Our research team has been nailing some really great trades recently in gold, silver, crude oil, ETFs and many other market segments. Some of these trades have resulted in gains of +10% to +20%.

One trade in particular that we called back in July was the energy play in crude oil and ERY. Specifically, we suggested that crude would fall based on our ADL predictive modeling system and that ERY would set up a nice trade with targets set relatively close to the basing/bottom pattern.

Here's our research:

July 10, 2019: PREDICTIVE MODELING SUGGEST OIL HEADED MUCH LOWER

July 26, 2019: ENERGY SETS UP TWO NEW TRADES

While the original move resulted in a strong trade setup and completion – where both targets were hit and the price extended more than $10 beyond our Target 2, we are now saying that ERY will likely set up another, even bigger opportunity over the next 30+ days.

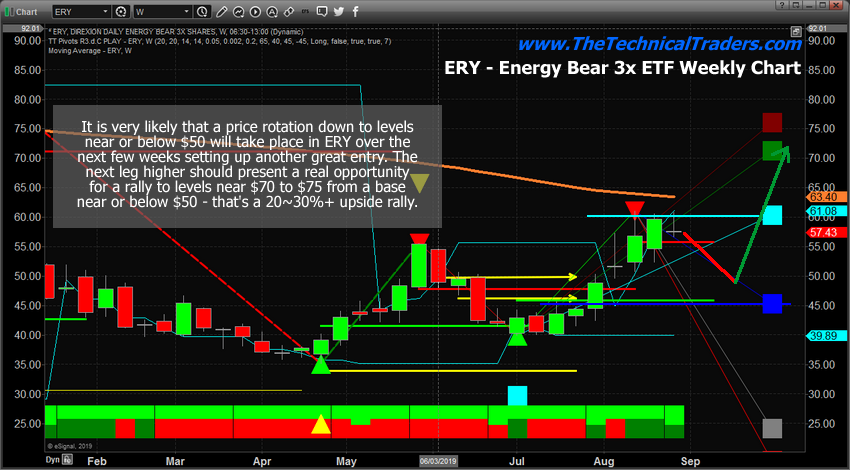

We believe our previous research, particularly related to crude oil, will result in ERY rotating lower over the next 20+ days, possibly toward the $50 level, before setting up another momentum base and beginning an upside move targeting the $70 to $75 range. If our research is correct, this move will come at a time when global markets are expecting much slower economic activity and/or a massive supply glut in oil.

This daily ERY chart shows the original trade setup that occurred after our July 26 post and includes the original target levels drawn as YELLOW ARROWS on the chart. It is easy to see the success of this trade and how ERY rotated higher as oil weakened.

This weekly chart highlights what we believe will be the next trade setup, which will start to complete the momentum base sometime near the end of September or into early October. We expect the rally in ERY to begin in mid-October and carry on into November based on our modeling system (see the original article listed above).

We believe the downside rotation in ERY that we are expecting will coincide with a moderate upside move in crude over the next 30+ days before a bigger breakdown in oil prices creates this opportunity in ERY. Skilled technical traders just need to wait for the momentum base to complete.

Concluding Thoughts

If you follow our ADL predictive modeling system’s research, you’ll see that it expects crude oil to break down to levels below $40 before or near the end of 2019. That move could come quicker than we expect is global markets accelerate the economic slowdown we’ve seen recently.