Emini buy climax and failed breakout to new high

I will update around 6:55 a.m.

Pre-Open market analysis

While Monday broke above the 3 week trading range, yesterday had a bear body on the daily chart. In addition, it reversed yesterday’s bull breakout. I said yesterday morning that a bear bar was likely because most trading range breakouts fail. Furthermore, a bull breakout in an overbought trend was likely to have bad follow-through buying on the next day.

The weekly chart is extremely overbought. Consequently, the odds are that it will begin to reverse down below its moving average within the next few weeks. Is this the start of the reversal down? It is too early to tell. Yet, the context is good for the bears.

Sell signal on daily chart

Yesterday created a 2 bar reversal on the daily chart. It is therefore a sell signal bar on the daily chart. If today trades below yesterday’s low or gaps below, it will trigger the sell signal. A gap down would create a 2 day island top, which is slightly more bearish if the bears can keep the gap open for a few days.

It is important to remember that most tops fail. Even though the daily chart has a decent sell setup, it has had many others since the November low. It does not matter that the weekly chart is overbought and there will be a selloff soon. Betting that any one reversal will be the start of the selloff is a low probability bet. Until there is a strong reversal down, the odds still are that every top will be followed by at least one more new high.

Overnight Emini Globex trading

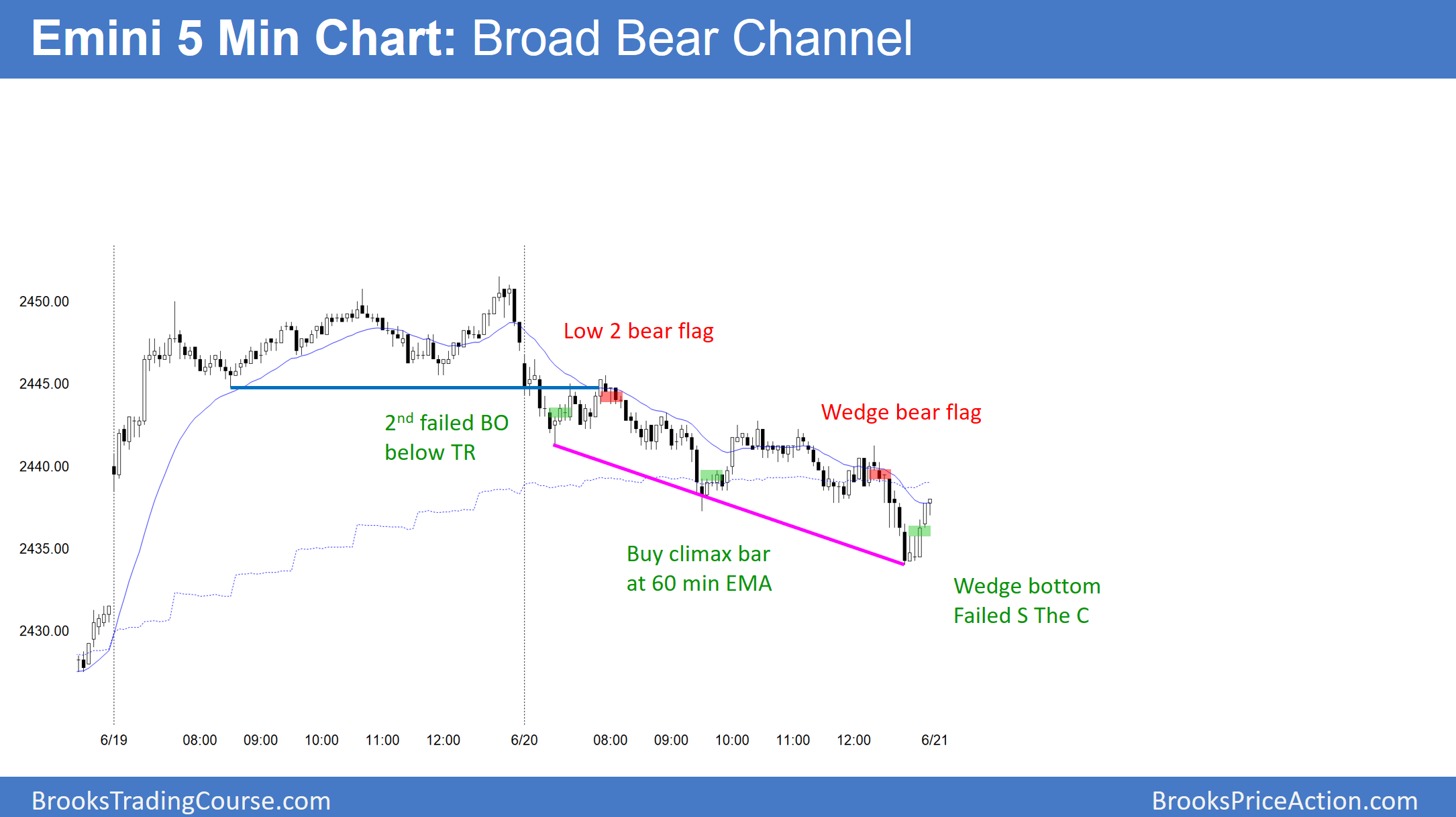

The Emini is down 1 point in the Globex market. Since yesterday was a bear channel, it was a bull flag. In addition, it was an endless pullback from Monday’s gap up and rally. Therefore, the odds favor a break above the bear channel today. Furthermore, channels usually evolve into trading ranges. Hence, the bulls will probably test yesterday’s lower highs today and create a 2 day trading range.

While the pullback is still above the June 16 rally low and is therefore a bull flag, yesterday’s selloff was in a tight bear channel. Therefore the 1st reversal up will probably lead to a test of yesterday’s low. The bulls will probably need at least a small double bottom on the 60 minute chart before rallying to test Monday’s all-time high. Consequently, the odds favor a couple sideways days.

Yesterday’s setups