Back in the game

Emulex’s longer-term prospects should become clearer as visibility on its ability to reinstate its position in 10gE and leverage synergies from Endace become apparent. With only modest revenue growth forecast, the $30m cost savings and the $200m share repurchase programme should drive strong earnings growth into 2015. This should support the shares’ value on the downside, and evidence of successful execution of its strategy could see 10-20% rating upside and could drive significant earnings upgrades.

Relaunching redesigned Ethernet solutions

Emulex supplies solutions for connecting and monitoring servers, storage and networks within the data centre. Over the past few years its progress in the high-growth 10g Ethernet market has been handicapped by patent litigation, while the FC adaptor market (estimated 49% of 2013 sales) declined at a mid-single digit rate, albeit offset by market share gains. With three patent claims outstanding, further disruption is a risk. However, with the bulk of the mitigation work now completed, Emulex is at last able to readdress its position in 10gE. The $130m acquisition of network monitoring appliance supplier Endace diversifies exposure into a $345m market growing at 25% pa, with significant sales synergies targeted.

Financials: 2014 should be a transitional year

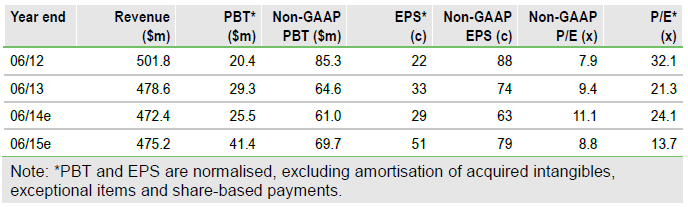

Recovery prospects should start to become clearer during 2014 as visibility on the potential leverage from Endace and lead indicators of a recovery in Ethernet start to emerge. Early signs are encouraging with 21% sequential growth at Endace in the September quarter and some meaningful 10gE design wins announced. Incoming CEO Jeff Benck has announced $30m of cost savings to support margins and a $200m accelerated share buyback programme, which means that with even modest growth in revenues the group should report strong earnings growth in 2015; after a forecast 15% contraction in EPS to 63c in 2014, we forecast EPS of 79c in 2015 +26%. If it can successfully execute on its 10gE and Endace strategy, we see scope for EPS forecasts to double by 2016.

Valuation: Evidence of top-line growth needed

Emulex trades at a 15-25% P/E discount to peers. The share buyback programme should provide some downside support; meanwhile, evidence of its ability to return the group to a growth trajectory would drive the shares’ valuation. We look to quarterly results to confirm Endace’s growth trajectory and newsflow regarding 10gE OEM wins for evidence that progress here is on track. Delivery on our ‘successful execution’ scenario would put the company on a mere 6x 2016 P/E, justifying significant upside, even at the current 11.1x P/E rating.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Emulex Initiation Of Coverage

Published 12/20/2013, 06:08 AM

Updated 07/09/2023, 06:31 AM

Emulex Initiation Of Coverage

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.