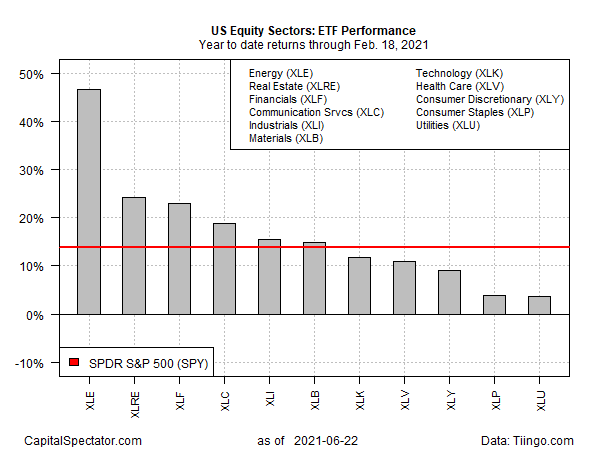

Shares in the conventional energy sector may be destined for dinosaur status as the shift to renewables marches inexorably on, but that hasn’t stopped Big Oil from leading US equity sectors this year.

Using a set of ETFs to track performance shows that traditional energy stocks remain far and away the top performer in 2021 for the main sector groups through yesterday’s close (June 22). Energy Select Sector SPDR (XLE (NYSE:XLE) is up a sizzling 46.6% year-to-date. In Tuesday’s session, the ETF traded at roughly its pre-pandemic level.

“Even though [environmental, social and corporate governance] and other things have kept equity managers away from the energy stocks, I think the supply-demand dynamics for oil are so good that the energy stocks have the most upside of any sector right now,” Fundstrat’s Tom Lee told CNBC on Monday.

A distant second-place sector performer this year: US real estate shares. The Real Estate Select Sector SPDR Fund (NYSE:XLRE) is up a strong a 24.3%, but that’s still far behind XLE’s rally this year.

Overall, all 11 US sectors are posting gains in 2021, although the results vary widely. The weakest performer: Utilities Select Sector SPDR® Fund (NYSE:XLU), which is ahead by a relatively modest 3.7% this year.

The broad US stock market, based on SPDR® S&P 500 (NYSE:SPY), is up 13.9% year-to-date. That translates into a performance that trails most of the main sector results with six out of 11 posting higher gains.

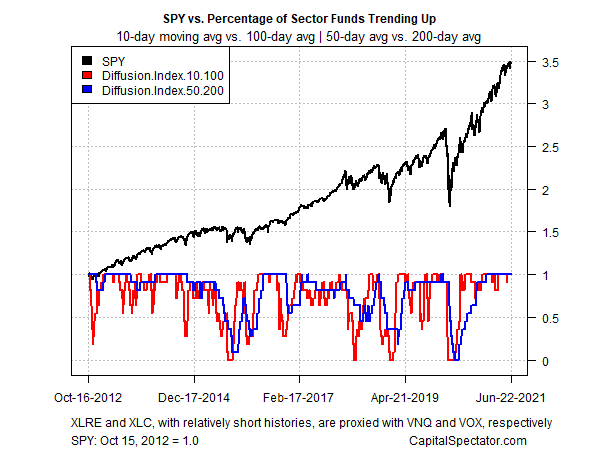

Although sector results are wide ranging, the common feature is strong upside momentum, based on a set of moving averages (see chart below). Both short- and medium-term momentum remains solid for the sector funds overall. Keep in mind, however, that the bull run has been unusually lengthy, relative to recent years, and so the potential for a correction appears elevated.