Endeavour Mining Corp (TSX:EDV) Q219 results were significantly ahead of not only the prior quarter, but also our expectations. In general, grades increased relative to Q1, owing to improved access to higher-grade material and a lower proportion of processed material being derived from low-grade stockpiles. As Endeavour enters H219, the improved gold price environment is coinciding with a sharp reduction in capex and continued improvements to operating conditions, which has caused us to upgrade our FY19 forecasts materially.

Ity CIL hits the ground running

Of particular note in Q2 was the performance of Ity in its maiden quarter of commercial production. Both mining activity and plant throughput ramped-up quickly, even before debottlenecking initiatives have been put in place. Arguably more significantly, cash costs and all-in sustaining costs were within 1.4% of our prior expectations, at US$537/oz and US$585/oz, respectively.

Exploration success de-risks valuation

On 24 June, Endeavour announced a maiden reserve at Kari Pump of 710koz, which represented a higher conversion of resources into reserves (71%) than at the remainder of the Houndé mine. Following that, on 2 July, it announced that it had extended mineralisation at Houndé at Kari West and Kari Center. Finally, on 8 July, it announced that it had increased its resource at Le Plaque (at Ity) by 397koz gold at an average grade of 3.42g/t almost exclusively within the indicated category. While the additional resources and reserves drilled by Endeavour are not yet sufficient to bring the production profiles at Houndé and Ity up to 250koz per annum for at least 10 years (NB we calculate that the reserves drilled – or implied – to date amount to c 61% and 57% of those required, respectively), they nevertheless materially de-risk our valuation, which is implicitly based on this assumption.

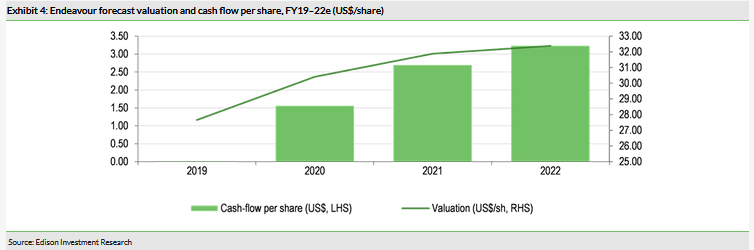

Valuation: Homing in on US$27.66/share

In valuing Endeavour, we have opted to discount potential cash flows back over four years from FY19 then to apply an ex-growth, ad infinitum terminal multiple of 10x (consistent with a discount rate of 10%) to forecast cash flows in that year (FY22). For Endeavour, our estimate of cash flow in FY22 is US$3.24 per share (including exploration expenditure), in which case our terminal valuation of the company at end-FY22 is US$32.38/share, which (in conjunction with forecast intervening cash flows) discounts back to a value of US$27.66/share (cf US$27.58/share previously).

Business description

Endeavour Mining is an intermediate gold producer, with four mines in Côte d’Ivoire (Agbaou and Ity) and Burkina Faso (Houndé and Karma) and two major development projects (Ity CIL and Kalana) in the highly prospective West African Birimian greenstone belt.

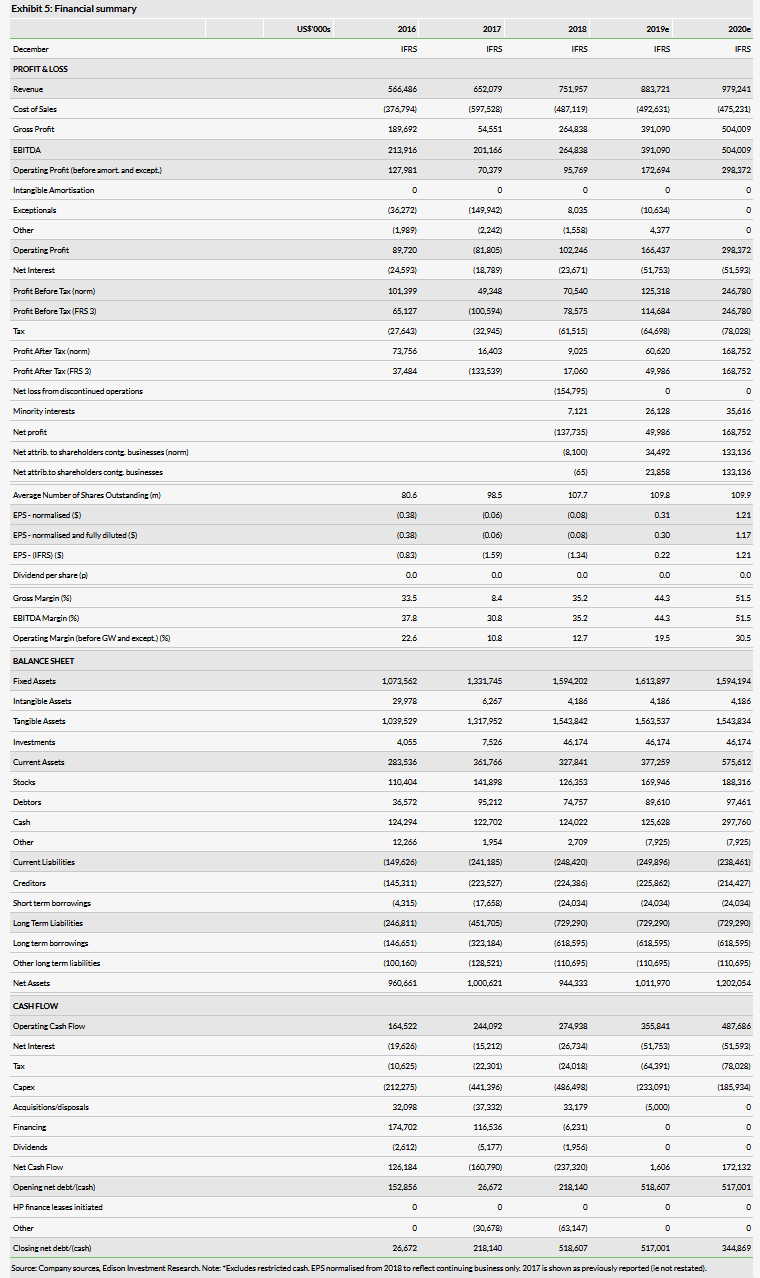

Q219 results summary

Endeavour’s results in Q219 were materially ahead of not only the prior quarter, but also our expectations, which already anticipated a significant quarterly rise in production. In general, grades increased relative to Q1, owing to improved access to higher-grade material as a result of earlier pre-stripping, and a lower proportion of processed material being derived from low-grade stockpiles, partially offset by a higher proportion of transitional/fresh ore relative to oxide ore (NB this was particularly true of Houndé).

On an individual mine basis, all of Endeavour’s mines outperformed our production expectations during the quarter, with the exception of Karma, where a defective elution column allowed a build-up of gold in circuit. From a financial perspective, all of its mines outperformed our expectations, with the exception of Agbaou, which experienced a sharply higher depreciation charge. Of particular note was the performance of Ity in its first quarter of commercial production (which was declared on 8 April). Both mining activity and plant throughput ramped-up quickly, with the former achieving an annualised rate of 5.6Mtpa over the entire quarter and the latter achieving an annualised rate of nearly 5Mtpa (helped by the fact that the ore mined during the quarter was predominantly oxide in nature) in June, even before any debottlenecking initiatives have been put in place. Arguably more significantly, cash costs and all-in sustaining costs were within 1.4% of our expectations, at US$537/oz and US$585/oz, respectively. At US$13.72 per tonne milled, processing costs were approximately 10% higher than feasibility study estimates for the first five years of operation as higher reagent consumption was required to achieve higher recoveries on some ores containing high cyanide soluble copper. This is now reported to have decreased as the blend of ores fed to the mill has stabilised. In addition, mining efficiencies are expected to improve following the end of the rainy season in Q3/Q4, as more, harder ore is exposed, which will enable increased use of larger, rigid body trucks.

In summary, gold production was 41.8% higher than in the previous quarter and 19.4% (27.8koz) above our expectation. This resulted in a positive variance of US$42.4m in revenues relative to our expectations, only partially offset by operating expenses, depreciation and royalties, which were, collectively, US$16.0m higher. In addition, there was an US$11.8m loss on financial instruments, while taxes and the minority interest were US$6.4m and US$3.3m higher, respectively, to result in net earnings that were US$13.6m (or 12.4c per share) ahead of our forecasts. A detailed analysis of Endeavour’s financial and operational performance, relative to both the previous quarter and our prior expectations (as set out in our note, Endeavour Mining: Starting as it means to go on, published on 3 May 2019) is as follows:

Once again, it is notable that both the tax charge and the minority interest charge during the quarter were anomalous and not reflective of the realities of Endeavour’s commercial circumstances.

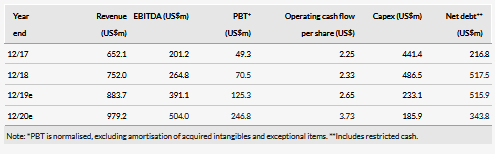

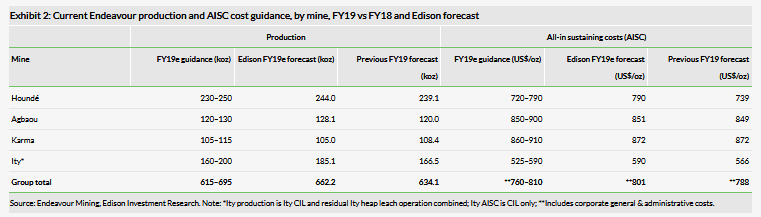

FY19 cost and production guidance and Edison forecasts

Historically, Endeavour has a good record of meeting its production and cost guidance targets. For FY19, these remain unchanged, as follows (cf Edison’s updated forecasts):

In the second half of the financial year, operations at Houndé are expected to benefit from access to high-grade ore from the Bouéré deposit, where pre-stripping was completed in Q219 and from which ore began to be processed early in Q319. While the proportion of fresh ore processed at Houndé is thus anticipated to rise to in excess of 30% (from c 20%) in the interim, it will reduce in Q4, before increasing once again in 2020 as mining at both Vindaloo and Bouéré transition to deeper levels. Given exploration success at Houndé and its increasing reserve and resource profile, management has confirmed that a review of the plant will be conducted during Q319 with a view to increasing capacity. Similarly, operations at Karma will benefit from the stacking of higher-grade oxide ore once again from the Kao North pit, which started in Q219 and is expected to be the main source of ore in H219.

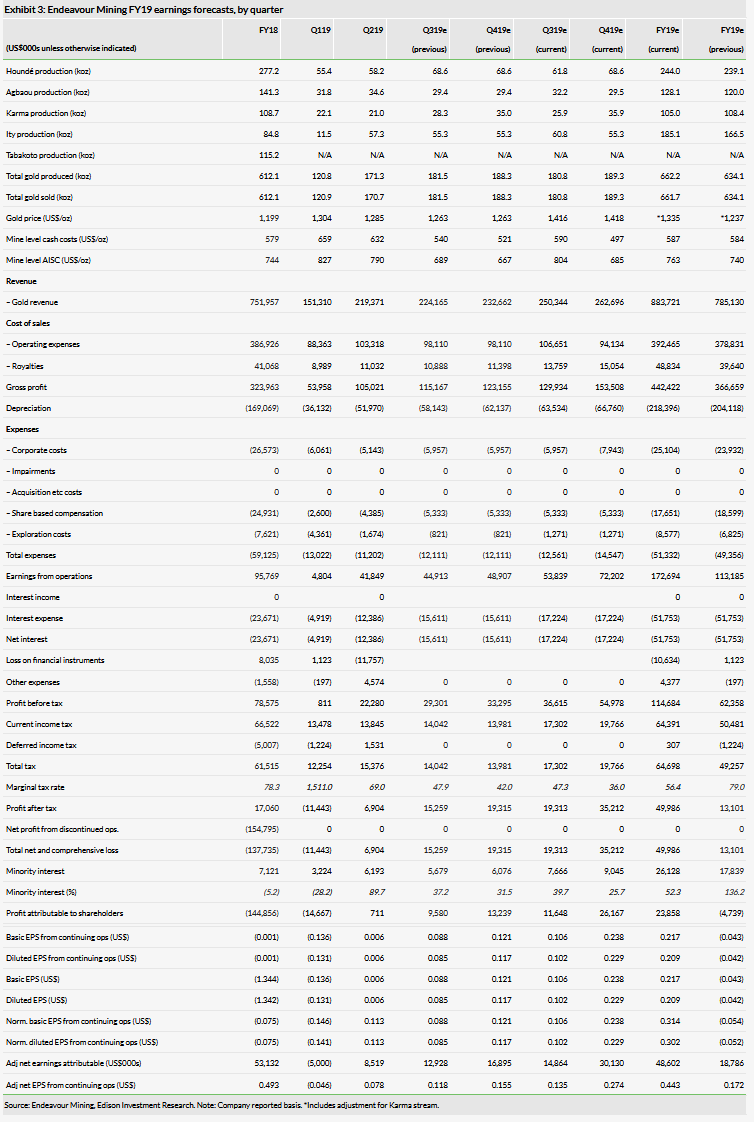

Aside from the changes to production and cost estimates noted in Exhibit 2 above, Edison’s forecasts for FY19 continue to reflect Endeavour’s sustaining and non-sustaining capital cost guidance for each of its mines for the remainder of the year in addition to the assumption that operational performance will, in some cases, be adversely affected by the onset of the rainy season in Q3. Otherwise, compared with our previous forecasts, the most noteworthy change to our ongoing forecasts for Q3–Q419 relates to the assumed gold price in Q3 and Q4, which (in the light of recent moves and its current spot price) is now expected to be US$1,416/oz and US$1,418/oz, respectively (cf US$1,263/oz previously):

We note that forecasting on a quarterly basis is prone to large variations between actual and forecast numbers (as demonstrated, not least, by the variances observed between Q219a and Q219e in Exhibit 1). To this end, it is worth noting that the top end of Endeavour’s production guidance is 32.8oz gold above our updated forecast for the year, which is worth a material US$47.3m in additional revenue to the company (at the current spot price of gold of US$1,441/oz) and therefore has the ability to increase Endeavour’s full year profit before tax by 41.2% relative to our forecasts above (assuming all other things are equal). As such, the exhibit above should be regarded as more indicative than prescriptive with respect to the individual quarters. Within this context, however, the table above nevertheless demonstrates the effects of a number of anticipated operating developments over the course of the year, including:

production from the higher-grade Bouéré pit at Houndé in H2;

the start of commercial production from the Ity CIL project in Q2; and

the processing of higher-grade ore (cf low-grade stockpiles) at Karma in H2.

By contrast, to date, we have given no credit to Endeavour’s plan to increase the Ity CIL plant nameplate capacity by 1Mtpa to 5Mtpa (which is expected to be completed in Q419). These plant upgrades are expected to be completed during scheduled maintenance shut-downs over the next four months. However, should the process be completed by the end of Q3, then we estimate that it would have the potential to increase quarterly Ity CIL production from 55.3koz to 69.1koz in Q4 and group adjusted net earnings attributable (see Exhibit 3, above) from 27.4c per share to 35.7c per share (all other things being equal) in Q419 and from 44.3c/share to 52.5c/share for FY19.

Exploration success

In addition to its Q2 financial results, towards the end of June and the beginning of July, Endeavour made three announcements relating to its exploration activity at Houndé and Ity:

On 24 June, it announced a maiden reserve at Kari Pump of 710koz. Not only would this be sufficient to extend Houndé’s mine life by two to four years, but it is also capable of doing so at a materially increased grade of 3.01g/t (cf an average grade at the balance of Houndé’s operations of 1.97g/t). Endeavour had already announced a maiden resource at Kari Pump in November 2018. Nevertheless, there was a higher conversion of resources into reserves (70.6% on average) than the remainder of the Houndé deposit (51.2%). Moreover, owing to a higher percentage of oxide and transition ore (53% vs 12%), the company estimated that it could be mined at a low average life of mine production cost of c US$674/oz.

Further to its delineation of a maiden reserve at Kari Pump (over an area 1,300m long by 800m wide, or 1,040,000m2 in total), on 2 July, Endeavour announced that it had extended mineralisation at Houndé at Kari West (over an area 1,000m long by 500m wide, or 500,000m2 in total) and Kari Center, comprising Kari Main (over 1,300m along strike with a width of 300m, or 390,000m2 in total) and Kari South (over 1,000m long by 500m wide, or 500,000m2 in total). Approximately 85% of the holes drilled are reported to have encountered at least one interval of mineralisation of 0.5g/t gold over at least 2m and metallurgical and geotechnical tests are already being conducted at the same time as a dedicated Environmental Impact Assessment over the whole Kari area. Endeavour aims to publish maiden resource and reserve estimates for both Kari West and Kari Center in Q419, after which an updated mine plan and technical report, integrating Kari Pump, Kari Center and Kari West, is also expected to be released.

Finally, on 8 July, Endeavour announced that it had increased its resource at Le Plaque (at Ity) by 397koz gold contained within 3.6Mt of material, at an average grade of 3.42g/t almost exclusively within the indicated category. In line with its strategic objectives, these additional resources were discovered at a cost of only US$15 per indicated resource ounce. At Ity’s erstwhile conversion ratio, we estimate that this resource could convert into approximately 330koz gold, contained within 3.1Mt of material, or slightly less than one year’s processing, albeit at a higher grade of 3.33g/t within the probable category. Note that this 3.33g/t compares to Ity’s erstwhile reserve grade of 1.56g/t – ie it is 113% higher. A follow-up 20,000m drill campaign is expected to begin after the rainy season, which, in conjunction with additional metallurgical and geotechnical tests, is anticipated to give rise to a maiden Le Plaque reserve statement in either late Q419 or early Q120. At the same time, Environmental & Social Impact Assessment (ESIA) studies that were begun in mid-2018 are also expected to be completed later this year. Note that reconnaissance drilling has indicated that Le Plaque represents only 20% of the large anomalous area located in the northern portion of the Floleu licence where at least seven other targets have been identified. Drilling on these targets is also expected to continue into H219 with the intention of delineating maiden resources in FY20.

In the meantime, 37,600m of a c 43,000m campaign has been completed to date at the company’s greenfield Fetekro property, with the aim of delineating additional indicated resources at the Lafigue deposit and testing other nearby targets, with an updated resource expected to be published in late Q319.

Exploration expenditure/investment amounted to US$39m in H119, or approximately 82% of the company’s US$45–50m budgeted total for FY19, to drill 307,124m at an average cost of US$127 per metre. While demonstrably lopsided however, this asymmetry between H119 and (implied) H219 exploration budgets was always expected, as it was Endeavour’s intention to substantially complete exploration drilling prior to the onset of the region’s seasonal rains in Q319.

While the additional resources and reserves drilled by Endeavour are not yet sufficient to bring the production profiles at Houndé and Ity up to 250koz per annum for at least 10 years (NB we calculate that the reserves drilled – or implied – to date amount to c 61% and 57% of those required, respectively), they nevertheless materially de-risk our valuation calculation (see below), which is implicitly based on this assumption.

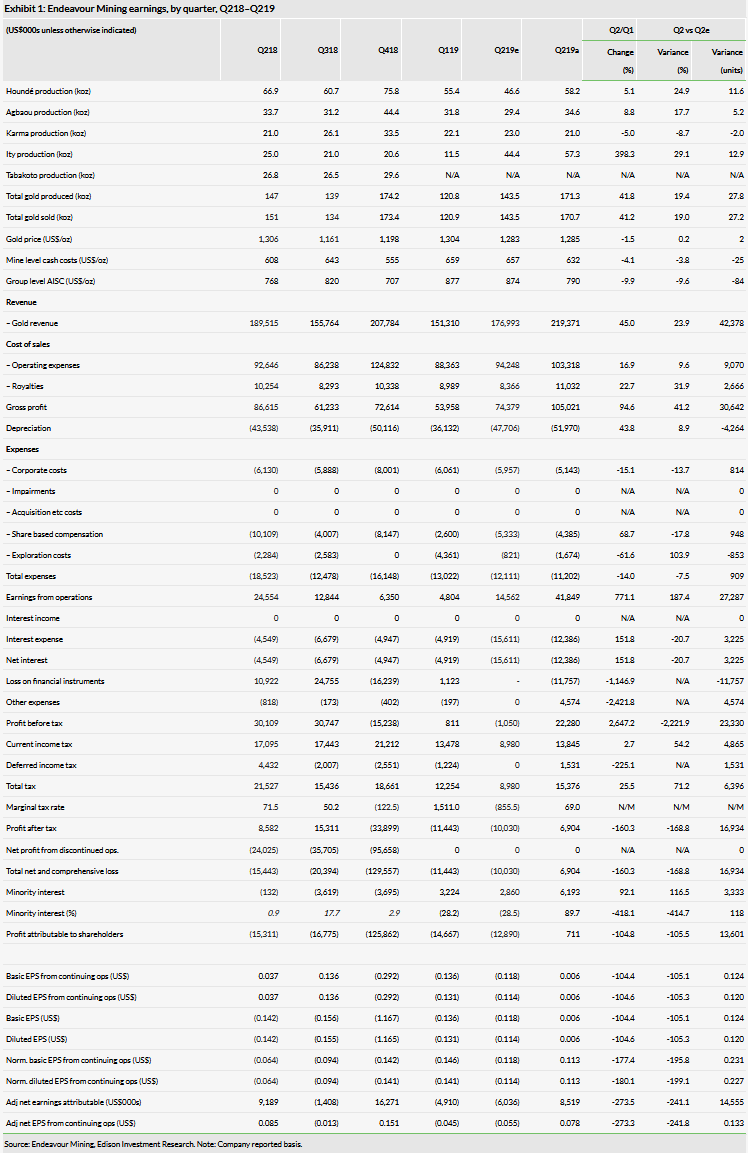

Valuation

Endeavour is a multi-asset company that has shown a willingness and desire to trade assets to maintain production, reduce costs and maximise returns to shareholders (eg the sale of Youga in FY16, Nzema in FY17 and Tabakoto in FY18). Rather than our customary method of discounting maximum potential dividends over the life of operations back to FY19, therefore, we have opted to discount potential cash flows back over four years from FY19 and then to apply an ex-growth terminal multiple of 10x (consistent with using a standardised discount rate of 10%) to forecast cash flows in that year (ie FY22). In the normal course of events, exploration expenditure would be excluded from such a calculation on the basis that it is an investment. In the case of Endeavour, however, we have included it in our estimate of FY22 cash flows on the grounds that it may be a critical component of ongoing business performance in its ability to continually expand and extend the lives of the company’s assets.

Within this context, our estimate of Endeavour’s cash flow in FY22 remains largely unchanged at US$3.24 per share (cf US$3.26/share previously), on which basis our terminal valuation of the company at end-FY22 is US$32.38/share (cf US$32.58/share previously), which (in conjunction with forecast intervening cash flows) discounts back to a value of US$27.66/share at the start of FY19 (cf US$27.58/share previously).

Financials

Endeavour had US$653.2m in net debt (including restricted cash) on its balance sheet at end-Q219 (vs US$615.3m at end-Q119, US$517.5m at end-Q418), after US$66.1m in net capex during the quarter (vs US$103.9m in Q119, US$87.1m in Q418 and US$110.8m in Q318). This level of net debt equates to a gearing (net debt/equity) ratio of 76.5% (vs 72.4% at end Q119, 60.3% at end-Q4 and 52.1% at end-Q3) and leverage (net debt/[net debt + equity]) ratio of 43.3% (vs 42.0% at end-Q119, 37.6% at end-Q4 and 34.3% at end-Q3). Note that US$653.2m accords with Endeavour’s Q219 balance sheet; it differs from the figure of US$660m quoted in some of the company’s other materials because the formal accounting treatment of the finance leases in particular requires future cash flows to be discounted back to present value – whereas the higher figure is quoted on an undiscounted basis.

With capital expenditure relating to the Ity CIL project now having been, to all intents and purposes, completed, Endeavour has no major capex commitments in the future until the development of Kalana. In the new gold price environment, we therefore estimate that cash flows will be strongly positive in H219, such that, overall, we estimate that Endeavour will generate US$1.6m in net cash flow during FY19 (cf US$93.3m in pre-financing cash outflows in H119), such that we are forecasting that the company will have net debt of c US$515.9m as at end-FY19 (cf US$531.9m previously), which will equate to a gearing ratio of 57.4% (cf 61.0% previously) and a leverage ratio of 36.4% (cf 37.9% previously). Thereafter, net debt should decline rapidly such that we estimate the company will be net debt-free early in FY22 (notwithstanding capex related to the Kalana project), at which point it will potentially be able to make dividend distributions to shareholders.