Demand for feed, seed, and ethanol from across the globe and domestically has strained U.S. corn and soybean supplies. The global demand for these two grains has increased as exports have risen by a combined 75 million bushels, due to lower domestic grain prices. Although demand remains elevated for corn and soybeans, it is being met with increased global production.

Corn

U.S. corn use for the 2013/14 marketing year increased 100 million bushels due to an increase in exports and a rise in food, seed, and industrial use. Corn use for ethanol is estimated 50 million bushels higher due to attractive blending margins since mid October. Exports are also estimated 50 million bushels higher due to strong sales to date and projected increase in global demand.

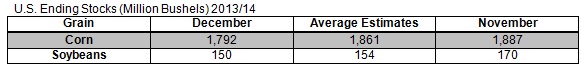

Due to the rise in domestic and foreign demand for corn, ending stocks for 2013/14 were decreased 95 million bushels to 1.792 billion, the highest since 2005/06. The season average corn price for 2013/14 was decreased 10 cents at the midpoint to $4.05 to $4.75. Global course grain supplies for 2013/14 were increased by 3.6 million tons due mainly to the increase in global corn production.

Soybeans

Production for the 2013/14 year was unchanged at 3.258 billion bushels. U.S. soybean supplies for 2013/14 were increased by 10 million bushels due to an increase in imports. Soybean exports were increased 25 million bushels as there have been record commitments through November.

Soybean ending stocks for the 2013/14 marketing year were contracted 20 million bushels to 150 million, due to increased exports. The projected season average price range for 2013/14 was $11.50 to $13.50 per bushel, an increase of 35 cents on both ends of the range.

Wheat

U.S. wheat supplies for 2013/14 were increased by 10 million bushels due to higher than expected imports. As a result, U.S. ending wheat stocks for 2013/14 were raised 10 million bushels. The season average wheat price for 2013/14 was estimated at $6.65 to $7.15 per bushel, narrowed by 10 cents at the midpoint.

Global wheat production for 2013/14 was increased by 5.0 million tons due mostly to a projected record crop from Canada. Record production in Canada is expected to spill over into the U.S. market.

Outlook

Demand for U.S. grain seems to be picking up at home and abroad. Ethanol demand has picked up the past few months due to favorable blending margins and analysts believe this demand will stay or increase in the first part of 2014. Global demand will be the hot topic as we move through the winter months.

- Colvin