsche quotes: Interpretation is a function of power and not truth. Bulls have some power now, and appear not afraid to use it. Rationality means nothing, maybe less than nothing.

The bulls would bid up The Emperor of Ice Cream if they could. It is (literally) their job.

Buying into a false trend can be a mind-bending exercise.

It’s a funny thing buying into false trends. You have to sort of see into the head of the other person (or the institutional money manager).

In our general view, long-term investors who buy at dangerous valuation outliers because they “have to” are fools. (It’s one thing to buy for a trade, knowing you can quickly exit or reverse your position. It’s another thing buying when you can’t or won’t sell.)

Then, too, there is the benchmark-driven behavior that makes rational money managers behave exactly like risk-blind fools, even if they are smart and logical in their daily lives. Being aggressively long might be really dumb here, but oh well — falling 5% behind the crowd is more dangerous (to the money manager’s career) than losing 20% of client capital, as long as everyone else loses at once.

So we observe, and play along, and show willingness to participate in potential false trends (against a backdrop of tight risk control).

We see potential in emerging markets (and bought yesterday). Energy stocks could have potential too.

With so many indices at new highs, and valuations stretched, we agree with Ben Inker of GMO who advises a focus on “unloved” assets.

The price behavior of emerging markets is bullish, suggesting slow accumulation. As an aside Barron’s put out a bearish piece this week, noting very large put buyers in iShares MSCI Emerging Markets (ARCA:EEM), the bellwether emerging markets ETF. But this makes little sense to us, because positions do not exist in a vacuum.

If there is a large buyer of puts or put spreads, how do you know he (or she) is bearish? The options position might be a hedge against an even bigger long position. Barron’s never mentions the lack of information, re, total positioning. It is dumb and sloppy of them not to.

At any rate, energy stocks are now exhibiting bullish accumulation patterns similar to emerging market stocks. The SPDR Energy Select Sector Fund (ARCA:XLE) and FirstTrust ISE-Revere Natural Gas Fund (NYSE:FCG) have climbed above their respective 50 day moving averages… registered bullish 20/50 DMA crosses… and broken their multi-month downtrend lines.

As such, we could have a window here for too-clever-by-half money managers to enjoy bargain buys in the energy space. (Before eventually taking a frying pan to the face again.)

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer