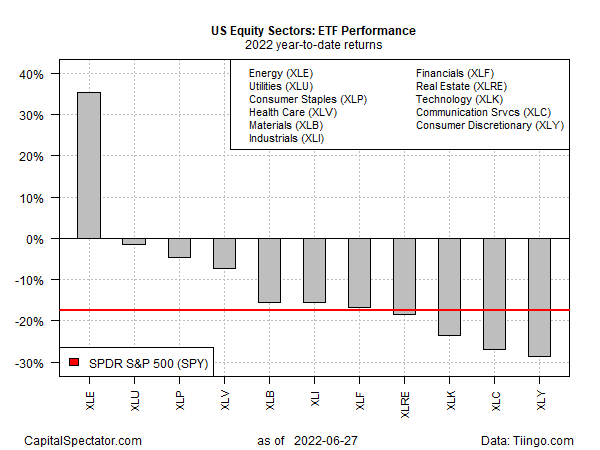

High-flying energy shares have hit turbulence in recent weeks but remain, by far, the leading performer for US equity sectors so far in 2022, as of yesterday’s close (June 27), based on a set of ETFs. But with global growth slowing, and recession risk rising, analysts are debating if it’s time to cut and run.

The broad-based correction in stocks has weighed on energy shares lately. Energy Sector SPDR (NYSE:XLE) has fallen sharply after reaching a record high on June 8. Despite the slide, XLE remains the best-performing sector by a wide margin year to date via a near-36% gain in 2022.

By contrast, the overall US stock market is still in the red via SPDR® S&P 500 (NYSE:SPY), which is down nearly 18% year to date. The worst-performing US sector: Consumer Discretionary Select Sector SPDR® Fund (NYSE:XLY), which is in the hole by almost 29% this year.

The case for, and against, seeing energy’s recent weakness as a buying opportunity can be filtered through two competing narratives. The bullish view is that the Ukraine war continues to disrupt energy exports from Russia, a major source of oil and gas. As a result, pinched supply will continue to exert upward pressure on prices in a world that struggles to quickly find replacements for lost energy sources. The question is whether growing headwinds from inflation, rising interest rates and other factors will take a toll on global economic growth to the point the energy demand tumbles, driving prices down.

The market seems to be entertaining both possibilities at the moment and is still processing the odds that one or the other scenario prevails, or not. Meanwhile, energy bulls predict that the pullback in oil and gas prices is only a temporary run of weakness in an ongoing bull market for energy.

Goldman Sachs, in particular, remains bullish on energy and advises that the potential for more prices gains in crude oil and other products “is tremendously high right now,” according to Jeffrey Currie, the bank’s global head of commodities research. “The bottom line is the situation across the energy space is incredibly bullish right now. The pullback in prices we would view as a buying opportunity,” he says. “At the core of our bullish view of energy is the underinvestment thesis. And that applies more today than it did two weeks, three weeks ago, because we’ve just seen exodus of money from the space… investment continues to run from the space at a time it should be coming to the space.”

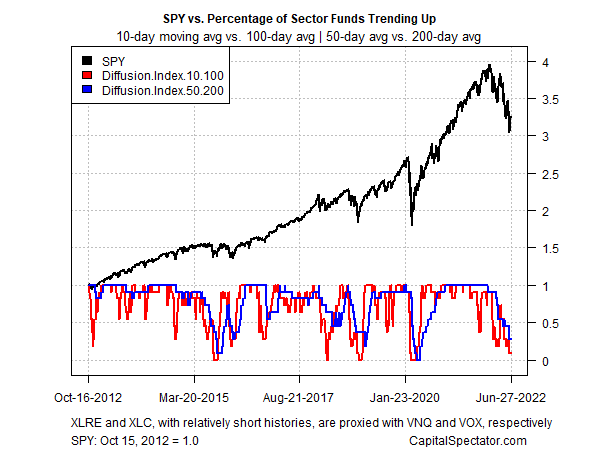

Meanwhile, a bit of historical perspective on momentum for all the sector ETFs listed above reminds that the trend direction remains bearish overall. But contrarians take note: the downside bias is close to the lowest levels since the pandemic first took a hefty bite out of market action back in March 2020 (see chart below). This may or may not be a long-term buying opportunity, but the odds for a bounce, however, temporary, look relatively strong at the moment.