Pre-Open market analysis

While yesterday was a bear day on the daily chart, it had a prominent tail on the bottom of the bar. It is a sell signal bar for a 3 week wedge top. However, since the bull trend is strong, the odds are that the reversal down will be minor, like all of the other topping attempts over the past 6 months. Most tops fail and lead to higher prices. That is what is likely to happen again.

However, since the daily, weekly, and monthly charts have need all been this overbought, the odds favor a 5% correction beginning this year. However, until there is a strong reversal down with follow-through selling, the odds continue to favor at least slightly higher prices.

I mentioned that the Emini November 5th close is usually above the October 26 close. That bull window ends soon. In addition, there is an adage on Wall St. about the holidays: “Thanksgiving is owned by the bears and Christmas is owned by the bulls.” That means that there is often a selloff in the middle of November. I have not tested this to know if it is true, but I always enjoy watching seasonal tendencies unfold. However, I totally ignore them when I make trading decisions because I cannot convince myself that I make more money by considering them.

Overnight Emini Globex trading

While the Emini is up 1 point on the Globex chart, it is at the top of a reversal from a 12 point overnight selloff. The day session will therefore probably open within yesterday’s 4 hour range. The bulls will try for a higher low major trend reversal, and the bear want a resumption of yesterday’s bear trend. Since the 5 minute day session chart will probably open within its 4 hours range, the open will then be neutral.

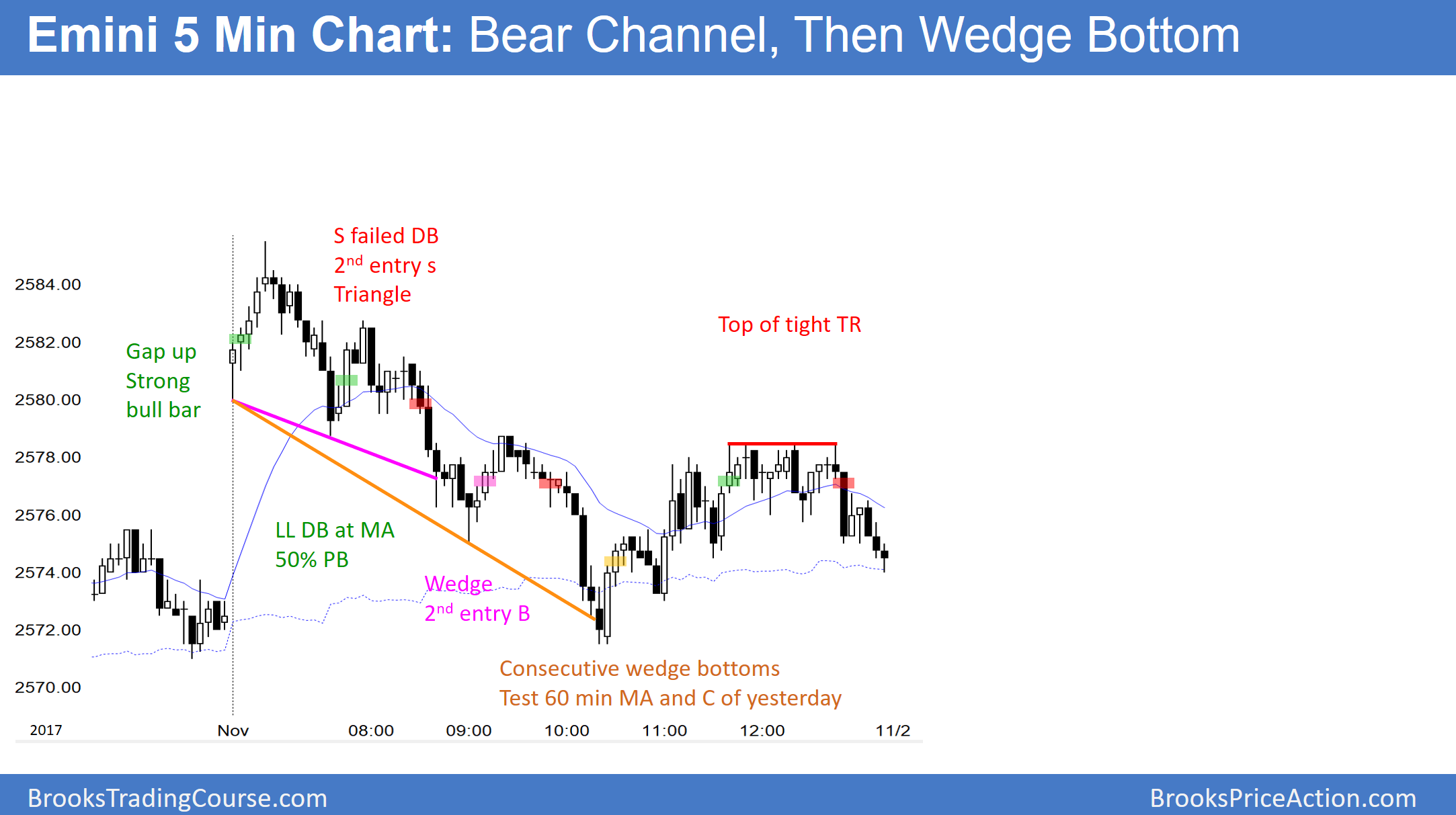

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars