Emini Wedge Top Before Tax-Reform VotePre-Open Market Analysis

Yesterday broke to a new high, but was a weak small pullback bull trend day. It is a weak sell signal bar for a wedge top on the daily chart. Despite the buy climaxes on the daily, weekly, and monthly charts, the bears need consecutive strong bear days. Without that, the odds favor at least slightly higher prices. However, the odds also favor the start of a 5% pullback to below the August 8 high starting before year-end.

Overnight Emini Trading

The Emini is up 1/2 point in the Globex market. The daily chart has rallied 3 days in a small wedge bull channel. The legs up and down have lasted only 2 – 3 days. The bulls want a strong breakout above the wedge top. Yet, they only have a 40% chance of a measured move up. Consequently, the odds favor a 1 – 2 day selloff beginning today or tomorrow.

Since most tops fail, the odds are that this one will as well. Until the bears get consecutive big bear bars, the odds favor at least slightly higher prices.

Yesterday’s Setups

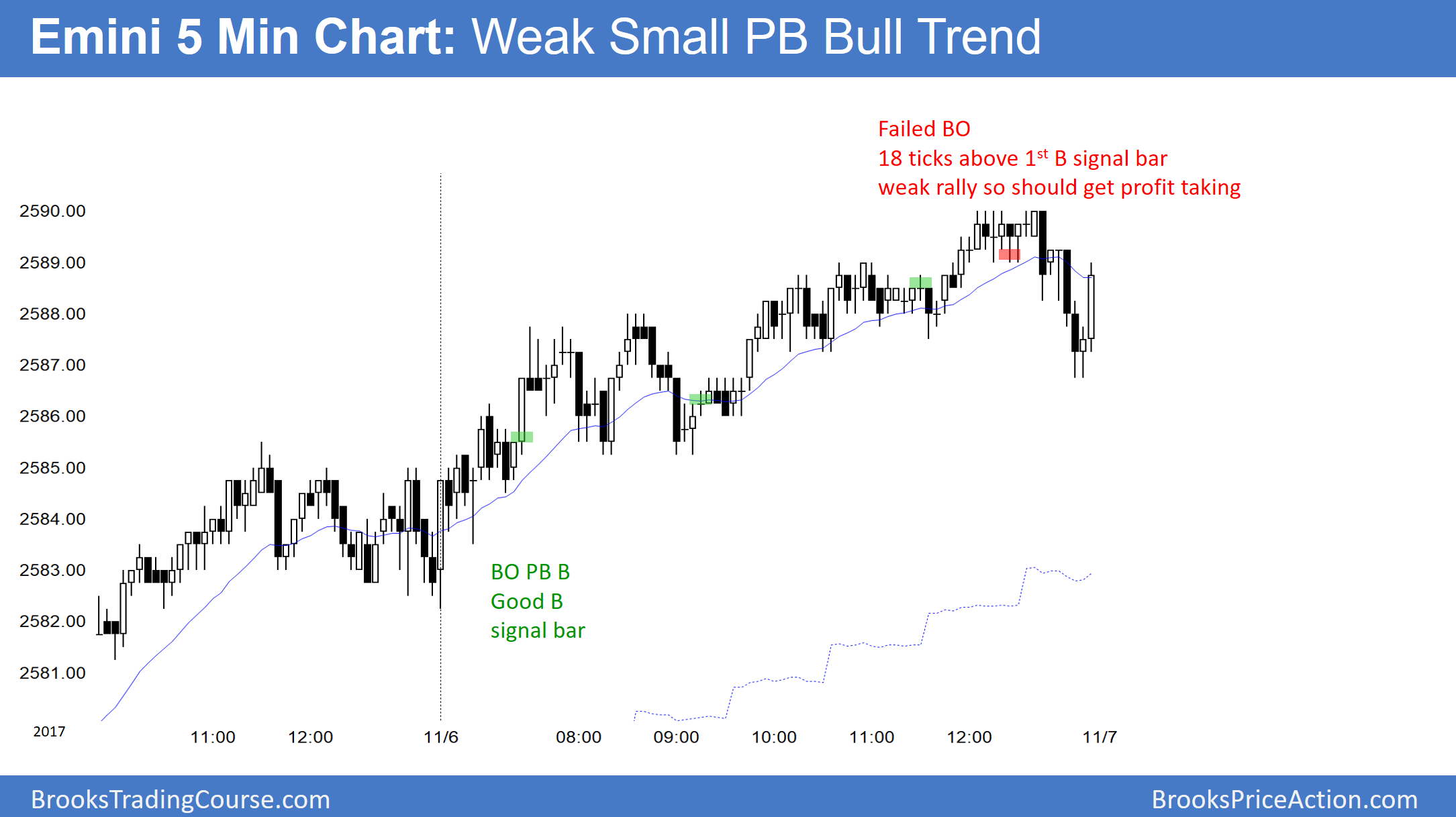

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.