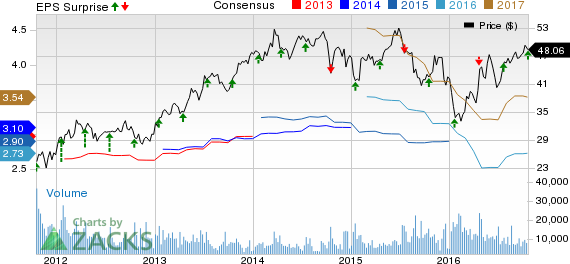

Comerica Inc. (NYSE:CMA) delivered a positive earnings surprise of 16.5% in the third-quarter 2016. Adjusted earnings per share of 92 cents came substantially ahead of the Zacks Consensus Estimate of 79 cents. The adjusted figure excludes a restructuring charge of 8 cents per share. Also, earnings increased 24.3% year over year.

Share of Comerica gained more than 3% in the beginning of the trading session today reflecting investors’ positive sentiments on substantial lower provisions and higher revenues. However, the price reaction during the full trading session will give a better idea.

Nonetheless, on the downside, the quarter experienced higher expenses.

Net income came in at $149 million, up 9.6% year over year. This figure includes a restructuring charge of $20 million.

Furthermore, segment wise, on a year-over-year basis, net income decreased 1.5% at Business Bank, 14.3% at Wealth Management and significantly at Retail Bank. Notably, Finance segment recorded a lower net loss compared to prior-year quarter.

Interest Income Grows, Expenses Climb

Comerica’s third-quarter net revenue was $722 million, up 5.9% year over year. However, the figure marginally lagged the Zacks Consensus Estimate of $723 million.

Net interest income increased 6.6% on a year-over-year basis to $450 million. Moreover, net interest margin expanded 12 basis points (bps) to 2.66%.

Total non-interest income came in at $272 million, up 4.6% year over year. Increased commercial lending fees and income from bank-owned life insurance mainly led to the rise.

However, non-interest expenses totaled $493 million, reflecting a growth of 7.9% year-over-year. The rise was primarily due to higher restructuring charges, software expenses and FDIC insurance expenses.

Stable Balance Sheet

As of Sep 30, 2016, total assets and common shareholders' equity were $72.9 billion and $7.7 billion, respectively, compared with $71.3 billion and $7.6 billion as of Sep 30, 2015.

Total loans were slightly up on a year-over-year basis to $49.2 billion. However, total deposits decreased 2% from the prior-year quarter to $58.1 billion.

Credit Quality a Mixed Bag

Total non-performing assets jumped 73.2% year over year to $660 million. Also, allowance for loan losses was $727 million, up from $622 million in the prior-year period. Additionally, the allowance for loan losses to total loans ratio was 1.48% as of Sep 30, 2016, up from 1.27% as of Sep 30, 2015.

However, net loan charge-offs plunged 30.4% on a year-over-year basis to $16 million. Also, provision for credit losses plummeted 38.5% year over year to $16 million.

Strong Capital Position

As of Sep 30, 2016, the company's tangible common equity ratio was 9.64%, down 27 bps year over year. Common equity Tier 1 capital ratio was 10.68%, up from 10.51% in the prior-year quarter.

Capital Deployment Update

Comerica repurchased 2.1 million shares worth $97 million under its existing equity repurchase program during the quarter. Further, the company returned $137 million to shareholders through shares repurchase and dividends.

Impressive Outlook for Q4 2016

Comerica guided for fourth-quarter 2016 taking into consideration the current economic environment and the persistent low rates.

The company expects higher net interest income based on a decline in wholesale funding costs and an increase in LIBOR.

Non-interest income is expected to be relatively stable. Fee income is likely to be strong, in-line with third-quarter levels.

Non-interest expenses are anticipated to be lower, excluding an estimated $30-$35 million restructuring expense, partially offset by the related GEAR Up expense savings of approximately $25 million.

Provision for credit losses are expected to remain low, while net charge-offs are likely to be below historical norms.

Income tax expense is anticipated to approximate 30% of pre-tax income.

Comerica expects average loan growth to be stable. The outlook reflects growth in National Dealer Services, Technology and Life Sciences and small increases in several other lines of business. Seasonality in Mortgage Banker Finance and a sustained decline in energy business are expected to be the offsets.

Our Viewpoint

The consistent improvement in the loan portfolio is expected to offset the pressure on revenues to some extent. Further, the company should benefit from its on-going strategic initiatives. Additionally, its strong capital position supports steady capital deployment activities through shares repurchase and dividend hikes, seem impressive. However, regulatory issues, unstable credit metrics and rising expenses remain major concerns.

Currently, Comerica carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Banks

Banking major – JPMorgan Chase & Co. (NYSE:JPM) – reported third-quarter 2016 earnings of $1.58 per share, outpacing the Zacks Consensus Estimate of $1.40, primarily driven by improved trading and mortgage banking revenues. Notably, the results included a legal benefit of $71 million. Further, higher net interest income perhaps attributable to the rise in loan supported its top line. However, higher-than-expected rise in provisions (largely driven by growth in the Card portfolio) hurt results marginally in the quarter.

Bank of America Corporation’s (NYSE:BAC) third-quarter 2016 earnings of 41 cents per share surpassed the Zacks Consensus Estimate of 34 cents. Also, the figure was 8% higher than the prior-year quarter number. Rise in fixed income sales and trading revenues as well as mortgage banking fees drove the better-than-expected result. However, weakness in equity trading revenues marginally offset these positives. Notably, absence of legal costs and efficient expense management were sufficient to support the bottom line.

PNC Financial Services Group, Inc.’s (NYSE:PNC) third-quarter 2016 earnings per share of $1.84 surpassed the Zacks Consensus Estimate of $1.78. However, the bottom line declined 3% year over year. The results were driven by increased net interest income as well as non-interest income. Also, continued growth in loans and deposits were among other positives. However, on the downside, the quarter recorded higher expenses and provisions.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

JPMORGAN CHASE (JPM): Free Stock Analysis Report

PNC FINL SVC CP (PNC): Free Stock Analysis Report

COMERICA INC (CMA): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

Original post

Zacks Investment Research