Pre-Open market analysis

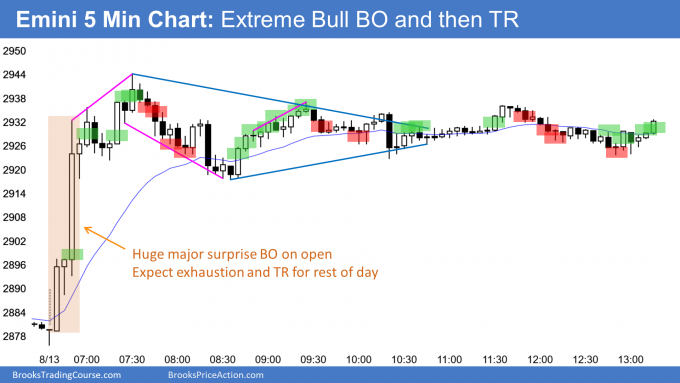

I have been saying since Friday that this week would go above last week’s high to trigger the weekly buy signal. But I also said that there probably would be sellers above last week’s high and that the Emini is probably beginning to form a trading range that will last at least a couple weeks more. Yesterday triggered the buy signal but did not close far above last week’s high. That hesitation is consistent with what I have been saying.Something important happened yesterday on the 5 minute chart. That rally on the open was so unusually strong that it would normally have a 60% chance of follow-through buying over the next several days. However, context is important. It was also a test of last week’s high, and a trading range is likely for at least a couple weeks. Therefore, there is a 50% chance that it will turn out to be a bull trap and it will form a double top with last week’s high.Overnight Emini Globex trading

The Emini is down 43 points in the Globex session. It, therefore, is reversing most of yesterday’s rally. But because the daily chart is in a trading range, this selloff might simply be a test of Monday’s low and a deep pullback from yesterday’s rally. The bears hope that it is the start of a reversal down from a double top with last week’s high.

Both possibilities are equally likely. The location at the bottom of the 5 day range is good for the bulls, but the likely big gap down today from yesterday’s close is good for the bears.

Day traders will be ready for anything today. There might be a break below Monday’s low and a trend down, or a reversal up after a test of Monday’s low. Finally, since the Emini has been sideways for 5 days and yesterday spent most of the day in a trading range, today could be another trading range day.

Yesterday’s setups