Gold (via NYSE:GLD) has moved higher over the last 7 months in fits and starts. The latest leg higher started in May and has just surpassed the mid April high. It looks strong and has momentum on its side. The US Dollar Index has had the opposite trajectory, falling from a peak in December with several bounces along the way. Unlike gold though, the latest leg down has extended well beyond the early may low. Rising gold and falling dollar.

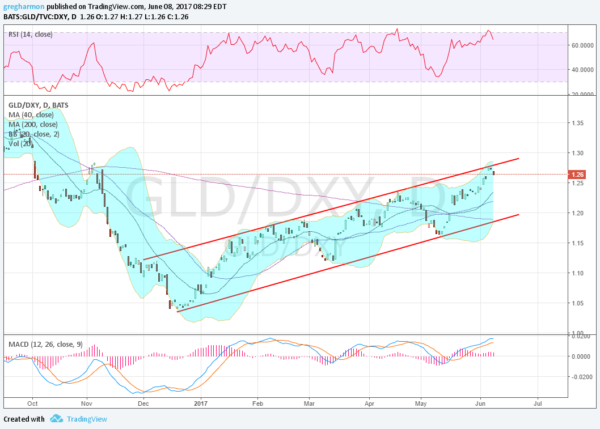

When you put the two together there is an interesting correlation over the past 7 months. Not just that one has been rising as the other falls. But as the ratio chart below shows, the pair has traded in a rising channel over that period. Bounded at both the top and bottom. Earlier this week the ratio hit the top of the channel and it is starting lower Thursday.

Of course this correlation could evaporate at any moment, and if you want a technical argument for that just look at the Golden Cross, the 50 day SMA crossing up through the 200 day SMA, in mid May as a reason for it to continue higher. But should the channel hold and the ratio reverse lower there are trades to be made. Momentum in the ratio has turned back from overbought signals in the RSI and the top of the Bollinger Bands®.

A push lower to the bottom of the channel would also be a retest of the 200 day SMA.

But what does this mean for the two commodities? For the ratio to head lower, gold has to fall, the Dollar Index has to rise or both can move together, but with gold falling faster than the dollar or rising slower than the dollar. The first two are the easiest to detect. And gold may be the place to watch closely as it is in its second day pulling back. A confirmation by the consolidating dollar with a reversal higher would seal the trade.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.