Emini Test Of Wedge Top Before Trump Tax-Reform Vote

I will update around 6:55 a.m.

Pre-Open Market Analysis

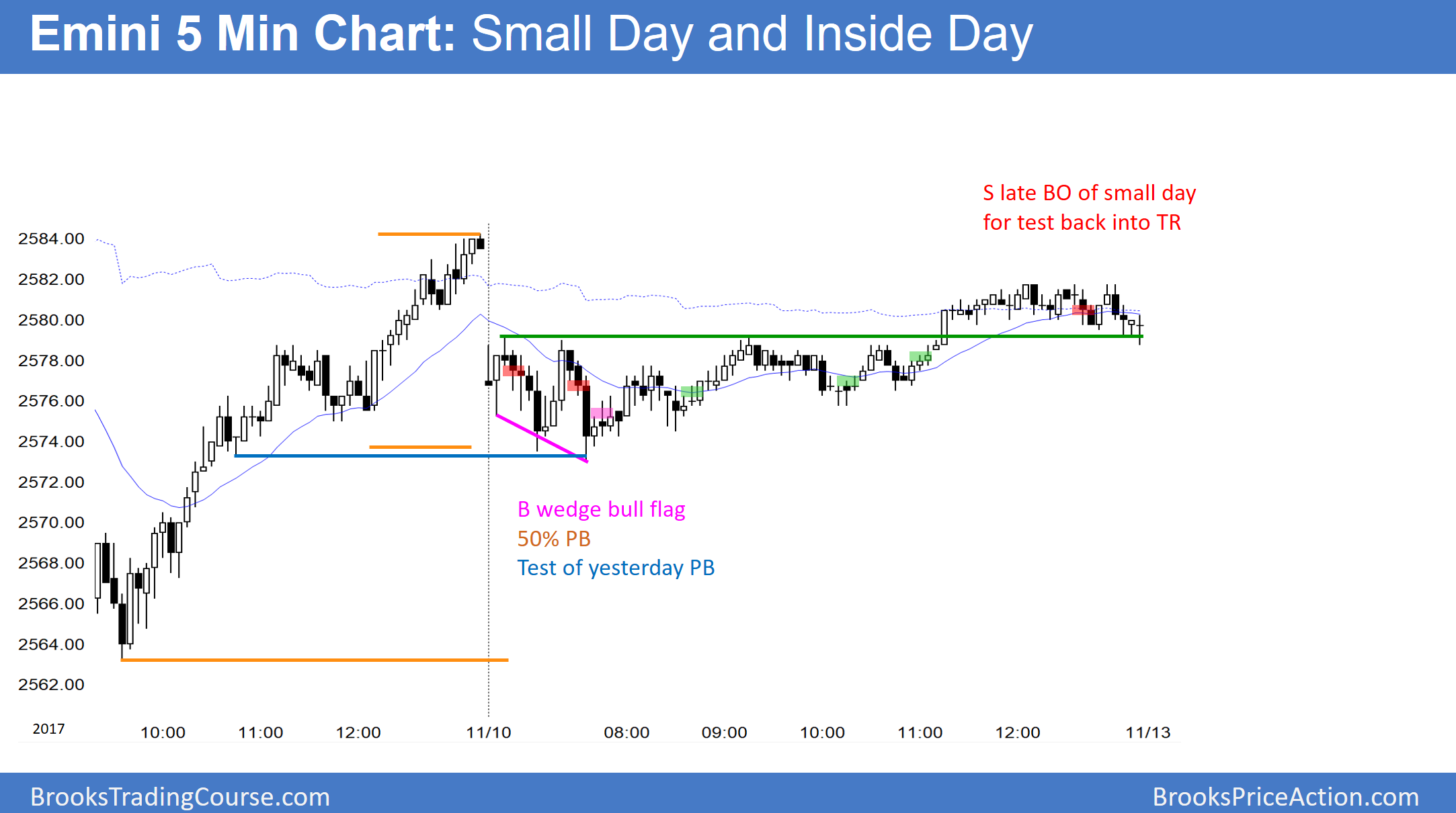

Friday was an inside day after Thursday’s big bull reversal day. Since all higher time frames are in bull trends, the odds continue to favor new highs. Yet, since the climaxes are extreme, the odds also make a 5% pullback likely to begin soon. There is a wedge top on the daily chart. If the bulls break above, they will have a 40% chance of a 40 point measured move up. If the bears break below the October 25 low around 2540, they will probably begin a 5% correction to below 2500.

Overnight Emini Globex Trading

The Emini is down 7 points in the Globex market. The wedge top triggered when Thursday traded below Wednesday’s low. Yet, Thursday and Friday were bull bars and neither fell below the October 25 bottom of the wedge. In addition, all strong selloffs over the past 6 months reversed up on the day they began or on the next day. Consequently, until there are consecutive big bear bars, the odds still favor higher prices. However, since the Emini has never been this overbought, traders have to be ready for a very strong reversal down beginning any day.

Today will probably gap down. There is a 25% chance of either a trend from the open bull or bear trend. There is a 75% chance of a trading range over the 1st hour or two. If so, the bulls will try to create a reversal up from a double or wedge bottom. Additionally, the bears will try to create a double top or wedge bear flag just below the moving average.

Friday’s Setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.