The AUD is being pulled in two different directions – the BoJ liquidity bonanza and risk appetite pulling it up. Aussie fundamentals suggest little fuel for further upside. Meanwhile – look for signs that the EUR/USD is ready to pivot lower.

No huge surprise to see Australia posting a negative payrolls report overnight after the blowout positive February numbers. The -36k reading was far weaker than expected -7k, though it still must be seen in the light of the +74k Feb. reading. Still, the unemployment rate has now pushed to the highest level since 2009, and will garner considerable attention if it heads a mere 0.3% higher as this would put it at near 10-year highs. The AUD/USD has broken above important near term resistance at 1.0500 on the strength of the BoJ liquidity tsunami theme and strength in risk appetite. As I have mentioned over the last couple of days, there’s no support from the Australian short end of the curve, and even less so overnight in reaction to the employment data. Also of concern, gold has been selling off sharply again since late yesterday. This would be a great spot to see the pair swoosh back steeply through 1.0500 and give bears a hook for going short. It’s surprising Aussie officials haven’t been made more uncomfortable by the Aussie’s strength.

There’s word here, exactly a week after the BoJ meeting, that there are endless options expiries in very large sizes at various strikes, at and below the 99.00 area in USD/JPY, so JPY volatility may be restrained in the shortest term until after those expiries at 10 am New York time. There may also be some restraint until the other side of the U.S. retail sales report tomorrow. The USD side of the pair will focus heavily on incoming data as a way of anticipating the Fed’s attitude towards eventually reducing the rate of asset purchases. The Dallas Fed’s Fisher, long a vocal opponent of current Fed policy, said yesterday he would prefer to see the end of asset purchases entirely by the end of this year (he’s not a voting member this year). Yesterday marked a flurry of intraday volatility as Kuroda said that he has done all he can for now, and will have to see how the market reacts to the BoJ measures. Overnight CGPI data from Japan cheekily showed a -0.5% YoY rate of deflation, -0.1% lower than expected. JGB’s saw another manic session, as the 5-years gapped lower to a new recent high yield of 30 bps, only to close below yesterday’s low yield at 20 bps. As long as yields remain orderly, we’ll see the JPY avoiding a disorderly sell-off.

Chinese currency reserves ballooned a massive $130 billion in March – see FTs coverage, which suggests that some of the influx of money is from the massive BoJ and Fed easing, and that some of the trade numbers for China are misleading because some are a result of hot money flows rather than goods trading. Chinese officials will be very unhappy with this – beware of a response if it goes beyond domestic measures aimed at tightening credit. China will respond at some point to what it sees as a provocation from Japan and the BoJ.

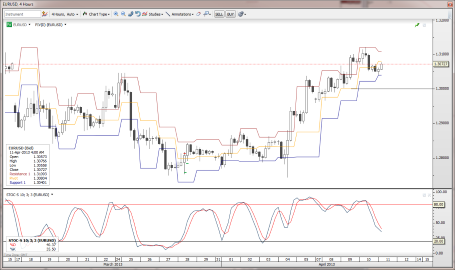

Chart: EUR/USD

Yesterday we noted that the EUR/USD is finding resistance in the key zone between the key 0.382 FIbo retracement level (at 1.3112), and the 55-day moving average a bit higher. I’m looking for the pair to pivot lower soon, but it will take more doing - there is still plenty of room for retracement higher within the context of a mere consolidation rather than calling it a new uptrend. So we need either a big down bar, or a strong move higher that is strongly rejected for the first real signs that we are ready to pivot back lower. Looking lower, it is always difficult when you have the nuisance of a big round figure (1.3000) in the area where you are looking for confirmation, as this can aggravate the movements at the local price action level. The risk is that we could remain rangebound for some time, unless there are new developments out of Europe and the market is distracted with the action in JPY crosses. Look out for Italian bond auction results up around 10:00 am London time as a possible trigger to intraday action. EUR/USD" title="EUR/USD" width="455" height="270">

EUR/USD" title="EUR/USD" width="455" height="270">

GBP/USD: quite a line of resistance built up in the 1.5340-65 area. If we get through there, this could just trigger one more round of squeezing higher to get the last weak shorts out of the marke, after which I would suspect that the potential for further upside will quickly fade ahead of the 1.5500 level. If no squeeze materializes, we still need to see a move well through 1.5250 again to set up any short-term bearish potential.

Looking ahead

The USD/JPY is critical to watch around this 100 level.

Let’s see if the weekly US jobless claims issued today continue their recent worrying climb. Tomorrow, we have two interesting U.S. data points as well. The preliminary April University of Michigan confidence indicator, which I demonstrated some time back tends to lead the Conference Board number. We saw a dramatic reversal lower in confidence last month: is this something that is deepening in April, or a one off from smaller paychecks after the expiry of the payroll tax cuts? Retail Sales for March are up tomorrow.The big US banks are beginning to report earnings in the coming few days, and the earning season is in full swing starting next Tuesday, with a number of big tech companies reporting.

Be careful out there.

Economic Data Highlights

- New Zealand Mar. Business NZ PMI out at 53.4 vs. 56.0 in Feb.

- Japan Mar. CGPI out at +0.1% MoM and -0.5% YoY vs. +0.2%/-0.4% expected, respectively and vs. -0.1% YoY in Feb.

- Japan Feb. Machine Orders out at +7.5% MoM and -11.3% YoY vs. -7.6% YoY expected and -9.7% YoY in Jan.

- China Mar. Foreign Exchange Reserves out at $3440B vs. $3361b expected and vs. $3311.6B in Feb.

- China Mar. New Yuan Loans rose +1060B vs. +900B expected and +620B in Feb.

- Australia Mar. Employment Change out at -36.1k vs. -7.5k expected and +74.0k in Feb.

- Australia Mar. Unemployment Rate out at 5.6% vs. 5.4% expected and 5.4% in Feb.

- New Zealand Mar. REINZ Housing Price Index out at +2.4% MoM and +10.9% YoY vs. +7.5% YoY in Feb.

- US Fed’s Plosser to Speak (1000)

- US Mar. Import Price Index (1230)

- Canada Feb. New Housing Price Index (1230)

- US Fed’s Bullard to Speak (1230)

- US Weekly Initial Jobless Claims (1230)

- US Weekly Bloomberg Consumer Comfort Survey (1345)

- Japan BoJ’s Kuroda to Speak (0310)