GBP/USD Daily" title="GBP/USD Daily" height="242" width="474">

GBP/USD Daily" title="GBP/USD Daily" height="242" width="474">

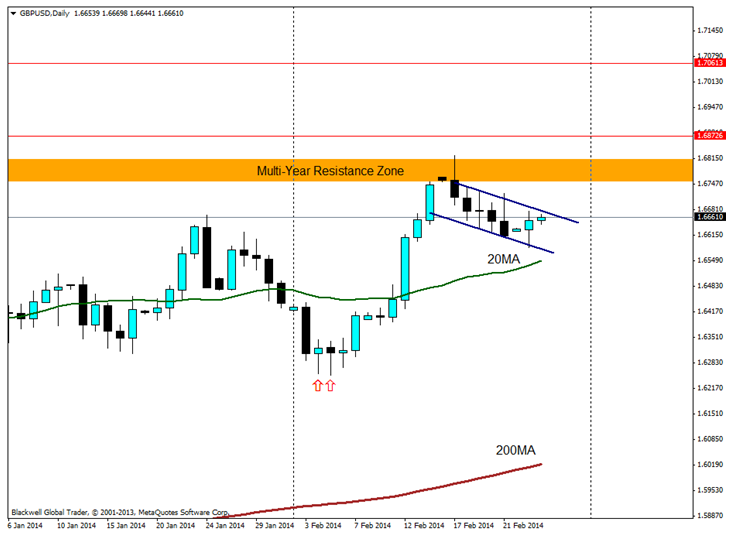

The Cable is on my watch-list for a potential impulsive bullish wave 3. After a strong bullish momentum of more than 400 pips since the 2 pin-bar rejections off 1.6250, the Cable has transitioned into a corrective stage trading within a clean downward channel range.

There are several technical points that I would like to draw your immediate attention to that supports my bullish bias:

1. Multi-year Resistance

The 1.6760 zone highlighted is critical as it is a multi-year resistance and price has not been able to break past it since failed attempts in the 3rd quarter of 2009 and mid-2011. It is no wonder that price has just rejected thelevel on 17th Feb. However, it is important to note that this rejection did not find a strong follow through that one would expect out of such a key level. It is therefore my opinion that the Cable is in a corrective pullback stage.

Also, be wary of fake breakouts of the zone. A real breakout through this level would garner strong upward acceleration, at least breaking past the previous high of 1.6672.

2. Price above critical Moving averages

The 20-day and 200-day moving average are of particular significance because they represent averages of a trading month and trading year respectively. As you can see, price is still above the 2 MAs. A strong close below the 20MA would signal that it is time to re-evaluate the bullish bias.

3. Bullish close in Corrective Channel

After the series of bearish candles with rejections of the upper and lower boundaries of the channel, price on 24/02/14 managed to close above its open. Intraday traders can start looking for clues that point toward a breakout of this channel. An example would be a flattening out of price action that shows that the short-term sellers who are trading the channel are losing steam.

News to look out for

Even though the technicals are lining up, traders still have to be aware thatGBP Second Estimate GDP q/q data is coming out on 26/02/14. Any number worse than the forecast of 0.7% could spell disaster for bulls in the days following.

Conclusion

All in all, you can easily see why the Cable is on my watch-list this week. Riding the impulsive wave 3 is always exciting and rewarding for trend traders and there are good prospects for this opportunity materialising soon. A daily close below 1.6500 will eliminate by bullish bias. Other than that, I am lock and loaded with upside targets of 1.6820, 1.6872, and possibly 1.7000 if price action supports it.