Longtime readers know our schedule…

Fridays I break out the charts. Mondays I expose Wall Street’s biggest myths.

Well, today, I’m combining both practices in an effort to debunk a pesky little lie about oil.

It’s a relevant topic, too. After all, President Obama did pitch energy independence as a cornerstone of his economic plan. And there’s no way we can get there without oil.

Yet many people doubt that energy independence is even a remote possibility. They’ve been told too many times that the world’s running out of oil. Or at least all the affordable oil.

That’s just not the case, though.

I’ll prove it, too. Then I’ll provide an indication of how far away we are from true energy independence in the United States. (Hint: It’s attainable in our lifetimes.)

The Problem With Theories

Each time oil prices spike higher during a short-term deficiency, the concept of Peak Oil rears its ugly head.

Peak Oil is the theoretical idea that the world will eventually reach a maximum rate of oil production, which will be followed by a terminal decline.

No doubt, that’s a scary theory should it come to pass. However, as Yogi Berra famously, said, “In theory there is no difference between theory and practice. In practice there is.”

And go figure. We have a career theorist (i.e. – a research geologist) to blame for Peak Oil. So we shouldn’t be surprised if reality doesn’t match his theory.

His name is Marion King Hubbert. In the mid 1950s, he developed a quantitative technique that could be used to predict the remaining supplies of any finite resource – and the time of ultimate depletion. And Hubbert used it to predict that oil production would peak by the early 1970s.

Nice try, Nostradamus.

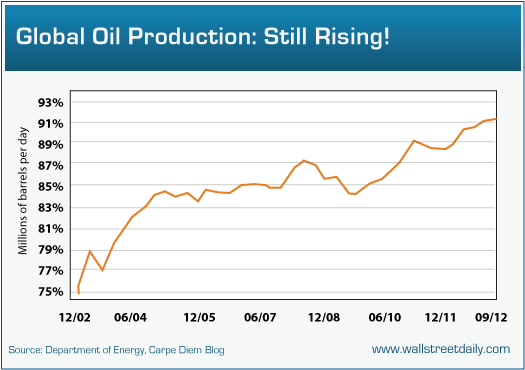

After peaking briefly around 60 million barrels per day in the mid-1970s, global oil production resumed its upward march. And now it’s firmly above 90 million barrels per day, according to the latest data from Energy Intelligence Group.

Here are the two major reasons Hubbert’s Peak Oil theory breaks apart when put into practice…

First off, a peak in production doesn’t mean a peak in availability. In other words, even if production spikes and tapers off, it’s not an indication that oil’s running out.

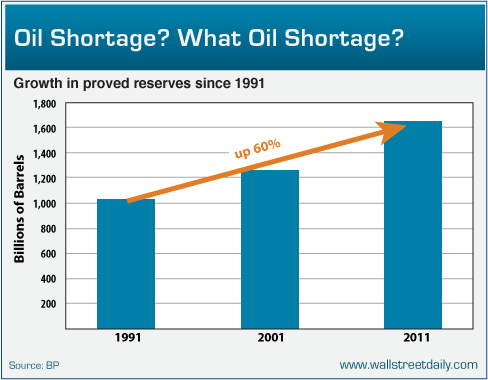

Truth is, we’re nowhere close to running out of oil. Take a look:

As oil giant, BP plc (BP) said in its annual Statistical Energy Review, “The world is not structurally short of hydrocarbon resources -- as our data on proved reserves confirms year after year.”

Second, Hubbert’s theory ignores “unconventional” fossil fuel sources like tar sands, heavy oils and shale oil. They weren’t easily accessible back in his day, hence they couldn’t be considered affordable and/or available. Fair enough.

Fast-forward to today, though, and Peak Oil adherents still hold onto Hubbert’s idea. They ignore, or grossly discount, the impact of unconventional sources on availability.

Yet five decades’ worth of technological advancement has made many of these sources very accessible – and much more affordable. And vast amounts of oil have been discovered in these unconventional sources.

The end result? As my colleague, Matthew Weinschenk, said back in June, New developments have rendered Hubbert’s curve ineffective, or at least delayed it by decades.

I’ll go a step further and declare it useless.

So what about America’s prospects for energy independence?

They’re improving.

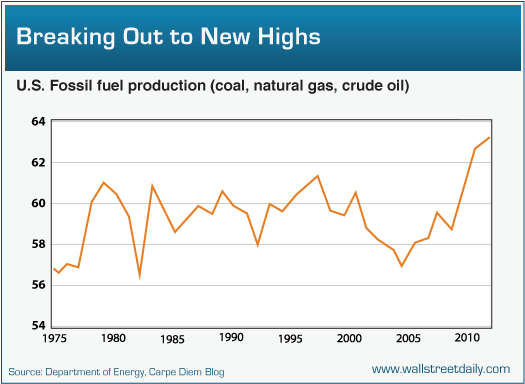

Exhibit A: Fossil fuel production is in a confirmed uptrend, increasing about 12% since 2005.

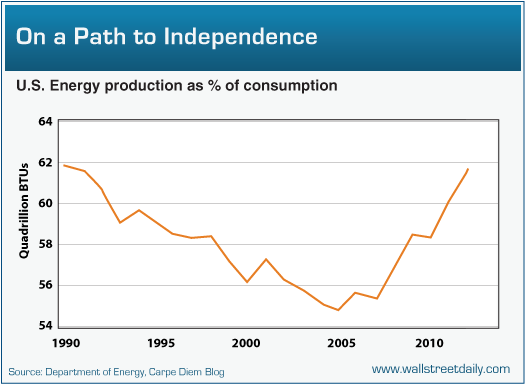

Exhibit B: We’re now producing enough energy to meet almost 84% of our energy consumption. Again, the trend is moving in a decidedly positive direction.

Bottom line: Don’t believe the Chicken Littles of the world when they go around screaming, “We’re running out of oil! We’re running out of oil! We’re running out of oil!”

It’s just not true. Oil supplies and production are actually rising. And so are America’s prospects for energy independence.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Energy Independence And The Myth Of Peak Oil

Published 11/12/2012, 02:00 PM

Updated 05/14/2017, 06:45 AM

Energy Independence And The Myth Of Peak Oil

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.