Pre-Open Market Analysis

Yesterday had a big gap up, but then a weak bull trend. By going above last week’s high, the Emini triggered a weekly buy signal. The rally broke and closed above the March 22 high of the year as well.

If the bulls get consecutive closes above that high, especially if today closes far above, the odds will favor a new all-time high within the next 2 months. Otherwise, the odds will still favor a 2-month pullback before the new all-time high.

Overnight Emini Trading

While yesterday was not a strong bull trend day, it was relentless. The odds still favor a continuation of the yearlong trading range. This is true even if there is a break to a new all-time high. However, the bulls have not yet begun to take profits. Consequently it is still easier for a day trader to make money on the long side.

The Emini is up 2 points in the Globex session. Yesterday broke above the March 21 high, which is resistance. Today is the follow-through day. A 2nd close above that resistance increases the chance of a test of the next resistance. That is the all-time high.

Because the daily chart is in a trading range, there is an increased chance of disappointing follow-through today. That means an increased chance of a bear candlestick on the daily chart. Consequently, day traders will look for a major trend reversal down on the 5-minute chart at some point today. Their minimum goal will be a close below the open.

Since yesterday was not a strong bull trend day, the odds are against a big bull trend day today. There will probably be a transition into a trading range or a bear swing by the end of the 2nd hour.

Yesterday’s Setups

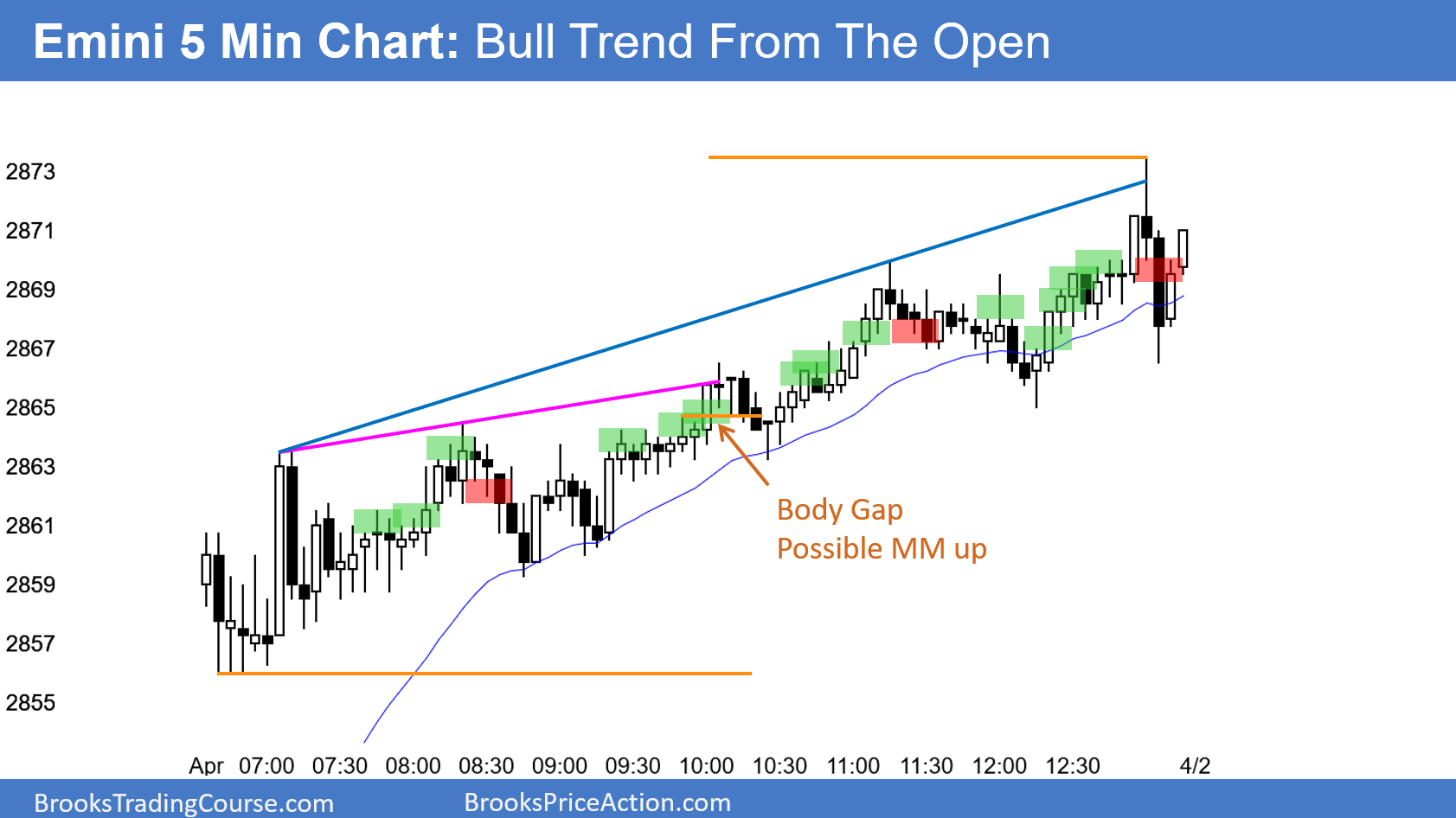

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.