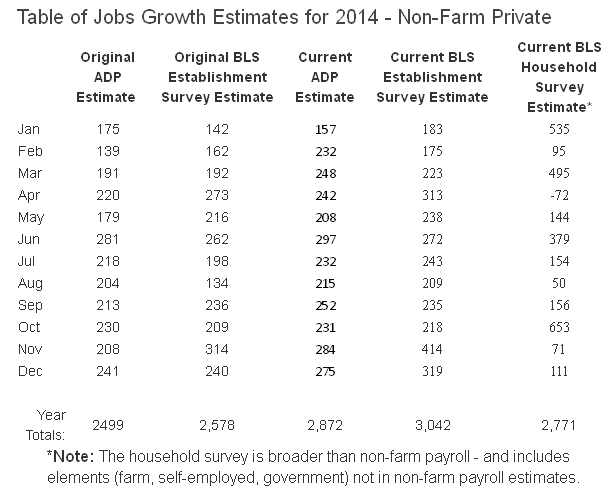

A year ago, I penned a post ADP Does A Better Job Of Estimating Employment In Real Time than BLS. This year the results look different.

Follow up:

In my simple mind:

- Employment reports are truly guesses based on extrapolated survey information. Only the BLS Household Survey is not revised as the year progresses - but it still is an extrapolated number based on monthly interviews of 60,000 households. [Here is a good explanation of the establishment and household surveys.]

- There is no excuse in the USA that a significant more accurate real-time estimate methodology is not developed. This is the age of internet and connectivity, and the current method is from the dark ages;

-

The ADP survey is designed to mimic the BLS establishment estimate.

The final step of the process is to use the estimation results to predict the current month’s BLS number by super sector and size class, which can then be aggregated into total private sector employment.

I want to know why anyone would consider the BLS estimate any better than another informed guess. I liked it better when ADP's methodology was to simply provide what ADP thought the jobs growth was.

As a systems engineer, there a warning bells which accompany complex data gathering systems which have high levels of inaccuracy. Here is part of what the BLS says about accuracy:

Statistics based on the household and establishment surveys are subject to both sampling and nonsampling error. When a sample, rather than the entire population, is surveyed, there is a chance that the sample estimates may differ from the true population values they represent. The component of this difference that occurs because samples differ by chance is known as sampling error, and its variability is measured by the standard error of the estimate. There is about a 90-percent chance, or level of confidence, that an estimate based on a sample will differ by no more than 1.6 standard errors from the true population value because of sampling error. BLS analyses are generally conducted at the 90-percent level of confidence.

For example, the confidence interval for the monthly change in total nonfarm employment from the establishment survey is on the order of plus or minus 105,000. Suppose the estimate of nonfarm employment increases by 50,000 from one month to the next. The 90-percent confidence interval on the monthly change would range from -55,000 to +155,000 (50,000 +/- 105,000). These figures do not mean that the sample results are off by these magnitudes, but rather that there is about a 90-percent chance that the true over-the-month change lies within this interval. Since this range includes values of less than zero, we could not say with confidence that nonfarm employment had, in fact, increased that month. If, however, the reported nonfarm employment rise was 250,000, then all of the values within the 90- percent confidence interval would be greater than zero. In this case, it is likely (at least a 90-percent chance) that nonfarm employment had, in fact, risen that month. At an unemployment rate of around 6.0 percent, the 90-percent confidence interval for the monthly change in unemployment as measured by the household survey is about +/- 300,000, and for the monthly change in the unemployment rate it is about +/- 0.2 percentage point.

ADP underestimated in 2014.

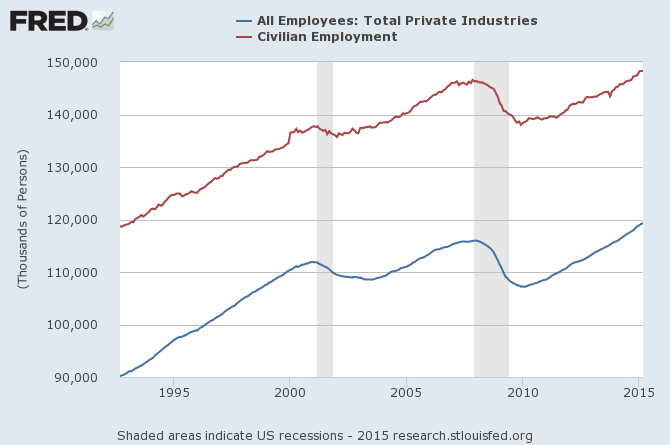

Although it is a rough ride (significant monthly variations), from a systems approach - I consider the household survey potentially a better gauge of employment. The data requires some averaging because of the variations.

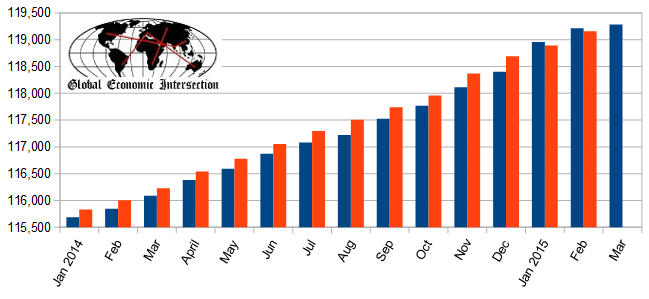

With the last employment situation report from the BLS, all employment numbers in 2015 were revised downward.

Change in Seasonally Adjusted Non-Farm Payrolls Between Originally Reported (blue bars) and Current Estimates (red bars)

This significant revision brings into the spotlight that the jobs reports may be far from accurate not only in real time - but the methodology may fail completely at turning points.

If ADP wants to be judged by how well they estimate against the BLS - then they wasted their time in publishing their data in 2014.

Other Economic News this Week:

The Econintersect Economic Index for April 2015 is indicating growth will be sluggish. Most tracked sectors of the economy are expanding - but now there is contraction in some data sets. The negative effects of the recently solved West Coast Port slowdown (a labor dispute which had been going on for months) and bad weather continues to be seen in much of the raw data - and it will be an economic drag on 1Q2015 GDP and into 2Q2015. It is difficult to differentiate these transient issues (weather and labor) from cyclic economic conditions - but one could argue that transient issues are the cause of economic cycles.

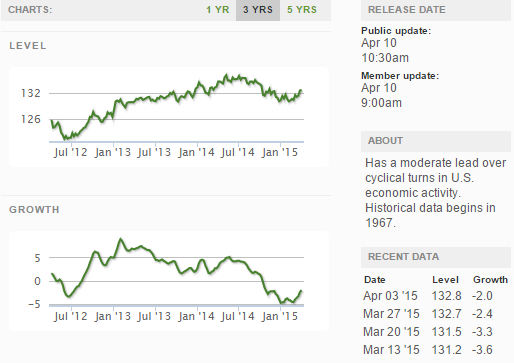

The ECRI WLI growth index remains slightly in negative territory which implies the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

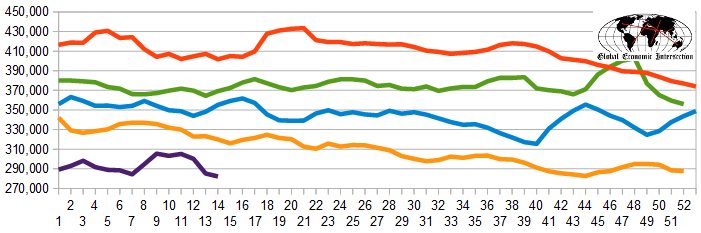

The market was expecting the weekly initial unemployment claims at 275,000 to 325,000 (consensus 285,000) vs the 281,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 285,250 (reported last week as 285,500) to 282,2500. The rolling averages have been equal to or under 300,000 for most of the last 6 months.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Xinergy Ltd (TO:XRG) (fka Greenwich Global Capital), EveryWare Global

Weekly Economic Release Scorecard: