Pre-Open Market Analysis

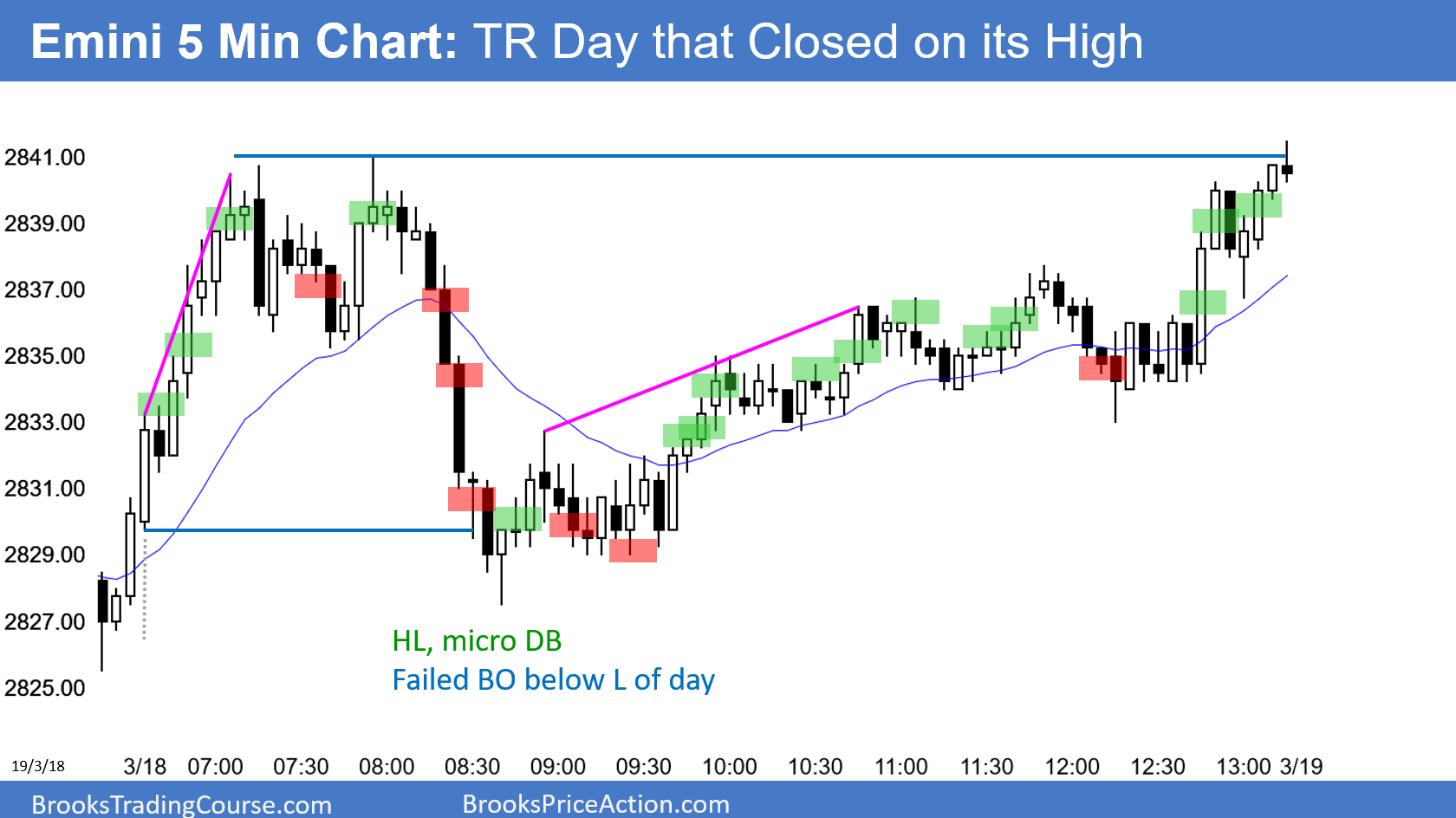

The Emini S&P 500 broke above last week’s high. That was the minimum objective for the bulls after a strong bull reversal last week. Despite being sideways all day, the day closed on its high. This is good for the bulls, and increases the chance of at least slightly higher prices today.

The Emini began the week almost exactly at the midpoint between the March 8 low and the all-time high. The momentum up favors a test of the all-time high.

But, the 3-month buy climax and the 16 month trading range are more important. As a result, the next 120 points could very well be down.

The break above the October high could continue for another 2 weeks before there is a reversal down. Furthermore, if the bulls get a couple consecutive bull bars closing near their highs, the probability of a new all-time high within a month or two will increase significantly.

Even if they get it, most trading range breakouts fail. Therefore, there will probably be more sellers there than buyers above the all-time high. This is because it is also the top of a 16-month trading range. The bears would look to sell a reversal down from a big expanding triangle on the weekly and monthly charts.

Overnight Emini Globex Trading

The Emini is up 10 points in the Globex session. It will therefore probably gap above yesterday’s high. This would be the 3rd gap up in the 8 day rally. That is a sign of strong bulls.

However, it is coming late in a 3 month strong bull trend. It therefore might also represent an exhaustion move. This is especially true after breaking above the 2825 major resistance. This increases the chance of a swing down on the daily chart.

But, when a rally is as strong as this 8 day rally has been, it usually has to transition into a trading range before a swing down can begin. Consequently, the bulls will probably buy the 1st 1 – 2 day selloff.

Most recent days have spent a lot of time within trading ranges. They also tended to close near their highs. Since markets have inertia, traders should always expect a continuation of what has been going on.

Despite the trading range price action, the legs up and down have been big enough for day traders to swing trade. The odds are that this will continue today. With tomorrow’s FOMC announcement being a potential catalyst, there is less chance of a big trend day today.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.