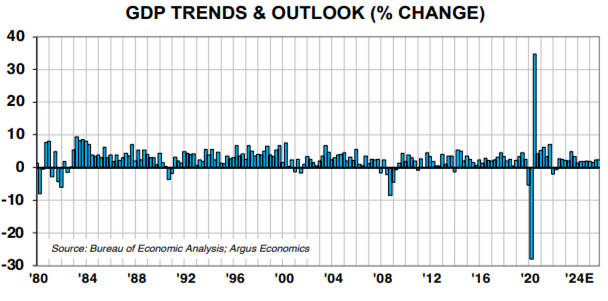

The latest report of first-quarter 2024 GDP showed growth of 1.3%, down from 3.4% growth in 4Q23. Personal consumption expenditures for 1Q24 increased 2%, down from 3.3% for 4Q23. All goods spending fell 1.9% in 1Q24, after rising 3% in 4Q23. PCE goods categories were strong in the holiday quarter. Post-holiday, consumers pulled back sharply amid the effects of multi-year inflation.

Outside GDP, economic indicators generally suggest deceleration, although growth continues at a subdued level. April retail sales were unchanged from March, extending the weak PCE performance in first-quarter GDP. US factory orders rose 1.6% in April, while durable goods orders rose 0.7%. Industrial production dipped 0.3% in April, and capacity utilization of 78.4% was 1.2 points below its long-run (1972-2023) average.

Given the realities of the current environment, we lowered our forecast for 2024 GDP growth to 1.8%, from a prior 2%. Our expectations for 2025 GDP growth are in the 2% range.

Still, five months into 2024, the market is showing impressive sector breadth. Unlike in 2023, the top growth-focused sectors are barely beating the market rather than trouncing it as they did a year earlier. Seven sectors are either tracking or beating the S&P 500.

Beyond summer, investors are bracing for what could be the most partisan election in the modern era. Yet they are simultaneously anticipating the first rate cut in this cycle, which would also be the first rate cut since the COVID-19 pandemic.

We have adjusted our recommended sector allocations, as we do each quarter at the beginning of March, June, September, and December. The following reflects our guidance for the calendar third quarter of 2024.

Although we use a quantitative, six-part, “blind” sector model, our sector recommendations tend to align with qualitative and fundamental dynamics in the market outlook. We have raised the Energy sector to recommended Market-Weight from recommended Under-Weight. Energy demand appears to have stabilized, as initial consumer euphoria over EVs has cooled, and global economic recovery has put petroleum supply and demand into relative balance.