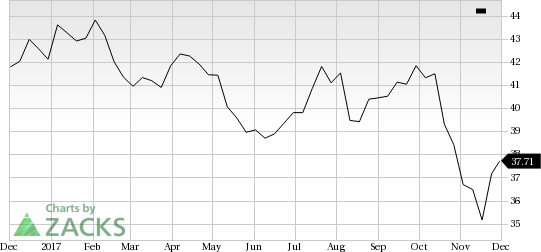

Enbridge Inc. (NYSE:ENB) was a big mover last session, as the company saw its shares rise nearly 6% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This breaks the recent trend of the company, as the stock is now trading above the volatile price range of $34.50 to $37.16 in the past one-month time frame.

The move came after the company announced its strategic plan and strong financial outlook for the next three years.

The company has seen two negative estimate revisions in the past few weeks, while its Zacks Consensus Estimate for the current quarter has also moved lower over the past few weeks, suggesting there may be trouble down the road. So make sure to keep an eye on this stock going forward, to see if this recent move higher can last.

Enbridge currently has a Zacks Rank #4 (Sell) while its Earnings ESP is negative.

A better-ranked stock in the Oil and Gas - Production and Pipelines industry is Holly Energy Partners, L.P. (NYSE:HEP) , which currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Is ENB going up? Or down? Predict to see what others think: Up or Down

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Enbridge Inc (ENB): Free Stock Analysis Report

Holly Energy Partners, L.P. (HEP): Free Stock Analysis Report

Original post