We continue the progression to a robotic workforce. This change is far from uniform, and some companies are better at the transition than others. Wal-Mart (NYSE:WMT) continues to be in a failure mode.

Follow up:

Walmart has lost control of its stocking systems.

In the early 70's when companies began the transformation of logistics and warehousing systems - most efforts resulted in failure. It became the norm for the personnel to use a manual "card" system in parallel to the "new" computer system. It should come as no surprise that the "card" system was far more accurate than the computerized one. There are a variety of reasons for this failure - but the biggest reason is that the computer system required the workers to do things unnatural in their work flow, whilst the "card" system was completely integrated in the work flow methodology.

It was not until the late 80's that I could begin to eliminate the duplicate control "card" systems - as for the first time (based on audit results) that the computer systems were more accurate than the manual ones. At his point, the generally less educated workers responsible for stocking, warehousing, and logistics were better trained, the input methods had been integrated into the workflow, and workers believed the computer was easier to use and more accurate than the manual processes.

Knowing exactly what you have on hand is important, or customers will see shelves filled with what they do not want, and empty spaces for things they want. Welcome to Walmart!!!

In 2013, the issues of Walmart's logistic failures were front page news. But the problems remain. In the last 30 days, I have encountered 2 failures of their stock / logistics systems - with apologies from Walmart employees saying their system is not reliable. If you lose control of what is on the shelves - you end up with empty shelves.

On the other hand, I continuously use Home Depot's (NYSE:HD) system - and its accuracy is frightening. Here is one example of the detail available to consumers online:

CE TECH Low Voltage Recessed Cable Plate - White

Model # 5018-WH Internet # 202689906 Store SKU # 640816

$4.97 / each

24 in Stock at [store location deleted by author]

Aisle37 Bay010

And yes, I went to the store immediately and counted - 24 in stock was correct. I began my career as a logistics / material control / warehousing specialist - and I am sensitive to failures or successes in material control processes.

Amazon (NASDAQ:AMZN) is another success story on automated logistics system - and their purchase of Kiva Systems (warehouse robotic systems) further enhances their abilities. Yet there are failures in the automation / robotic game even for Amazon which likely will drive even further automation / robotics.

No one can accurately forecast the progression of automation - or timeline its effect on employment. In my opinion, the end result will literally be a world without jobs. But watching this robotic cycle unfolding, the short to medium term effect in the USA may actually be positive. From the Harvard Business Review:

Companies will be forced to transform or die.” The latter claims that up to 47 percent of American jobs are susceptible to robots and automation within the next seven to 10 years.

Despite the doom and gloom, advances in robotics and associated technology are having a positive impact on local manufacturing and services and both sustaining and creating jobs. In developed economies, they have even sparked a trend toward the return of jobs from overseas, or “botsourcing.” This new wave of bringing production back home through robotics automation may be the single biggest disruptive threat to India’s $118 billion information technology industry. The more processes can be automated, the less it makes sense to outsource activities to countries where labor is less expensive.

The threat is being taken seriously elsewhere in Asia as well. Foxconn, the world’s largest contract electronics manufacturer best known for manufacturing the iPhone, has recently announced it will spend $40 million at a new factory in Pennsylvania, using advanced robots and creating 500 jobs.

The USA employment situation has already been decimated by outsourcing and globalization - thanks to the tax system in the USA which favors an imported product over a locally made product (an imported product is not taxed while the USA product is subject to USA taxes in during manufacture). But this cycle has run its course. Due to energy prices increasing the cost of transport, the economic optimum point of production has moved closer to the point of use. In addition, robotics has lowered the cost of manufacture - removing the cost advantage of using foreign labor.

The current robotic dynamics are biased towards bringing manufacturing back to the USA - thus creating more U.S. jobs than likely will be eliminated due to robotics. The employment deterioration caused by the globalization took 10 to 15 years to run its course - and hopefully the USA will enjoy 10 to 15 years of positive employment dynamics from robotics to partially reverse the globalization effect.

Other Economic News this Week:

The Econintersect Economic Index for May 2014 is showing marginal growth acceleration - but the pattern over a half a year remains in a fairly tight range. The major soft data point remains personal income which is not part of our Economic Index. My position remains that the economy remains too strong to recess, and too weak to grow.

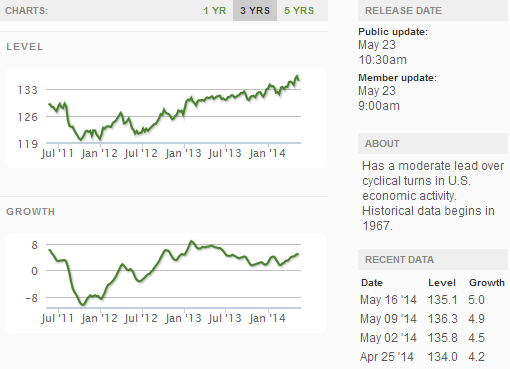

The ECRI WLI growth index value has been weakly in positive territory for many months - but now in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

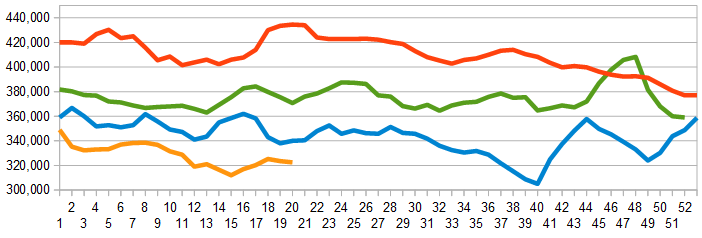

Initial unemployment claims went from 297,000 (reported last week) to 326,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate. The real gauge – the 4 week moving average – improved marginally from 323,500 (reported last week as 323,250) to 322,500. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line)

Bankruptcies this Week: None

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks