Propelled by an optimistic global demand outlook and shrinking supplies, the WTI oil price achieved over $90 per barrel last week – a noteworthy ten-month high - prompting a noticeable upturn in energy funds and a gain of 0.93% for the FT Wilshire 5000 Energy Index.

This positive trajectory echoes a wider transformation within the global economy, bolstered by both internal and external influencing factors. A recent move by The People’s Bank of China to reduce its cash reserve requirement for the second time this year, has given black gold an unexpected lift. By providing a more conducive environment for economic recovery, this strategy serves to stimulate demand within China – one of the world’s largest consumers of oil.

Several major central banks also appear to be bringing their tightening cycles to an end, providing additional upward pressure on oil prices. As lending conditions soften and liquidity improves, this shift could set the stage for increased activity across multiple sectors – notably those fueled by petroleum products.

From a supply perspective, predictions of a market deficit in the fourth quarter from industry stalwarts such as OPEC, alongside that of US agencies and the International Energy Agency (IEA), are further boosting forecasts. This projection comes off the back of extended supply cuts implemented by Saudi Arabia and Russia; two nations commanding significant sway in global production quotas.

In response to these shifts on both the demand and supply side, energy exchange-traded funds have been gaining momentum, appealing to investors seeking exposure to rising oil prices yet without wishing to invest directly into futures contracts or physical commodities.

Group Data: Energy, Crude Oil

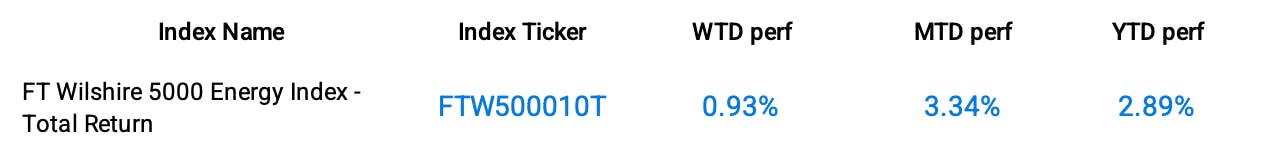

Index Data

Funds Specific Data: USO (NYSE:USO), DBO, BNO

This content was originally published by our partners at ETF Central.