International energy transporter Enbridge Inc. (NYSE:ENB) and Calgary-based energy infrastructure company Veresen Inc.'s joint venture (“JV”) Alliance Pipeline recently announced force majeure (legal indemnity allowing it to stop shipments without breaching contractual obligations) on its export pipeline connecting Chicago. Heavy rain and slope movement in Northern Alberta affected a segment of the natural gas conduit’s mainline, which forced the joint owners to cut down its transportation service. The affected segment is located approximately 25 kilometers southwest of Grande Prairie, beside the Wapiti River.

The JV issued a notice on Jun 13 to its customers that it has to expose and inspect the affected segment, which is now expected to last no more than five days. The service will continue to be affected if additional inspection and repair work is required on the pipeline.

Alliance Pipeline – one of North America’s key infrastructure assets – expects no commercial impact on firm contracts of customers. The company announced that it will not provide any operational temporary relocation during the inspection and repairing period.

The 3,848-kilometer pipeline delivers, on an average, 1.6 billion cubic feet (cf) of natural gas from northeastern British Columbia and northwestern Alberta to Chicago every day. It is believed that the force majeure will affect the production of 500 million cf of natural gas and this could adversely impact gas prices.

The affected companies include a number of Western Canada producers like Calgary-based Crew Energy Inc. It may have to reduce its second-quarter 2017 production guidance. Other affected energy companies include Canadian Natural Resources Limited (TO:CNQ) , Cenovus Energy Inc. (TO:CVE) and Seven Generations Energy.

About the Company

Enbridge, which is based in Calgary, Canada and owns 50% stake in the pipeline, is a leading energy transportation and distribution provider in North America and internationally. The company mainly operates in Canada and the U.S., owning the world's longest crude oil and liquids pipeline system. Enbridge owns and operates Canada's largest natural gas distribution company, and provides distribution services in Ontario, Quebec, New Brunswick and New York State.

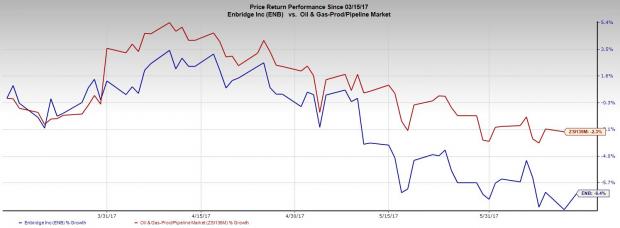

Price Performance

Enbridge has underperformed the corresponding industry over the past three months. During the aforementioned time period, Enbridge’s shares fell 6.5% compared with the Zacks categorized Oil and Gas - Production and Pipelines industry’s decrease of 2.3%.

Zacks Rank and Stock to Consider

Enbridge presently has a Zacks Rank #5 (Strong Sell). A better-ranked stock in the oil and energy sector is Delek US Holdings, Inc. (NYSE:DK) . It sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Delek US Holdings’ sales for 2017 are expected to increase 71.35% year over year. The company has a four-quarter average positive earnings surprise of 60.68%.

Zacks' 2017 IPO Watch List

Before looking into the stocks mentioned above, you may want to get a head start on potential tech IPOs that are popping up on Zacks' radar. Imagine being in the first wave of investors to jump on a company with almost unlimited growth potential? This Special Report gives you the current scoop on 5 that may go public at any time.

One has driven from 0 to a $68 billion valuation in 8 years. Four others are a little less obvious but already show jaw-dropping growth. Download this IPO Watch List today for free >>

Delek US Holdings, Inc. (DK): Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis Report

Cenovus Energy Inc (CVE): Free Stock Analysis Report

Enbridge Inc (ENB): Free Stock Analysis Report

Original post

Zacks Investment Research